It’s been a banner year for the tech sector, and that’s especially true for the best tech stock to buy in November 2018…

Just look at what some of the big tech stocks have already done. Tech giant Amazon.com Inc. (NASDAQ: AMZN) is up a staggering 44%. Apple Inc. (NASDAQ: AAPL) has risen 18%.

With tech stocks like Amazon and Apple near all-time highs, it can feel like investors have missed the boat on tech investment.

However, that couldn’t be further from the truth. Some of the best tech stocks to buy right now are flying under the radar – and they’re easy to find if you know where to look.

We do. And we’re going to show you how this booming new tech sector is going to send our top tech stock soaring…

The Most Exciting Tech Field to Invest in Right now

One product on the verge of redefining modern life in the same fashion as the personal computer is autonomous electric vehicles.

You see, self-driving electric cars stand at the convergence of three important and innovative trends – clean energy, technological innovation, and safer transportation.

As of this writing, more than 1 billion gas-burning vehicles are used every day – and that’s just passenger cars. Trucks, motorcycles, and vehicles using combustible engines use immense amounts of oil.

Burning fossil fuels is one of the leading causes of greenhouse gases, which many believe are driving climate change.

With carbon emissions expected to rise an additional 100% by 2035 without substantial intervention, limiting the carbon output of traditional gas burning vehicles is imperative.

And that’s where self-driving electric cars come in. Because they limit the global net consumption of fossil fuel, autonomous electric cars are a crucial part of limiting carbon emissions – and will play a tremendous roll in future green investments.

Electric cars are also expected to play a vital role in improving vehicle safety and navigation.

You see, autonomous vehicles can sense and reduce driver error – saving lives and making traffic accidents a thing of the past.

Because of the clear benefits in safety and navigation, analysts believe that the self-driving car market will increase tenfold in fewer than 10 years, jumping to a value of $556 billion.

And we’ve identified one company that’s going to ride this boom into immense profits.

It’s a major tech firm that’s going to play a vital role in the mass production of electric autonomous vehicles.

And it’s going to make shareholders a killing in the process…

The Best Tech Stock to Buy in November 2018 Is a Leader in Self-Driving Vehicles

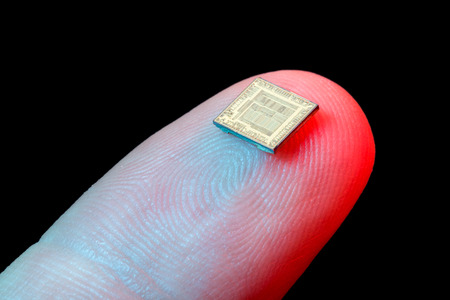

Money Morning Defense and Tech Specialist Michael A. Robinson believes the best tech stock to buy in November 2018 isn’t a vehicle maker. It’s a microchip company that supplies the brains, not the brawn.

Nvidia Corp. (NASDAQ: NVDA) is expected to be a prime beneficiary of the self-driving car market.

Nvidia is best known for its video game products. It makes the graphics cards for computers and video game consoles.

But it makes a lot more than that. The company’s latest strategy is to partner with car manufacturers and offer a wide spectrum of advanced tools centered in technology that they will use on the way to fully self-driving vehicles.

Nvidia combined its development strategy with sensor suppliers, advanced mapping software, research shops, and more. As a result, Nvidia’s Drive AX platform is the premier product in its class.

Drive AX operates as a central nervous system for self-driving vehicles.

Nvidia has a number of automotive partners. They include Volkswagen AG (OTC: VALKA), one of the larger global manufacturers. According to reports, Volkswagen intends to give a majority of its self-driving vehicle development to Nvidia.

Nvidia is also working with automakers Audi AG (OTC: AUDVF) and Volvo AB (OTC: VLVLY). Truck makers such as PACCAR Inc. (NASDAQ: PCAR) and logistics firms such as Deutsche Post AG (OTC: DPSGY) are also deploying the Nvidia Drive AGX platform.

All of this effort is having a great effect on the company’s bottom line too. Nvidia sales soared to $10 billion in 2017 from just $5 billion the year before. In 2019, the company is expected to rake in net sales of $19 billion.

Not bad for a company and industry at the very start of its potential growth trajectory.

Robinson forecasts that its growth in earnings, combined with its work in red-hot innovative fields, will propel the share price to $400 in 12 months.

That’s a soaring 96% rise from its current price of $204.

Buffett just went all-in on THIS new asset. Will you?

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

Source: Money Morning