After a 14-month bull run, the stock market has seen a return in volatility of late — and a few big sell-offs. It’s clearly a more nervous market, and that means investors have to be more careful in choosing what stocks to buy.

That means sticking with quality stocks and avoiding those that can blow a hole in your portfolio. These 10 stocks all continue that level of risk.

In a bull market, in some cases those risks are worth taking. Ahead of what looks like a potentially dangerous second quarter, however, investors should steer clear of these 10 stocks.

Worst Stocks to Buy: Blue Apron (APRN)

Blue Apron Holdings Inc (NYSE:APRN) has been one of the worst IPOs in recent memory. At $2, APRN stock has lost 80% of its value from its IPO price in June. And bear in mind that the $10 price was well below the original range of $15-$17 per share.

All the way down, APRN has attracted buyers. The stock even posted a short-lived rally in December. But the fact remains that there’s basically no price where Blue Apron stock is cheap enough.

2018 numbers should be better in terms of both profitability and cash flow. But Blue Apron still expects to lose money even at the EBITDA line — and to burn cash. With debt coming due in August 2019, there’s a possibility that APRN could go to zero within eighteen months, as I argued last month.

Even if that worst-case scenario doesn’t play out, there’s little reason to chase APRN at these levels. Q1 results don’t look likely to be notably better, as the company still is working through the addition of a new distribution center in New Jersey. Competition is intense, with Walmart Inc(NYSE:WMT), Kroger Co (NYSE:KR) and even Weight Watchers International, Inc.(NYSE:WTW), among many others, entering the meal kit space.

$2-per-share might sound cheap, but APRN still is valued at nearly $400 million. And with a mid-term path toward zero, there’s no price cheap enough for Blue Apron stock.

Worst Stocks to Buy: Chipotle (CMG)

There is a case to buy Chipotle Mexican Grill, Inc. (NYSE:CMG) at these levels. The impact of the company’s food safety issues is receding. A new CEO has sparked optimism, as Luke Lango argued last month. The company expects positive same-restaurant sales in 2018, and new stores will add to revenue growth.

But I’m not buying CMG, particularly with a quick and steep rebound after a disappointing Q4 earnings report in February. A new CEO can help, but his impact isn’t going to be seen in Q1. The entire restaurant industry looks rather weak, particularly for operators like CMG as opposed to franchisors like McDonald’s Corporation (NYSE:MCD) and Yum! Brands, Inc. (NYSE:YUM).

And CMG already is pricing in quite a bit of turnaround. The stock trades at over 50x 2017 EPS and 38x 2018 consensus. Those are huge multiples for a still-struggling company in this kind of market. And after the past few quarters, I certainly wouldn’t enjoy being long CMG ahead of Q1 earnings this month.

Worst Stocks to Buy: Fossil (FOSL)

Fossil Group Inc (NASDAQ:FOSL) had one of the best first quarters in the entire market. A blowout Q4 report in February sent the stock up a stunning 88% in a single session.

But the optimism seen in February already has started to fade. FOSL stock has pulled back over 20% from post-earnings levels. And a short squeeze no doubt drove at least some of the gains: FOSL was the most heavily-shorted stock in the Russell 3000 ahead of earnings, according to Bloomberg.

There is some good news here. Strength in wearables led to the surprising Q4 results, as it offset weakness in traditional watches. FOSL stock still isn’t that expensive, trading at ~5x FY18 EV/EBITDA guidance and ~13x implied non-GAAP EPS.

Still, long-term challenges persist. Even with the strong Q4, full-year same-store sales still fell 6%. The optimism toward the wearables business may be premature. Apple Inc. (NASDAQ:AAPL) has had some success, but Fitbit Inc (NYSE:FIT) has struggled mightily.

Meanwhile, earnings multiples aren’t out of line for brick-and-mortar retail — and suggest a stabilization in profits. With Fossil still guiding for profits to decline in fiscal 2018, that seems premature. FOSL did squeeze the shorts, but lightning isn’t likely to strike twice in Q2.

Worst Stocks to Buy: Barrick Gold (ABX)

Heading into Q2, I can see the case for Barrick Gold Corp (USA) (NYSE:ABX). Barrick was the world’s largest gold producer in 2017. Gold has risen for three straight quarters, and could rise more in Q2. More market volatility, geopolitical tension, or any macro concerns could stoke demand for gold as a “safe haven”. Meanwhile, ABX is bouncing off a multi-year low, and looks cheap at under 17x forward EPS.

