Last week, I was at my son’s friend’s birthday party, and one of the dads there brought up crypto.

We were discussing various coins when another parent overheard and broke into the conversation. “I hope you guys don’t own any bitcoin, because that thing is crashing hard!” he said with a grin.

I nodded politely and acknowledged that crypto is going through a rough patch, with prices correcting practically across the board.

Then I asked the other dad if he knew what a bitcoin cost a year ago. He didn’t.

So I told him that bitcoin was trading for around $948 one year ago. And that despite the recent pullback, bitcoin is still up around 9X to 10X over the last 12 months.

The entire crypto market, as tracked by Coinmarketcap, has risen from around $15 billion early last year to around $400 billion today.

I don’t know of any other asset that even comes close to these returns. And the further back you go, the more insane the returns get. When I first bought in the spring of 2013, bitcoin was trading for $84. And it had just run up to that price from around $5 only months before.

My point is that if you paid attention only to mainstream news sources, you might think bitcoin was trading at multiyear lows. It’s “crashing,” “plummeting “… it “won’t survive.”

I believe this pullback is completely natural. Here’s why…

A Natural (Yet Nasty) Correction

I look at the crypto market like this: 15 steps forward, nine steps back.

When an asset increases in value 20X, as bitcoin did last year, it’s only natural for some owners to take profits. Others who bought in at $15,000 or $19,000 are likely panic-selling.

This is simply how markets operate. Weak hands are shaken out during these times.

Yet a significant portion of the investors who bought in over the last year will hold strong. And they will continue to hold for years because historically, that’s the most proven way to make money in crypto. This is the sturdy base of crypto owners, and it continues to grow steadily.

Let’s look beyond price action for a moment and recognize that huge developments are taking place in the crypto world.

First, governments appear to be closer to regulating crypto markets. If done correctly, this will be a very positive development.

The fact that South Korea, for example, is banning anonymous cryptocurrency trading, is arguably a good thing.

We need trust to make these new markets work long term. And that will never happen if naysayers can point to crypto as a haven for hackers and criminals.

So, just as banks are required to verify accounts under “know your customer” laws, cryptocurrency exchanges around the globe are now moving in that direction as well.

We also got news this week that Robinhood, the commission-free stock trading service with millions of users, is moving into the crypto markets. Soon, users will be able to buy and sell crypto with zero commission.

Still, there’s clearly some other factor holding cryptocurrency markets back. And it’s not what you might expect…

Exchanges Are Growing Too Fast

A primary factor in the crypto pullback that most people haven’t recognized is this: Most exchanges are growing far too fast.

So many people are entering the market that many exchanges have had to shut down new user registrations. Most others can’t keep up with customer support.

Bittrex, Bitfinex, CEX. IO and Binance (four of the largest crypto exchanges in the world) have been forced to deny new customer accounts due to explosive growth.

Binance, for example, added 240,000 new accounts in a single hour on January 10. It has since stopped accepting new accounts and only recently began allowing a small number of new users per day.

Coinbase, the largest U.S.-based exchange, continues to experience major growing pains. Its customer support is flooded, and it can’t verify new accounts fast enough.

Exchanges simply can’t keep up with the massive influx of new crypto investors.

Naturally, this has put a damper on markets. When the flow of new buyers is bottlenecked by exchange capacity, it’s of course going to cause a temporary pullback in prices.

Behind the scenes, however, crypto exchanges are furiously upgrading their systems and hiring to meet demand. Due to security requirements and the fact that exchanges are now required to verify all customers, this takes time.

The point is that exponential user growth is a great problem to have. Exchanges are working diligently to accommodate new users, and I suspect that soon, most of them will reopen new account registrations and clear their customer service backlogs.

When this happens, I expect to see a sharp rebound in crypto markets. And then we can begin the next leg up. If we get more clarity on government regulation, even better. There’s also the X-factor of institutional buyers, who I still believe will start moving into the crypto market in the next few months.

By the end of the year, I’m fairly certain we’ll look back at this dip and say, “Damn, that was a great buying opportunity.” But in the midst of a nasty correction, the opportunity is hard to recognize.

It seems like the end of the world for crypto, but I assure you… it’s not.

We’re still at the very beginning.

Have a great weekend, everyone.

Adam Sharp

Co-Founder, Early Investing

Can a $10 Bill Really Fund Your Retirement? The digital currency markets are delivering profits unlike anything we’ve ever seen. 23 recently doubled in a single week. And some like DubaiCoin have jumped as much as 8,200X in value in 18 months. It’ unprecedented... but you won’t receive any of the rewards unless you put a little money in the game. Find out how $10 could make you rich HERE.

Source: Early Investing

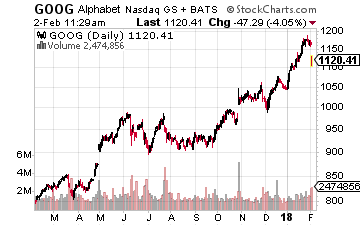

And let’s not forget that there continues to be intensifying competition in the premium smartphone market. Alphabet (Nasdaq: GOOG) officially closed its $1.1 billion deal with HTC Corp., adding more than 2,000 smartphone specialists in Taiwan. This is expected to help Google chase Apple in the increasingly cut-throat premium handset market.

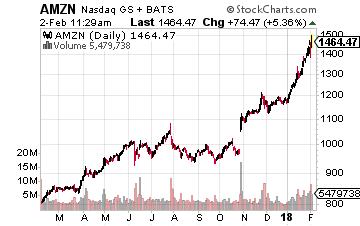

And let’s not forget that there continues to be intensifying competition in the premium smartphone market. Alphabet (Nasdaq: GOOG) officially closed its $1.1 billion deal with HTC Corp., adding more than 2,000 smartphone specialists in Taiwan. This is expected to help Google chase Apple in the increasingly cut-throat premium handset market. One bright hope was the smart speaker market. After all, Apple’s Siri was the leader in the virtual assistant space. But it has now taken a back seat to smart speaker products from both Google (Home) and, of course, Amazon.com (Nasdaq: AMZN)and Alexa. Amazon’s Echo speaker was launched in 2014 while we still wait for Apple’s entry.

One bright hope was the smart speaker market. After all, Apple’s Siri was the leader in the virtual assistant space. But it has now taken a back seat to smart speaker products from both Google (Home) and, of course, Amazon.com (Nasdaq: AMZN)and Alexa. Amazon’s Echo speaker was launched in 2014 while we still wait for Apple’s entry.