Source: Shutterstock

Well that came around quickly! We are now drawing to the end of 2018. And that can only mean one thing: it’s time to think about 2019. Chances are high that the volatility plaguing the markets in 2018 isn’t going anywhere next year. With that in mind, you need to be extra careful about how you re-balance your portfolio for the new year. Luckily Goldman Sachs is here to help. It recently released a report of exactly the kind of stocks you want to be thinking about right now.

These are ‘high quality’ stocks specially selected by the firm. And by ‘high-quality’ Goldman Sachs means stocks that meet the following 5 factors: strong balance sheets, stable sales growth, low deviation in operating income, low stock drawdown risk, and return-on-equity that exceeds peers. In other words these stocks are the best-positioned to 1) withstand an economic slowdown; and 2) diminishing equity returns. That sounds good to me!

On top of that I used TipRanks‘ stock data to find out what other top analysts have to say on these stocks.

That way I can highlight stocks with the most bullish Street consensus from Goldman Sachs’ list.

Let’s take a closer look at these top stock picks for 2019 now:

Stock Picks for 2019: Comcast (CMCSA)

I’m with Goldman Sachs on this one. Blue chip telecoms giant Comcast Corporation (NASDAQ:CMCSA) is a worthy 2019 stock pick. CMCSA stock has an extremely stable portfolio and growing free cash flow.

Not only is its credit high-quality, but its dividend is ‘sacrosanct’, and it repurchases shares when it’s not deleveraging from strategic M&A.

“CMCSA is arguably more a safety stock than a growth stock. While its valuation is modest we’d argue so is its risk” writes RBC Capital’s Steven Cahall (Track Record & Ratings).

He has just ramped up his price target to $45, citing the recent $15 billion deal for Sky. From current levels this means we are looking at upside potential of 19%.

“Excuse Me While I Kiss the Sky” Cahall calls his report, adding “We see the strategic merits of Sky being better appreciated in time.”

True CMCSA paid a hefty multiple, but Cahall sees long-term strategic benefits from Sky, ranging from a bigger subscriber base for emerging tech investments to savings on content acquisition and accelerated advanced advertising.

This ‘Strong Buy’ stock scores 15 buy ratings vs 3 hold ratings. Its $44 average analyst price target suggests 16% upside potential. Interested in CMCSA stock? Get a free CMCSA Stock Research Report.

Stock Picks for 2019: Visa (V)

This financial stock continues to outperform. Year-to-date, Visa Inc (NYSE:V) shares have surged over 19%.

And looking forward to 2019, I see no reason why Visa’s outperformance can’t continue.

Indeed, top-rated Cantor Fitzgerald analyst Joseph Foresi (Track Record & Ratings) has just reiterated his V Buy rating. This comes with a bullish $160 price target — 18% upside potential.

“Strong growth continues” cheers Foresi, before writing: “We remain attracted to Visa’s dominant position in the global card network market and to its strong, recognizable international brand.”

Notably, Foresi highlighted Visa’s opportunity to capitalize on the global conversion of cash into credit, international opportunities, and digital payment tailwinds.

Meanwhile Visa Direct, contactless payments, and B2B all have the potential to drive share prices higher.

Out of 18 analysts polled on this ‘Strong Buy’ stock, 17 are bullish. This is with a $167 average analyst price target. Get the V Stock Research Report.

Stock Picks for 2019: Alphabet (GOOGL)

Tech stocks may be going through a rough patch, but here’s one mega cap Goldman Sachs thinks is still worth buying for 2019.

Trading at ~11x 2019 EV/EBITDA, Alphabet Inc’s (NASDAQ:GOOGL) valuation looks compelling, says Brent Thill (Track Record & Ratings) of Jefferies. He picks GOOGL as his Franchise Pick i.e. a high conviction stock. This is with a juicy $1,450 price target (37% upside potential).

So what justifies this bullish call?

“The Internet Team remains bullish on Alphabet due to continued expected mobile search growth and a positive stance on YouTube” explains Thill.

Online video is lining up as the biggest online ad growth driver — with GOOGL’s YouTube capable of driving meaningful upside by stealing ad budgets away from television.

Meanwhile, “mobile search has been the number one driver of revenue growth for the past several quarters and the team sees continued opportunity given the ubiquity of smartphones and the important location and contextual signals from mobile devices” writes Thill.

Plus, Alphabet also boasts its fast-growing Google Cloud, and a strong leadership position in both AI and autonomous vehicles. Its Waymo vehicles have driven many millions of miles on public roads more than peers.