But that’s kind of the point. Barrick hasn’t benefited from the recent spike. Gold is up 16% since the beginning of 2017. ABX is down 22%. Gold has risen nearly 50% over the past decade; ABX has declined 72%.

That problem isn’t going to change in 2018. Barrick’s disappointing production guidance helped send Barrick stock to that multi-year low. Goldcorp Inc. (USA) (NYSE:GG) is likely to take Barrick’s crown as the top gold producer. Issues in Zambia and a settlement in Tanzania provide further pressure.

Gold indeed may rise again in Q2 — and ABX may follow. But given the long history here and the slow pace of Barrick’s turnaround make it a poor choice to play a higher gold thesis. Investors would be much better off buying GG, Newmont Mining Corp (NYSE:MEM) — or gold itself.

Worst Stocks to Buy: Deutsche Bank (DB)

The long-running turnaround at Deutsche Bank AG (ADR) (NYSE:DB) simply hasn’t taken. DB shares have bounced off a three-decade low reached in 2016. But a recent sell-off has pushed DB back below $14, with returns even from those lows barely over 20%. In the meantime, fellow investment banks like Goldman Sachs Group Inc (NYSE:GS) and Morgan Stanley (NYSE:MS) have soared.

The case for a long-term turnaround isn’t dead. There is some potential value in Deutsche Bank stock. But it’s highly unlikely investors will enjoy the next couple of months. The company already admitted that planned cost cuts would be delayed. Rumors are swirling around the future of CEO John Cryan — with reports suggesting multiple candidates already have turned the job down.

Deustche Bank looks like a mess, plain and simple. And with speculation likely to swirl throughout the quarter, and further hurt morale and the company’s competitive position, that mess isn’t getting fixed in the next three months.

Worst Stocks to Buy: Walt Disney Co (DIS)

The long-term case for Walt Disney Co (NYSE:DIS) remains up for debate. I remain skeptical toward DIS, largely due to the long-running (and very real) concerns surrounding the key ESPN unit.

The short-term case, however, looks outright bearish. Disney is trying to acquire assets from Twenty-First Century Fox Inc (NASDAQ:FOX, NASDAQ:FOXA) — a deal the market sees as necessary for Disney to build out its content empire. But Comcast Corporation(NASDAQ:CMCSA) is stepping in to bid for Sky PLC (ADR) (OTCMKTS:SKYAY), which Fox itself is trying to buy. And that deal potentially could wind up scuttling the entire Disney-Fox tie-up — or push Disney to up its bid.

There’s going to be a lot of speculation, and a lot of uncertainty, over Disney’s M&A over the next few months. And in this market, that’s probably not going to be a great thing for DIS stock. DIS already fell 6.6% in Q1, and between Fox and what looks like an accelerating trend toward cost-cutting, Q2 would be worse. There is value here, and the company’s new streaming service could drive growth in the future. But until then, and without a lower price, DIS looks likely to at best continue its range-bound trading of the last three years.

Worst Stocks to Buy: Under Armour (UA)

Under Armour Inc (NYSE:UAA, NYSE:UA) shareholders have received some good news of late. UAA stock has rallied 43% after hitting a four-year low in November.

But I continue to be skeptical about Under Armour’s prospects, even after a better Q4 result. And there’s a good chance that UAA could revisit the lows in the second quarter.

UAA stock remains dearly valued, at 57x-forward-earnings. Margin pressure continues. Analysts aren’t backing the stock, with the average target price of $14.28, 13% below the current price. Meanwhile, Nike Inc (NYSE:NKE) just posted a strong quarter and projected an inflection point in its North American business — the same business from which Under Armour is trying to take market share.

More broadly, UAA has teased investors before during its long decline from above $50 to under $12. The recent gains look like another head-fake that could reverse after the Q1 report a few weeks from now.

Worst Stocks to Buy: Box

As far as high-growth tech stocks go, Box Inc (NYSE:BOX) doesn’t look that out of line from a valuation standpoint. FY19 (ending January) guidance suggests a 5x EV/revenue multiple. With high-flyers like Workday Inc (NASDAQ:WDAY) and Shopify Inc (NYSE:SHOP), among many others, trading at 8x-10x or higher, Box’s valuation isn’t that onerous.

