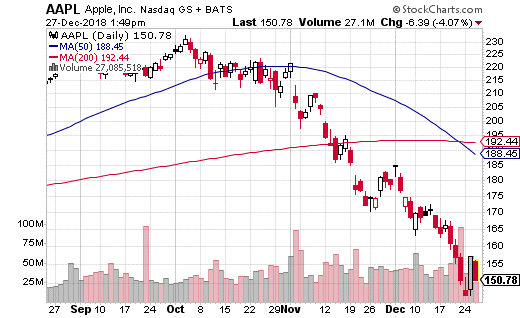

Markets were on track to finish higher Friday, when the rhetoric between the President and Democrats around the partial government shutdown heated up, with jabs being thrown by both parties. President Trump, in a tweet, threatened to close the border with Mexico, abandon the newly minted USMCA trade deal, and cut off aid to several Central American countries he has criticized for not stopping caravans of immigrants headed to the U.S. border. A spokesman for incoming House Speaker Nancy Pelosi returned fire saying the Democrats had offered solutions to the ongoing shutdown but would not fund the President’s “immoral, ineffective, and expensive wall.” Markets were once again derailed by the headlines as the DJIA rally vanished and the index finished down .33%. The S&P was off .12%, and the Nasdaq bucked the trend to advance .08%. Most traders are ready to throw in the towel on 2018, as this December will likely go down as one of the worst in history for stock market returns.

Investors will be watching the Dallas Fed Manufacturing Survey closely Monday after a major drop in the Richmond Fed Manufacturing Index on Wednesday. The fall in the Richmond numbers was very unexpected, and caught analysts by surprise. The Dallas Fed numbers have been on the decline for several months now. Tuesday markets will be closed for the New Year holiday.

Redbook retail data and the PMI Manufacturing Index will be released Wednesday. The index tracks private sector output, new orders, and inventory levels to give investors an idea of how manufacturing industries are performing. Analysts will be parsing the data to determine if it ties with the Richmond and Dallas Fed releases.

The first earnings releases of 2019 begin Thursday when Unifirst Corp. (UNF) and The Simply Good Foods Company (SMPL) report. Simply Good Foods has recently shifted its marketing and branding message for its Atkins line from a diet product to a wellness product. The company has ramped marketing spend to get the word out, which has hampered earnings. RPM International (RPM), Lamb Weston Holdings (LW) and Cal-Maine Foods (CALM) all report earnings Friday.

Thursday, will see the release of motor vehicle sales and MBA mortgage applications. Mortgage applications fell sharply last week with the purchase index down 7%. The Challenger job cut report, ADP employment report, and jobless claims will also be released on Thursday. Jobs have remained a bright spot to this point in the economic cycle, and investors are counting on good numbers to kick off 2019. The ISM manufacturing index and construction spending numbers are slated to be released at 10 am Thursday.

The first Friday of 2019 will bring out Fed Chairman Jerome Powell to participate in a panel discussion at the American Economic Association in Atlanta, Georgia. Markets have been shaken recently by the Fed’s attempts to communicate policy, and investors will likely be hanging on Chairman Powell’s every word. Economic data released Friday includes the employment situation report and PMI services numbers.

This ‘Overlooked’ Sector Produced the Biggest Winners of the Last DecadeWall Street is oblivious to it, yet you can earn 2,537% profits from an overlooked "blue chip" sector. The same group of stocks that has produced some of the biggest winners of the last 10 years.

Investors have earned 618%, 834%, and up to 2,500% - performing better than Amazon, Netflix and Facebook.

Click here to get in on your own 2,537% windfall.