It happened so quietly, you may not have even noticed. But the script has flipped on interest rates—and today I’m going to give you my favorite way to profit. (hint: this buy pays an 8.8% dividend—enough to hand you $8,800 a year in cash on every $100k invested—and is poised for quick 10% price upside, too!).

Let’s start at the beginning.

A Low-Key 180

I’m sure I don’t have to tell you that the big story of the last three years has been the Fed’s aggressive rate hikes. But the big story of the next three years will likely be a lack of aggressive rate hikes.

The change happened fast—at just one Fed meeting in January—and the market now expects zero hikes in 2019. Funny thing is, our best buy for this new world is a group of investments that, if you relied solely on the headlines, you’d think are some of the worst things you could own now.

I’m talking about floating-rate loans, which should rise in value as rates go up. But the Fed’s move to no hikes this year has actually created a great contrarian buying opportunity here.

Floating-Rate Loans Have Been a Wildcard

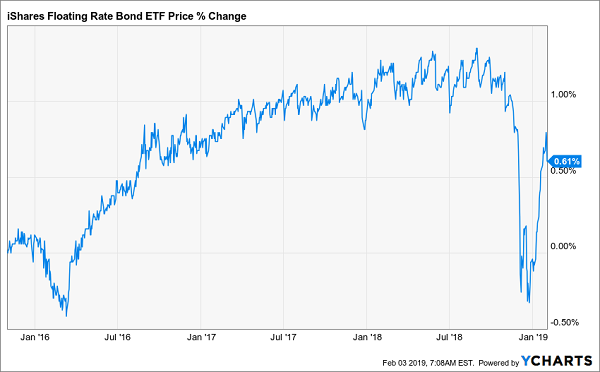

Floating-rate loans were touted as a way to profit from higher rates since the Fed started hiking in late 2015, but there’s been a problem: reality kept butting against this theory.

Floating-Rate Loans Freeze Up

Despite the rising-rate cycle kicking off in December 2015, the benchmark iShares Floating Rate Bond ETF (FLOT) went nowhere following a brief, small bump in early 2016. And investors were no doubt frustrated with the 1% gain they got in the years they held FLOT, before kissing most of that gain goodbye in the late-2018 market panic.

In short: floating-rate loans, for much of this period, didn’t work as planned.

But now is a great time for floating-rate loans, even though the Fed rate is likely to flat-line. Because just as theory didn’t translate to reality by using these loans to profit from higher rates, the theory that their value will go down in value as rates fail to rise is equally unrealistic.

That’s because the recent fall in floating-rate-loan values has nothing to do with interest rates.

The floating-rate loan market saw a huge drop in late 2018 for two reasons: 1) There was a record number of loans in the market, due to lenders choosing floating-rates over corporate bonds (thus increasing supply and limiting price growth); and 2) There was a panic as investors feared lenders would default on their loans due to bankruptcies caused by an economic crash.

The second fear is already proving to be nonsense: not only is there no crash, but employment and corporate earnings seem likely to keep improving in 2019, even after a strong 2018. The first issue, however, is also disappearing—but many people don’t know about it.

Instead of using floating-rate loans, as they did in 2018, more US companies are going back to raising cash by issuing corporate debt in the form of bonds. They are even doing this in unusual and unexpected situations. The Financial Times tells the story of TransDigm (TDG), an aircraft-component manufacturer that used corporate bonds instead of floating-rate loans to fund its $3.8-billion acquisition of aerospace-component maker Esterline.

Commenting on the deal, TwentyFour Asset Management Head of Credit David Norris told the Financial Times: “I would typically have expected a company like this, doing an acquisition, to go to the loan market. But they didn’t do that. There are opportunities right now in the high-yield bond market.”

With the decline in the number of floating-rate loans, demand for those still in existence (and the few new ones coming to market) will likely drive up prices, especially since overblown default fears have kept floating-rate loans below their pre-crash levels.

That means there’s a huge buying opportunity for savvy buyers—especially if we get our floating-rate-loan exposure through closed-end funds (CEFs).

Floating-Rate Confusion Hands Us an 8.8% Cash Payout

Since CEFs often pay huge dividends, your chance to grab 7%+ yields from floating-rate funds is now. But which funds to pick?

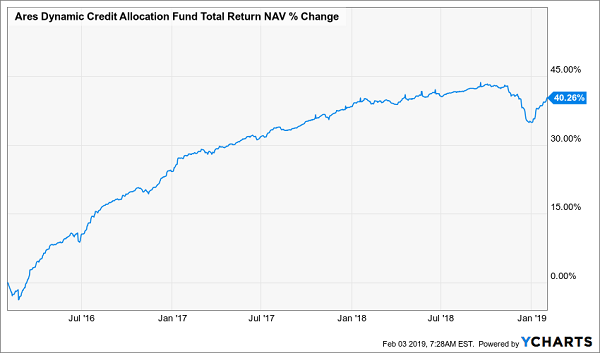

One of the most discounted floating-rate funds also has one of the biggest yields: the Ares Dynamic Credit Allocation Fund (ARDC) pays a massive 8.8%. It also gets “bounce-back” upside from its 13.1% discount to net asset value (NAV, or the what its underlying loan portfolio is worth). That’s well below the 7.2% discount it achieved in the past year.

As you might suspect, the fund’s name comes from its management team: Ares Management, which runs a number of funds and companies that provide credit to medium-sized businesses, including its business-development company, Ares Capital Corporation (ARCC). Ares Capital is the biggest BDC, with $12.3 billion in assets under management.

That size is important, because it means Ares has deep connections with many borrowers and knows which can pay their bills and which can’t. That has meant an impressive run-up for ARDC since interest rates started rising:

“In the Know” Management Delivers

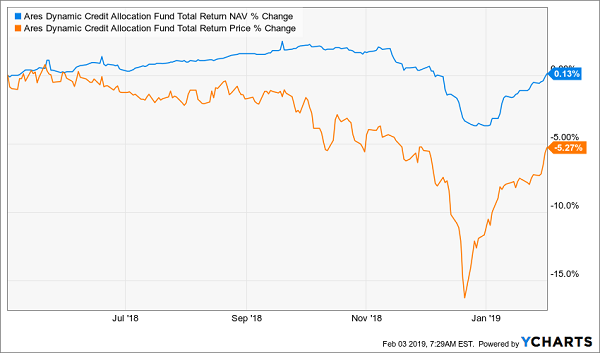

While investors typically reward ARDC with a steadily rising market price to match its portfolio’s fundamental strength, the fund’s price return is still lagging:

A Rare Buying Opportunity

The takeaway? Now is a great time to tap ARDC for its 8.8% income stream and hold while my expected 10% capital gain from both a strengthening floating-rate-loan market and the fund’s shrinking discount start to appear.

Source: Contrarian Outlook