Still, there’s an awful lot of reason for caution. The recent IPO of Dropbox Inc. (NASDAQ:DBX) could potentially steal investor attention, even though Dropbox is far more consumer-focused than business-centric Box. Q4 earnings in early March sent BOX stock plummeting, but the stock quickly reversed.

BOX stock doesn’t necessarily look like a short — less than 4% of shares outstanding are sold short at the moment — but it does look potentially dangerous ahead entering into Q2. Growth is solid, but not particularly impressive, with guidance suggesting a ~20% increase in FY19. Box isn’t close to profitability. Dropbox could soak up some of the attention and investor enthusiasm for the business model. If the market heads further south, BOX would seem to be a likely loser.

Worst Stocks to Buy: tronc (TRNC)

Newspaper stocks like tronc Inc (NASDAQ:TRNC) actually haven’t done that badly of late. Certainly, they’ve performed better than investors might think given the clear secular pressure on print sales, and the difficulty in monetizing content.

Indeed, TRNC has gained 14% over the last year. Gannett Co Inc (NYSE:GCI) has risen 21%, plus 6% in dividends; New Media Investment Group Inc (NYSE:NEWM) has risen the same amount, with an even larger dividend.

But the gains in the sector seem likely to reverse — and TRNC might be most at risk. Here, too, Q4 earnings disappointed badly. Chairman Michael Ferro recently retired ahead of sexual harassment allegations. The sale of the Los Angeles Times brought in much-needed cash, but profits continue to decline even with tronc spending on additional acquisitions.

There is a case that newspaper companies can be classic “cigar butt” stocks, generating enough cash flow to make even a declining business worth buying. But tronc’s lack of shareholder returns undercuts that case, as does the loss of Ferro, who had driven the company’s strategy. TRNC has performed well of late, but its run may be coming to an end.

Worst Stocks to Buy: General Mills (GIS)

Some investors no doubt are going to take a chance on General Mills, Inc. (NYSE:GIS) after the company’s post-earnings plunge last month. GIS trades at a five-year low. It yields 4.3%. It’s a 90-year-old company with well-known brands and a long, profitable history. From a distance, General Mills stock at $45 might look like an opportunity.

However, I don’t think that’s the case, and I think it’s highly likely it gets worse for GIS before it gets better. I wrote after fiscal first-quarter earnings back in September that General Mills had lost investor trust when it came to both revenue and margins. Two quarters later, those problems are only more pressing — and General Mills has proven that it has little in the way of answers.

In a somewhat odd way, GIS is reminiscent of General Electric Company (NYSE:GE). In both cases, bulls focused on the history and the dividend, while glossing over near-term problems and reasonably significant debt levels.

I’m not sure GIS’ trend will be quite as bad as that of GE, which has lost half of its value in less than two years, or that a General Mills dividend cut is on the way. But the case of GE, the underlying problems in the business led to a long, slow decline as investors adjusted to the new reality. That’s a very real risk that a similar process will play out at GIS over the next few months.

The 145 Companies Your Stockbroker Will NEVER Tell You About Did you know more than 145 tiny companies have grown to $1 billion-plus valuations since 2012? SpaceX is up 26,309% in value... Dropbox 31,733%... and Pinterest 487,404%. All of these 145 businesses started out as private companies your broker would have NEVER told you about. But now there’s a great way to find the next private companies poised for hyper-growth. Full Details Here.

Source: Investors Alley

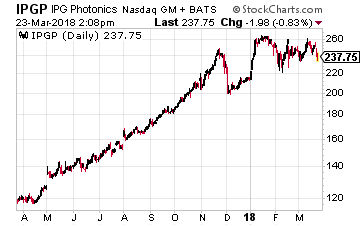

That leads directly to my recommendation – IPG Photonics (Nasdaq: IPGP), a leading developer and manufacturer of high-performance fiber & diode lasers and amplifiers for a vast range of industries and applications. Its products are used in industries such as materials processing, communications, medical and biotechnology, science and entertainment. IPG Photonics has been in the

That leads directly to my recommendation – IPG Photonics (Nasdaq: IPGP), a leading developer and manufacturer of high-performance fiber & diode lasers and amplifiers for a vast range of industries and applications. Its products are used in industries such as materials processing, communications, medical and biotechnology, science and entertainment. IPG Photonics has been in the