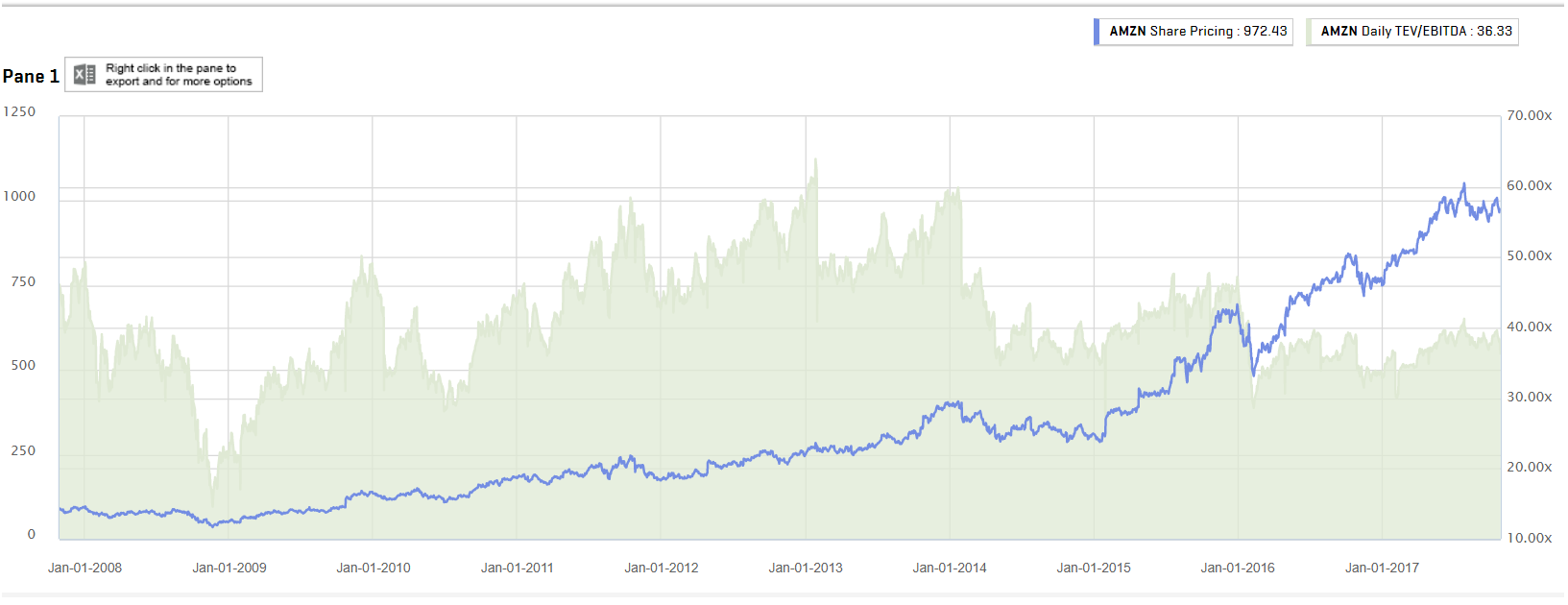

The energy infrastructure sector has continued to decline, even as the price of crude oil has climbed and stabilized. This sector is populated by the publicly traded master limited partnerships (MLPs) and corporations that for the most part function like their MLP brethren. Over the last three months, crude oil is up about 5%, yield the Alerian MLP Infrastructure Index (AMZI) has dropped by over 10%. If you like to invest in turn around candidates, there are strong signs that MLPs and related companies will start to turn higher in November.

Underlying energy infrastructure fundamentals look stable and expectations are that most MLPs have businesses continue to grow. In the second quarter, two-thirds of the AMZI component companies increased distributions, with the remainder keeping payouts level. For the third quarter, a pair of distribution cuts have been announced. These reductions are strategic versus signs of desperation. My forecast is that the majority of MLPs will announce distribution increases.

A further sign that fortunes in the MLP space are improving is that bond prices have risen even as equity values declined. This interesting piece of analysis comes from Yorkville Capital:

“Year-to-date, the Alerian MLP Index has declined by 5.6%, including distributions this year. Meanwhile, Yorkville’s index of MLP and midstream debt has produced a positive total return of 5.8%. This means that either the equity markets are getting it wrong and the bond markets are getting it right – or the other way around.

Bond investors primary concern is that the underlying business is healthy and stable enough to ensure that they will continue to receive their semi-annual, or quarterly, coupon payments (and principal upon maturity). Therefore, the increasing prices of MLP bonds suggest that MLP businesses are getting less risky and more stable – not the other way around.