Taking a step back, we can see that out of 31 analysts polled recently, 28 are bullish on the stock. This is with a $1,346 average price target (28% upside potential). Get the GOOGL Stock Research Report.

Stock Picks for 2019: O’Reilly Auto (ORLY)

O’Reilly Automotive Inc (NASDAQ:ORLY) is one of the largest specialty retailers of auto parts in the US, with over 5,000 stores. Already, year-to-date, shares are exploding by over 45%. And the stock has a long growth runway ahead.

Alongside Goldman Sachs, RBC Capital’s Scot Ciccarelli (Track Record & Ratings) is also a big fan of the stock.

“O’Reilly is a net market share gainer in an attractive industry,” says the analyst. And he sees four key reasons why ORLY is set to outperform. Namely: 1) strong pricing power, 2) little threat from e-commerce because the parts are too complex, 3) increasing number and age of vehicles and 4) a highly fragmented industry.

Further, steady ORLY stock performance suggests that the company is feeling little effect from price transparency/ e-commerce competition.

“Given the company’s highly consistent top/ bottom line growth we remain buyers of ORLY,” sums up Ciccarelli. He sees shares surging 10% to hit $389.

Now if we look at all analysts, the consensus is a cautiously optimistic Moderate Buy. However, if we shift to only the Street’s best-performing analysts, then the consensus also upgrades to Strong Buy. This is with a $380 average analyst price target (8% upside potential). Get the ORLY Stock Research Report.

Stock Picks for 2019: Booking Holdings (BKNG)

If you’re planning a holiday right now, chances are you’ll turn to Booking Holdings Inc(NASDAQ:BKNG). From a small Dutch startup, BKNG is now one of the world’s largest travel e-commerce companies. It holds Booking.com, Priceline.com, Kayak.com, Cheapflights, OpenTable and more.

From a Street perspective, what stands out is a recent upgrade from Wells Fargo’s Robert Coolbrith (Track Record & Ratings). Analysts usually reiterate their stock ratings — so when a stock is upgraded to Buy that definitely tells us something.

Plus Coolbrith simultaneously ramped up his price target from $2,150 to $2,200. From current levels, this means we are now looking at upside of close to 18%.

In this case Coolbrith cites the company’s Q3 performance and Q4 guide as well as management’s 2019 long-term strategy. This breaks down to: 1) platform investment, 2) above-market top-line growth and 3) a close focus on EBITDA dollar growth.

And crucially, even though shares are over $1,800, Coolbrith sees an appealing entry point right now. Shares are currently trading down over 5% in the last three months. “We note that shares remain significantly below historical valuation averages — BKNG’s current NTM EV/EBITDA is 12% below its 3-year median.”

Overall, BKNG stock earns a Moderate Buy analyst consensus. This comes with a $2,242 average price target — which means 23% upside potential lies ahead. Get the BKNG Stock Research Report.

Stock Picks for 2019: Dollar Tree (DLTR)

When trading is rough, defensive stocks tend to do well. And bargain retail store Dollar Tree, Inc. (NASDAQ:DLTR) is a perfect example of a defensive stock. Everything in the store sells for $1 or less.

On October 16, the NY Post reported that Carl Icahn is accumulating a stake in Dollar Tree. Apparently, we are looking at a ‘significant’ stake. On the news, DLTR stock jumped 6.8%. Icahn is an activist investor, known for pushing for changes at the company leadership level.

Five-star Oppenheimer analyst Rupesh Parikh (Track Record & Ratings) has an Outperform rating on the discount giant. He writes: “We continue to see meaningful optionality with the DLTR story from either an improving fundamental longer-term outlook or optionality with the Family Dollar asset.”

Encouragingly, he believes the stock is trading at attractive levels. This is in part down to the market undervaluing American variety store chain Family Dollar.

“At a low $80s stock price, the implied Family Dollar valuation is just a low single-digit EBITDA multiple” points out Parikh. And as for Icahn joining the team, he gives this reaction: “We await more details on Icahn’s stake and the proposed actions that could potentially unlock shareholder value from here.”

With a Moderate Buy consensus, the stock’s $94.18 average analyst price target works out at 15% upside potential from current levels. Get the DLTR Stock Research Report.

Stock Picks for 2019: Biogen (BIIB)

Biogen Inc (NASDAQ:BIIB) has a dominant position in neuroscience. The company has a leading portfolio of medicines to treat multiple sclerosis (MS) as well as the only FDA-approved treatment for spinal muscular atrophy (SMA).

To top it off, Biogen also boasts an extensive pipeline of new medicines in development. This includes Aducanumab for Alzheimer’s disease. It is estimated that over 25 million individuals are living with AD worldwide.

