While most income investors are reaching for big yields right now, a small group of “hidden yield” stocks are quietly handing smart investors growing income streams plus annual returns of 12%, 27.1% and even 54% or more per year.

So if you want to double your money every few years – and double your income as well – then you need to focus on the seven stocks I’m about to share.

(All seven are about to hike their dividends. Yet the “forward-looking market” hasn’t yet priced in these payout raises. This is free money the market is giving us, thanks to the most “underrated” shareholder return vehicle.)

The Most Lucrative Way Shareholders Get Paid

There are three – and only three – ways a company’s stock can pay us:

- A cash dividend.

- A dividend hike.

- By repurchasing its own shares.

Everyone loves the dividend, but investors usually don’t give enough love to the dividend hike. Not only do these raises increase the yield on your initial capital, but also they often are reflected in a price increase for the stock.

For example, if a stock pays a 3% current yield and then hikes its payout by 10%, it’s unlikely that its stock price will stagnate for long. Investors will see the new 3.3% yield, and buy more shares.

They’ll drive the price up, and the yield back down – eventually towards 3%. This is why your favorite dividend “aristocrat” – a company everyone knows and has paid dividends forever – never pays a high current yield. Its stock price rises too fast!

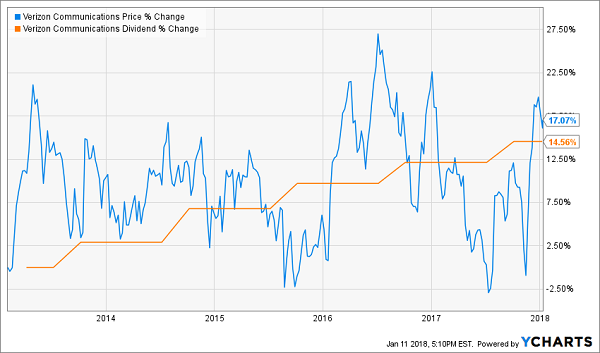

For example let’s look at Verizon (VZ), it pays a generous dividend – but doesn’t raise it meaningfully. This lack of payout upside caps the stock’s price upside.

Frustrated Verizon investors need not look further than this chart for an illustration of why their money is underperforming:

Verizon’s Sleepy Dividend Slows the Stock

Verizon’s stock and dividend have increased by roughly the same amount. That’s no coincidence – it happens all the time.

You’ll also notice that the firm’s track record of “yearly dividend raises” means little because the raises themselves weren’t meaningful.

This a common mistake dividend aristocrat fans make when they flock to track records. They’re not that far off the scent of 100%+ gains, however. They just need to look ahead, rather than behind. Let me explain.

The Path to Fast 162% Gains From Safe Blue Chips

Have you always wanted to buy a safe blue chip stock like Coca-Cola (KO) and get rich from it like Warren Buffett?

It’s doable. But most investors “live in the past” and fixate on dividend track records rather than a payout’s forward prospects. And looking ahead is the key to yearly gains of 12%, 27.1% or even 54% or more with blue chip stocks.

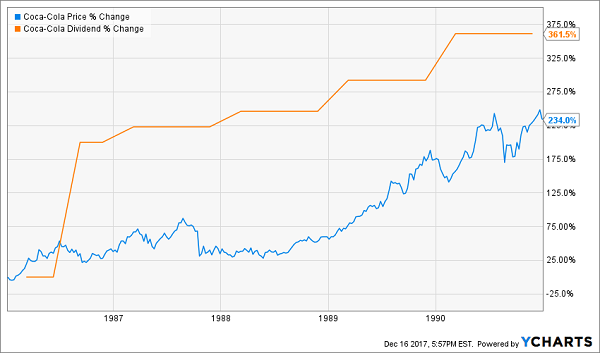

Let’s first consider the case of Coke, which achieved its dividend royalty status in 1987 (its 25th straight year with a dividend hike). The firm hit its coronation with a head of steam, rewarding investors with a 362% payout hike in just five years (from 1986 to 1991). Its stock price raced to keep up with its dividend, rising 234% over the same time period:

Great Dividend Growth, Great Returns

It didn’t really matter if you bought shares before or after the company was officially a dividend aristocrat. The driving factor for profits was the dividend’s velocity – it was moving higher quickly, so its stock price followed.

Fast forward to the last five years, and we see that Coke’s youthful exuberance has slowed considerably. The firm still hikes its payout every year, but it’s a slower climb – totaling 45% over the past five years. Which means its stock price merely plods along too (+25% in five years):

Average Dividend Growth, Average Returns

If you’re looking for great dividend growth in 2018, you should focus on these seven firms about to raise their payouts.

Tiffany & Co. (TIF)

Dividend Yield: 2.1%

Luxury goods company Tiffany & Co. (TIF), like many other retail stocks, is struggling to find any positive momentum whatsoever in 2018. The stock is off more than 9% through the first few months of the year – far worse than the broader market’s 1.9% declines.

That said, it’s not all thorns for Tiffany.

