t will take some time for investors to figure out all the investment related ramifications of the new income tax rules. Master limited partnership (MLP) focused funds are one asset class that will see a major benefit from the tax overhaul. Because they are forced into a different business structure, a fund with MLP assets of more than 25% will get the benefit of the corporate income tax reduction from 35% down to 21%. It’s a big deal.

The typical stock funds, including mutual funds, exchange traded funds (ETFs), and closed-end funds (CEFs), are formed and operated as Registered Investment Companies. The Investment Company Act of 1940 allows a fund to operate as a pass-through entity. This means the fund must pay out all portfolio income and realized capital gains as distributions to the fund investors. The fund does on pay income tax on the portfolio earnings. The tax characteristics of the income and capital gains are passed through to the fund investors.

The exception against a fund being able to operate as a registered investment company is if the fund’s portfolio holds more than 25% of its assets in MLPs. If that is the case, the fund will instead be organized as a C corporation and be liable to pay corporate income tax on the portfolio’s income and capital gains. Most of the MLP focused mutual funds, ETFs and CEFs have more than 25% MLP holdings and are organized as corporations.

In practice, here is how the corporate income taxes affect the returns of an MLP fund. Individual MLP distributions are classified as return of capital, so the dividends earned by MLP fund investors are typically mostly ROC. Profits and losses at the MLP level are reported to the fund on a Schedule K-1, and the fund will pay corporate income tax on profits or accumulate credit for the K-1 losses. If the portfolio’s MLPs go up in value, a fund will also occur an income tax liability on the capital gains. MLP funds account for the income taxes on gains in the fund net asset values (NAVs). The NAV is what each share is worth. Actual paid income taxes show up in a fund’s expense ratio. Which is why you sometimes see very high expenses reported by the MLP funds.

The corporate tax rate reduction will result in lower tax expense, and higher net returns for MLP fund investors. Consider this example. The MLPs in a fund’s portfolio go up by 10%. With a 35% corporate tax rate, the fund will have to account for the tax liability in the fund’s NAV, which means the share value will only go up by 6.5%. With the new 21% corporate tax rate, the hit to NAV will be lower, and the share value will go up by 7.9%. The new, lower corporate tax rate means that MLP fund investors will see over 20% higher gains when MLPs are rising compared to the 35% tax bite. The lower tax rate has already started to help MLP fund values. On December 26, the First Trust MLP and Energy Income Fund (NYSE: FEI) announced a NAV adjustment due to the fact it could lower the accrued tax obligation in the fund’s portfolio. The FEI share price was instantly increased by $2.016 or 8.75%. A good deal for investors. The adjustments for taxes on past gains will be one-time benefits for shareholders. However, the new corporate tax rate will provide ongoing increased profits as MLP values rise in the future. After a 2 ½ bear market, the MLP sector fundamentals are solid and with rising crude oil price, I expect the sector to do well in 2018.

Here are the three largest MLP closed-end funds. They all provide professionally managed exposure to the MLP sector.

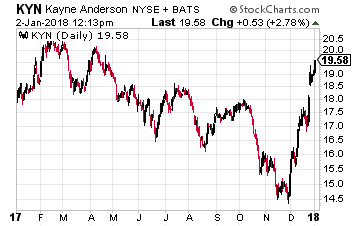

Kayne Anderson MLP Investment Company (NYSE: KYN) has $3.25 billion in assets. The fund currently trades at a 1.5% premium to NAV and yields 9.5%.

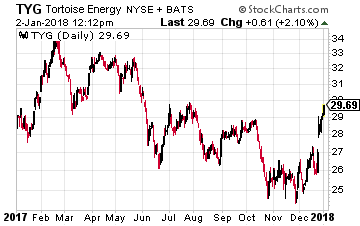

Tortoise Energy Infrastructure Corp. (NYSE: TYG) has $2.1 billion in assets. The TYG share price is at a 3.4% premium to NAV. The fund yields 9.1%.

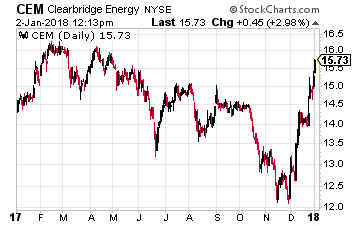

ClearBridge Energy MLP Fund Inc (NYSE: CEM) is a $1.6 billion assets fund. The CEM shares are currently at a 3.5% discount to NAV. This fund yields 9.5%.

We’ve put together our most comprehensive, step-by-step dividend plan yet. In just a few minutes, you will have a 36-month roadmap that could generate $4,804 per month for life.

It’s the perfect complement to Social Security and works even if the stock market tanks.

Source: Investors Alley