The memory loss and functional decline of Alzheimer’s disease have been linked to amyloid plaques, abnormal protein deposits that build up in the brain. Aducanumab is an antibody that binds to and may reduce amyloid plaques from the brain, potentially slowing the progress of the disease.

“We believe Biogen shares are undervalued based on our view that the company’s leadership position in neuroscience should deliver long-term growth. A business supporting high-risk, high reward studies puts BIIB in the lead to develop a potentially disease-modifying AD drug,” states Oppenheimer’s Jay Olson (Track Record & Ratings).

He has a buy rating on the stock with a $380 price target. According to Olson, BIIB has achieved a critical mass in neuroscience that enables high-risk programs with sufficient cash flow to embark on high-risk programs.

Overall this ‘Moderate Buy’ stock has scored 8 buy ratings vs 3 hold ratings in the last three months. Meanwhile the $391 average analyst price target works out at over 20% upside potential. Get the BIIB Stock Research Report.

Stock Picks for 2019: Cognizant (CTSH)

Goldman Sachs has just upgraded software stock Cognizant Technology Solutions Corp (NASDAQ:CTSH) from Hold to Buy. The firm’s James Schneider (Track Record & Ratings) also raised his price target for the shares to $84 from $81. He now predicts shares have 20% upside ahead.

Improving revenue growth brings prospects for a stock “re-rating,” Schneider told investors. Plus a rebound in the company’s Financial Services vertical should drive improved revenue growth in the near term.

This bullish analysis is echoed by other analysts. For example, Loop Capital’s Joseph Vafi has a Street-high $94 price target on shares (35% upside potential). Following the company’s upbeat analyst day, Vafi is even more confident in the company’s unique offer of a “full spectrum of services demanded by Fortune 500 CIOs”.

CTSH has now “successfully pivoted its business to the most leading-edge service capabilities,” and the bear case should be “put to bed”, especially given the forecast of improving margins in 2019.

Meanwhile valuation provides a positive risk/reward opportunity, with a roughly 60% multiple discount to Accenture’s PE in 2019, despite similar aggregate growth rates and higher margins.

Stock Picks for 2019: TJX Companies (TJX)

Owner of the discount TJ Maxx, Marshalls, HomeGoods stores and others, TJX Companies (NYSE:TJX) is a leading off-price retailer of home and fashion goods. Basically, if you’re looking for a bargain, TJX could be for you.

“Off-price remains one of our favored industries given its positive traffic, market share gains, and strong cash flow generation,” gushes five-star Guggenheim analyst Robert Drbul (Track Record & Ratings). And TJX is one of his top stock picks in this space.

“Despite expense headwinds, TJX continues to report enviable comps, one of the highest across retail landscape, fueled by traffic increases and share gains” the analyst writes. He now sees TJX delivering an impressive $50B revenues over the next five years.

Plus, TJX is a great stock for shareholders. This is thanks to its 1.7% dividend payout — a dividend which has now recorded 21 years of consecutive growth.

“Beyond the share gains and stable EPS growth, we believe with the increased dividend and the buyback program, TJX once again underlines FCF generating ability of the business model,” writes Drbul. He expects TJX to generate $2.5B of FCF and combined with $1B of repatriated cash, return all of it to shareholders with dividends and buybacks.

From top analysts, the stock scores a ‘Strong Buy’ consensus. This is with a $56 average analyst price target so we are looking at 24% upside ahead.

Stock Picks for 2019: MSCI Inc (MSCI)

Last but not least, comes a stock I only discovered recently, index provider MSCI Inc(NYSE:MSCI).

MSCI is a global provider of equity, fixed income, hedge fund stock market indexes and multi-asset portfolio analysis tools. It publishes the MSCI BRIC, MSCI World and MSCI EAFE Indexes.

“We continue to view the index business as a key catalyst that should produce solid top-line results (in the upper-single-to-low double digits)” is how Cantor Fitzgerald’s Joseph Foresi (Track Record & Ratings) describes the stock’s outlook.

The company is experiencing strong growth in its index business while margins are also expanding.

Foresi sums up as follows: “We expect shareholders to benefit over the long term from growth in indexing, recent investments/reorganization, margin expansion, and capital allocation.”

Buffett just went all-in on THIS new asset. Will you?