Just a few months ago, the company reported a solid holiday-season quarter that included a 5% jump in comparable-store sales and an 8% improvement in the top line, largely bolstered by impressive performances from the Asia-Pacific region and Europe. That led Tiffany to upgrade its own outlook for the fiscal year’s profits.

Sometime near the end of May, shareholders should be on the receiving end of another dividend hike. Tiffany has upgraded its payout by nearly 50% over the past five years, and is likely to tack on an additional bump during the last week of the month.

Phillips 66 (PSX)

Dividend Yield: 2.9%

Phillips 66 (PSX) is a welcome breath of fresh air in the energy space. That’s because while many energy stocks were slowing dividend growth down to a trickle during the oil-price collapse starting in summer 2014 – or even cutting payouts – Phillips 66 has kept the income pipeline flowing.

Namely, since 2014, this refiner and midstream company has juiced its dividend by nearly 80%, including a substantial 11% hike last year.

PSX should have plenty of ammunition for another dividend increase come early May, when it typically makes an announcement. That’s because the company reported yet another excellent quarter a couple months ago that beat the pants off analyst estimates – profits of $1.07 per share were well ahead of the consensus estimate of 86 cents.

But the spending won’t end there. Phillips 66 also plans to spend $500 million more on capital expenditures in 2018 than it did in 2017, which should fuel growth over the coming years.

Southside Bancshares (SBSI)

Dividend Yield: 3.2%

While the run-up in banks has left yields in the financial space awfully dry, Southside Bancshares (SBSI) offers a respectable yield of above 3%. That’s in some part thanks to an aggressive dividend policy that has seen the company raise payouts multiple times a year over the past few years.

Southside, by the way, is the bank holding company behind Texas community bank Southside Bank, which controls about $6.5 billion in assets across 60 branches within the state. There’s nothing out of the ordinary about this bank – it provides typical services such as mortgages, personal loans, and checking and savings accounts.

What is unusual about SBSI is its dividend program, which has featured varying numbers of increases across the past few years. But one thing that’s pretty consistent is the company announcing a dividend hike sometime in mid-May.

Leggett & Platt (LEG)

Dividend Yield: 3.2%

What would a list of potential dividend increases be without a Dividend Aristocrat?

Leggett & Platt is one of the more diversified manufacturers out there, producing a swath of products used in businesses, in homes and even in transit. Just a few examples? Its residential products include bedding, carpet cushions and furniture fasteners; its industrial products include various types of wires and sterling steel rods; and it even boasts an aerospace division that includes tubes and ducts.

That diversification has allowed Leggett to build a 47-year history of interrupted dividend increases, and No. 48 should be on the way in May. The company typically makes an announcement during the middle of the month.

Agree Realty (ADC)

Dividend Yield: 4.2%

Agree Realty (ADC) is a net-lease retail real estate investment trust that owns 458 assets in 43 states, making up about 8.8 million square feet of gross leasable space. Tenants include the likes of Walgreens (WBA), McDonald’s (MCD) and JPMorgan Chase (JPM).

It’s also a dedicated dividend raiser. Agree Realty has actually doled out a pair of dividend increases in each of the past couple years, and if history repeats itself, the company should be due for another dividend hike sometime in May.

Of course, the question is “when”? The company’s declaration dates have been all over the place – sometimes at the end of the month, sometimes at the beginning, and it has even stretched the announcement out into June before.

Stag Industrial (STAG)

Dividend Yield: 5.9%

Stag Industrial (STAG) is a highly respected monthly dividend stock that plays in the single-tenant industrial real estate space. That includes warehouse, distribution and light manufacturing facilities.

At the moment, the portfolio includes 356 buildings in 37 states, spread across numerous industries, including automotive, air freight, containers & packaging, food & beverages and business services, among others. The tenant list is diverse, too, and spread out – the largest tenant (the U.S. General Services Administration) makes up just 2.6% of ABR. Other tenants include XPO Logistics (XPO), Deckers Outdoor (DECK) and Solo Cup.

While Stag’s dividend increases tend not to take effect until the dividend paid out in August, it tends to announce said increase sometime in the first week of May. The company typically hikes its payout twice a year, though it did keep it to “just” one increase in 2016.

Spectra Energy Partners (SEP)

Dividend Yield: 8.7%

Spectra Energy Partners (SEP) is one of the largest energy master limited partnerships (MLPs) in the country, boasting more than 15,000 miles of transmission pipelines, 170 billion cubic feet of nat-gas storage and about 5.6 million barrels of crude oil storage, according to its own most recent data.

Spectra also is one of the more prolific payout raisers in energy.

The company has raised its distribution by about 50% over the past five years, which is plenty respectable. But Spectra has done it in style, announcing its 41st consecutive quarterly increase to its distribution in February.

No. 42 is likely coming sometime in the first week of the month.

Michael Foster has just uncovered 4 funds that tick off ALL his boxes for the perfect investment: a 7.4% average payout, steady dividend growth and 20%+ price upside. — but that won’t last long! Grab a piece of the action now, before the market comes to its senses. CLICK HERE and he’ll tell you all about his top 4 high-yield picks.

Source: Contrarian Outlook