Headline writers are warning of a junk bond apocalypse. The articles warn that this is bad news for stocks.

Many analysts believe bond traders are smarter than stock market traders. Bonds require more math to understand, and the logic is that only smart traders work in that market.

Since bond traders are smart, the theory says, they stay one step ahead of the stock market. A breakdown in bonds is a warning sign for stocks. And bond breakdowns should start in the weakest sector, which is junk bonds.

So, when junk bonds sold off last week, the message was clear — the bear market in stocks is inevitable.

The problem is, that’s wrong.

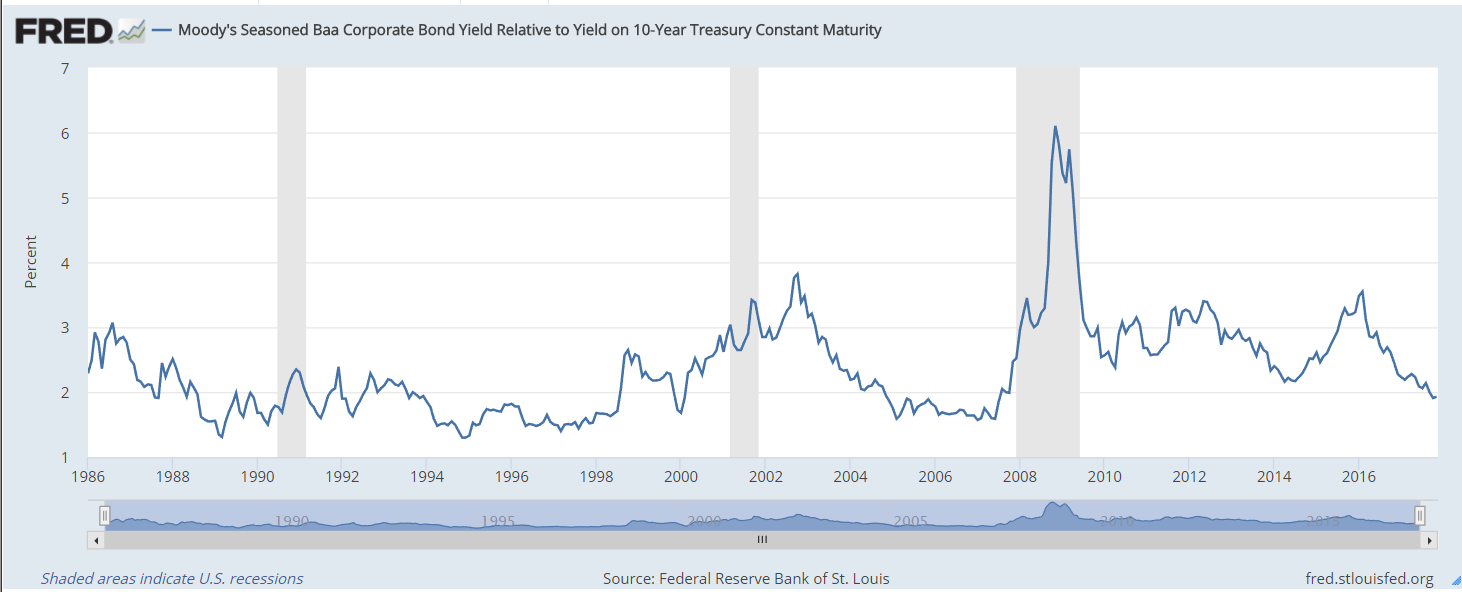

The chart below shows an indicator called the interest-rate spread. It’s falling … and that’s bullish for stocks.

(Source: Federal Reserve)

The interest-rate spread is the difference between the interest rate on low-grade corporate bonds and 10-year Treasury notes. Low-grade bonds include bonds we often call junk.

This indicator tells us whether bond investors are worried or confident about the future. When they are confident, they buy junk bonds. This pushes the yield on junk down. The indicator declines as rates on junk near rates on Treasuries.

When investors are worried, they avoid low-grade bonds. Instead, they buy Treasuries. This leads to lower rates on Treasuries.

To make low-grade bonds attractive, the interest rate must rise. When the rate gets high enough, investors will buy low-grade, or junk, bonds, and the spread falls.

I tested this indicator on the stock market with data going back to 1919. The rules were simple: Buy stocks when the spread is falling.

Specifically, if the spread is lower than it was a year ago, buy stocks. If the spread is higher than a year ago, sell stocks and hold cash.

This simple strategy beat the market by more than 170%. It also avoided steep losses in bear markets. Interest-rate spreads was the best economic indicator of 44 that I tested.

Right now, this indicator is bullish. That means the recent stock market pullback is a buying opportunity.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader

In this exciting NEW VIDEO, Wall Street legend and former multibillion hedge fund manager Paul Mampilly pulls back the curtain on the biggest investment opportunity in the market today. What insiders are calling “The Greatest Innovation in History,” this revolution will mint more millionaires and billions than any technology that came before it. Right now, the current market for this technology is just $235 billion, but given how fast this technology is moving experts predict it will soar to $19 trillion by 2020. But 8,000% growth is just the beginning—and now’s your chance to get in on the action. [CONTINUE TO VIDEO]

Source: Banyan Hill