The stock market has turned volatile, and the income stock sectors feel downright unwelcoming. Since I have contact with thousands of investors I learn there are a thousand different situations in the market. The investor who bought at a higher price doesn’t like to see the share price drops in his portfolio. Another is expecting a cash infusion next week and hopes prices will stay down until she gets the money and can load up on shares at the current low prices.

I regularly tell my subscribers that you can’t earn dividends unless you own shares of dividend paying stocks. Trying to time the market can easily leave an investor without any shares that are paying dividends. It takes a different mindset to get away from worrying about share prices and to focus on building an income stream. The good part is that when the stock market corrects, or gets scarily volatile, the income investor will continue to rake in dividends. In a choppy market I like to add to those stocks that hit my “sweet spot” combination of current yield and dividend growth.

In a flat or volatile market, cash dividends are real returns, so a higher yield can be viewed as a cushion against share price movement. Dividend growth is a factor that can make a stock more attractive even if the market is not in a share price appreciation mode.

Related: 3 High-Yield Dividend Stocks You Must Own During a Stock Market Crash

One strategy is to find dividend stocks with low yields, such as 3% or less and double digit annual dividend growth. At the other end of the spectrum are the 10% yield stocks, but with little potential for dividend growth.

If stock market returns go flat, I recommend going for the middle ground. Find stocks with attractive yields. In the current market the range would be 5% to 7%. These stocks should to have recent history and prospects of mid to high single digit dividend growth. The dividend payments give you solid cash returns, and the dividend growth prospects can support share prices in a volatile market. In the long run, this combination should produce total annual returns in the low double digits.

Here are three stocks that fit the criteria discussed above:

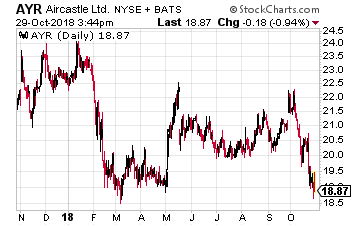

Aircastle Limited (NYSE: AYR) owns approximately 240 commercial aircraft that are leased to 84 airlines around the world. Aircastle must be nimble to adjust for changing needs for aircraft type and client airlines financial conditions. For example, in 2017, Aircastle purchased 68 aircraft and sold 37.

Aircastle Limited (NYSE: AYR) owns approximately 240 commercial aircraft that are leased to 84 airlines around the world. Aircastle must be nimble to adjust for changing needs for aircraft type and client airlines financial conditions. For example, in 2017, Aircastle purchased 68 aircraft and sold 37.

The business is very profitable. The company generated a 15% return on equity last year and reported adjusted net income of $2.15 per share. The current dividend rate of $1.12 per share per year is well covered by net income and free cash flow.

In recent years, Aircastle has been increasing the quarterly dividend by 7% to 8% per year. The foundation of Aircastle’ s results is the steady growth in international air traffic, which appears to be immune to global economic conditions.

The shares currently yield 5.9%.

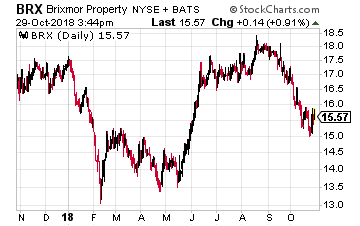

Brixmor Property Group Inc (NYSE: BRX) is a real estate investment trust (REIT) that owns community and neighborhood strip malls. These malls are typically anchored by a grocery store and the tenants are often in businesses that are largely immune from ecommerce sales competition.

Brixmor Property Group Inc (NYSE: BRX) is a real estate investment trust (REIT) that owns community and neighborhood strip malls. These malls are typically anchored by a grocery store and the tenants are often in businesses that are largely immune from ecommerce sales competition.

In 2017 the company’s board of directors recently shook up the management team, with the goal of more active rental rate management. The REIT’s major tenants are financially strong, but there is a group of weaker tenants with absurdly low rental rates. Replacing these tenants will allow Brixmor to grow revenue and free cash flow.

The company should be able to continue its recent history of 5% to 6% dividend growth.

The BRX shares yield 7.1%.

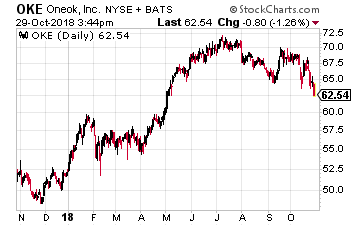

ONEOK, Inc. (NYSE: OKE) is an energy sector infrastructure services company. ONEOK focuses on natural gas and natural gas liquids (NGLs). The company provides gas gathering services in the energy plays, facilities to process NGLs into the different components like ethane and propane, and interstate pipelines to transport natural gas and NGLs to their demand centers.

ONEOK, Inc. (NYSE: OKE) is an energy sector infrastructure services company. ONEOK focuses on natural gas and natural gas liquids (NGLs). The company provides gas gathering services in the energy plays, facilities to process NGLs into the different components like ethane and propane, and interstate pipelines to transport natural gas and NGLs to their demand centers.

The growth in gas production has been lost in the news about the U.S. becoming the world’s largest crude oil producer. Oil wells also produce natural gas and NGLs.

ONEOK is the primary, and often the only, company gathering and processing gas in the major crude oil plays.

The company expects to grow its dividend by 8% to 10% per year. OKE currently yields 5.4%.

Starting today you can stop worrying about the market and instead fundamentally transform your income stream from a string of near misses to a steady, reliable flow of income right into your bank account.

It all starts with a simple to use, yet powerful calendar – called the The Monthly Dividend Paycheck Calendar, like the one below, only with more details. It’s kind of like the one you might have on your desk, only this one tells you when you’ll get paid and how much you’ll receive each and every month.

No more guesswork, no more confusion, no more worrying if you did the right thing… just steady paychecks coming like clockwork…

Paychecks currently averaging $3,453.27 every month. That’s money in the bank for you regardless how volatile remains for the rest of the year.

Pay Your Bills for LIFE with These Dividend Stocks

Get your hands on my most comprehensive, step-by-step dividend plan yet. In just a few minutes, you will have a 36-month road map that could generate $4,804 (or more!) per month for life. It's the perfect supplement to Social Security and works even if the stock market tanks. Over 6,500 retirement investors have already followed the recommendations I've laid out.

Click here for complete details to start your plan today.

Source: Investors Alley