On September 27, 2017, Moody’s upgraded their global midstream outlook to “positive” from “neutral” reversing the downgrade they appropriately made in late 2015. Their report highlighted expectations for business fundamentals to improve over the coming 12-18 months and noted that upstream activity out of the E&P industry has ramped with rig counts having doubled off the 2016 lows. Moody’s’ expects midstream EBITDA growth of 8-10% in 2018.”

The final puzzle piece of the puzzle for an MLP sector recovery is the possibility that the most recent value drop was due to tax selling. An MLP focused mutual fund, ETF or closed-end fund operates as a taxable corporation, so taking tax losses now can be used to offset future gains and lower future corporate income tax payments. The fiscal year for these funds ends on October 31. If tax selling is part of the cause of the recent down turn in MLP values, we can expect some price support in November.

Earnings season has just started for the energy infrastructure sector and results so far have been positive. If more MLPs and infrastructure corporations report strong third quarter results, the sector could really take off starting in November. Here are three companies with currently attractive dividend yields and the potential for much higher share or unit values.

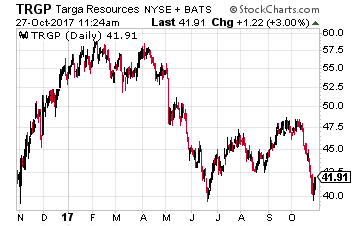

Targa Resources Corp (NYSE: TRGP) engages in the following energy midstream services:

Targa Resources Corp (NYSE: TRGP) engages in the following energy midstream services:

- Gathering, compressing, treating, processing, and selling natural gas.

- Storing, fractionating, treating, transporting, and selling NGLs and NGL products, including services to LPG exporters.

- Gathering, storing, and terminalling crude oil.

- Storing, terminalling, and selling refined petroleum products.

In February 2016, to simplify the business structure Targa Resources Corp. acquired all the outstanding common units of Targa Resources Partners LP (NYSE: NGLS) that it did not already own. The company continues to operate using the MLP model, but is a corporation. At the current $41 per share TRGP yields 9.0%. This stock could easily go over $50 in an MLP rally.

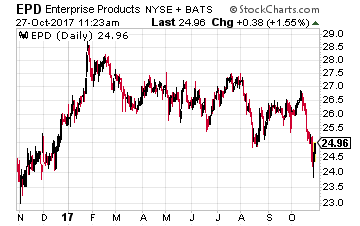

Enterprise Products Partners LP (NYSE: EPD) has a market cap more than $50 billion and is the largest MLP by enterprise value. The company’s business segments include:

Enterprise Products Partners LP (NYSE: EPD) has a market cap more than $50 billion and is the largest MLP by enterprise value. The company’s business segments include:

- NGL pipelines and services

- Crude oil pipelines and services

- Natural gas pipelines and services

- Petrochemical and refined products services.

EPD has increased its distribution for 62 straight quarters. Unlike most MLPs, Enterprise Products Partners can fund most of its growth projects without issuing additional equity. This $24 MLP could quickly move to over $30. EPD yields 6.9%.

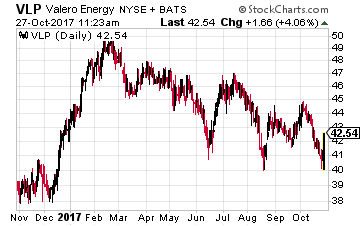

Valero Energy Partners LP (NYSE: VLP) is controlled by and provides pipeline, storage and terminal services to its sponsor, Valero Energy Corporation (NYSE: VLO). Through asset drops from Valero, the cash flow and distribution growth at VLP is very predictable. The VLP payments to investors will grow 25% in 2017 and at least by 20% in 2018, with high probability for 20% growth in future years. Now at $41, VLP could easily surpass its 52-week high of $51. The units currently yield 4.7%.

Valero Energy Partners LP (NYSE: VLP) is controlled by and provides pipeline, storage and terminal services to its sponsor, Valero Energy Corporation (NYSE: VLO). Through asset drops from Valero, the cash flow and distribution growth at VLP is very predictable. The VLP payments to investors will grow 25% in 2017 and at least by 20% in 2018, with high probability for 20% growth in future years. Now at $41, VLP could easily surpass its 52-week high of $51. The units currently yield 4.7%.

Owning a bit of the MLP sector should constitute a core part of any serious high-yield investor’s portfolio. And with the way trends appear for MLPs investors in those stocks will not only continue earning a steady stream of income but could very well enjoy considerable share price appreciation. It’s this type of strategy that I use with my new income system called The Monthly Dividend Paycheck Calendar.

Source: Investors Alley