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

Source: Investor Place

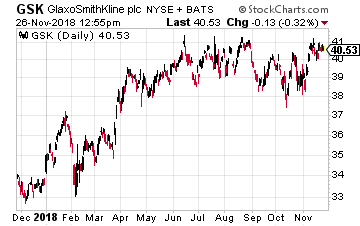

GlaxoSmithKline (NYSE: GSK) is probably the most active of all pharmaceutical companies in applying artificial intelligence to drug discovery. It even created an in-house artificial intelligence unit called the “In silico Drug Discovery Unit.”

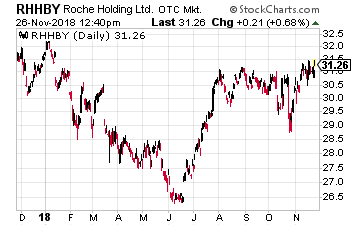

GlaxoSmithKline (NYSE: GSK) is probably the most active of all pharmaceutical companies in applying artificial intelligence to drug discovery. It even created an in-house artificial intelligence unit called the “In silico Drug Discovery Unit.” Another of my favorites in the sector with regard to the use of AI is the Swiss drug giant, Roche Holding Ltd. (OTC: RHHBY). This company’s stock, in the form of an ADR that trades well over 1.2 million shares a day, has been a slow and steady climber. It is very near its 52-week high despite a terrible stock market background.

Another of my favorites in the sector with regard to the use of AI is the Swiss drug giant, Roche Holding Ltd. (OTC: RHHBY). This company’s stock, in the form of an ADR that trades well over 1.2 million shares a day, has been a slow and steady climber. It is very near its 52-week high despite a terrible stock market background.

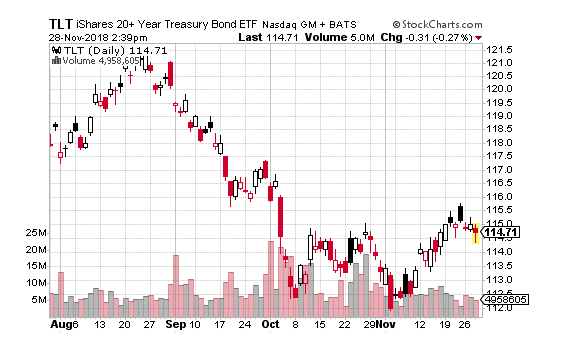

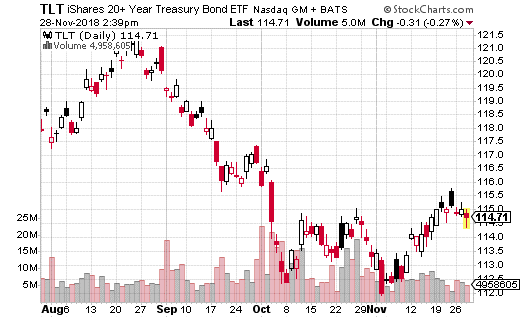

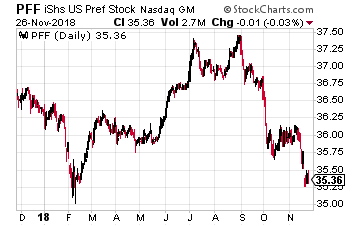

Preferred stock prices will rise in a recession if the Fed reduces interest rates, which it very likely will to stimulate the economy. You need to be aware preferred prices will decline in a rising rate environment. It’s tough to evaluate individual preferred stock issues, so I recommend using a dedicated fund like the iShares U.S. Preferred Stock ETF (NYSE: PFF).

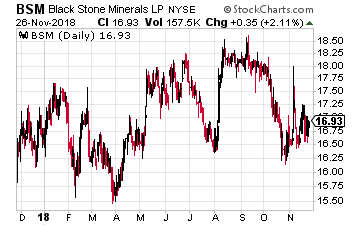

Preferred stock prices will rise in a recession if the Fed reduces interest rates, which it very likely will to stimulate the economy. You need to be aware preferred prices will decline in a rising rate environment. It’s tough to evaluate individual preferred stock issues, so I recommend using a dedicated fund like the iShares U.S. Preferred Stock ETF (NYSE: PFF). Commodity exposure can be a great hedge against rising prices and inflation. Black Stone Minerals, L.P. (NYSE: BSM) is the largest pure-play oil and gas mineral and royalty owner in the United States. The company has rights to over 20 million mineral and royalty acres with interests in 41 states and 64 producing basins.

Commodity exposure can be a great hedge against rising prices and inflation. Black Stone Minerals, L.P. (NYSE: BSM) is the largest pure-play oil and gas mineral and royalty owner in the United States. The company has rights to over 20 million mineral and royalty acres with interests in 41 states and 64 producing basins.