A great area to find investment opportunities is places where the Wall Street hype machine went crazy and then the bubble burst. I’ll give you a great example.

After the dot-com bubble burst, shares of Amazon plunged 95%. People thought the entire industry went bust when in reality, only the shady start-ups went under.

A current example is 3D printing, or, to use the more formal name, additive manufacturing. In 2013, valuations here went bonkers. We were told that a 3D printer would soon be in every home. Then in 2015, the bubble finally burst.

Now, if anything, we’re at the other extreme. Some folks who should know better think the field is dead. Well, they’re wrong. The long-term growth story for additive manufacturing is alive and well. The difference is that the industry has shifted its priorities to industrial and medical applications.

So what exactly is additive manufacturing? I’ll make it simple—it’s the process of making something by building it one layer at a time.

The first step is to create a design. This is typically done using computer aided design, or CAD software.

The software translates the design into a layer-by-layer framework for the additive manufacturing machine to follow. This is sent to the 3D printer which begins creating the object immediately.

There are some key benefits. With traditional manufacturing, the entire supply chain can take months and require an investment of millions of dollars that can only be recouped by high-volume production. With additive manufacturing, many of those intermediate steps are simply removed.

Manufacturing something additively also makes it possible to use different materials on the inside and outside. For example, making something that has high conductivity but that is also abrasion-resistant is no problem. With conventional manufacturing, this can be a big headache.

Additive manufacturing also makes it easier to create small amounts of something. Hearing aids, for example, which are customized for each person, could be almost entirely additively manufactured.

3D Printing Body Parts?

In the future, bioprinters will use human cells from the patients themselves as the “ink” in order to create living body parts. Sounds freaky? Sure.

We’re still years away from that, but when that day does arrive, it will offer the prospect of immunologically compatible replacement parts for humans. Here in the U.S. alone, about 900,000 deaths annually occur because of a shortage of organs for ailing patients.

According to the research firm Gartner, medical 3D printing will have a market value of $1.2 billion by 2020. 3D printing in medicine has already evolved from making relatively simple prosthetics to printing a silicon prototype of a functioning human heart. 3D printing can also be used to speed up surgical procedures and produce cheaper versions of required surgical tools.

In 2015, the FDA approved the first 3D printed drug used to treat epilepsy. Elderly patients in need of a hip or knee replacement could benefit from 3D printing of specialty implants. Particularly, as the process is more exact, these patients would avoid the second or third procedure to replace traditional, less-effective implants.

Materialise Is Leading the Way

The best 3D printing stock to own now is the Belgium-based firm, Materialise (MTLS). What got my attention is Materialise’s complete and automated software solutions and certified 3D printing services.

Materialise’s business isn’t something to dream of in the future. They’re already working on 3D printing solutions in dozens of different industries, and they’re currently working with firms like Hyundai, Toyota, HP, Airbus, Volvo, BASF, Stryker and Microsoft.

Consider some numbers. In the auto sector, 3D printing is estimated to grow at 34% per year. In healthcare, it’s expected to be 23% per year. By 2021, 75% of all commercial or military will contain a 3D-printed engine or airframe.

In March, Materialise became the first company ever to get FDA clearance for software for 3D printing anatomical models for diagnostic use. The software is a tool that makes it possible to convert patient medical image data, such as CT scans, to 3D models.

This is a game-changer. It will allow for the creation of patient-specific diagnostic models which doctors can use for three-dimensional and tangible examination of scan data, potentially revealing affected areas that may have been missed using traditional 2D medical images.

The medical community is enthusiastically welcoming this advancement. Sixteen of the top 20 hospitals in the U.S., as ranked by U.S. News & World Report, are using Materialise Mimics software as a medical 3D printing strategy.

Patient-specific 3D printed models are becoming increasingly common for pre-surgical planning procedures. Gartner writes that by 2021, “25% of surgeons will practice on 3D-printed models of the patient prior to surgery.”

The next step for Materialise may be receiving clearance for the tools to create actual 3D-printed implants, stents and other medical devices. If it jumps that hurdle, the company may then have a significant lead on other device manufacturers that have received FDA approval for individual devices and product categories, as it could potentially apply the clearance to a complete host of 3D-printed components at once.

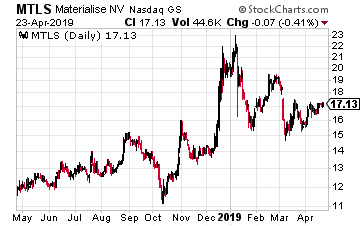

This is also a good time to add shares of Materialize since they’re off the peak from earlier this year.

Buffett just went all-in on THIS new asset. Will you?

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

Source: Investors Alley