The need for an ever-increasing amount of data storage is a growth story that appears to have a very long runway. Experts estimate that the “digital universe” will double every two years (that’s a 50-fold increase in a decade).

Enterprise IT, cloud computing and services, the Internet of Things, and autonomous vehicles all require larger and larger amounts of data storage capacity. Data center owning real estate investment trusts (REITs) are a conservative way to play this trend, with potential for high teens, up to 20% annual total returns.

There is a small handful of REITs that specialize in developing and leasing data centers. All these companies are in growth mode and are either acquiring and/or developing new facilities to lease out to a wide range of customers.

The investing public often forgets that this REIT sector is an integral part of the technology industry. Often, they are treated like any other class of REIT. This dichotomy of market focus allows the attentive investor to pick up data center REIT shares on sale when the larger REIT sector goes into a decline.

Multi-year investment returns from the data center companies will be driven by cash flow and dividend growth rates.

Here are three REITs that can put high-teens annual compounding total returns into your portfolio.

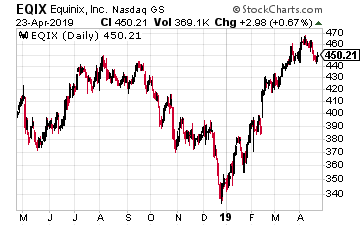

Equinix, Inc. (EQIX) is the $37 billion market cap, 800 lb. gorilla of the data center industry. The company converted from corporate tax payer to REIT status at the start of 2015. The company is a colocation and interconnection service provider.

Colocation is a data center facility in which a business can rent space for servers and other computing hardware. Typically, a colocation facility provides the building, cooling, power, bandwidth and physical security while the customer provides servers and storage.

The company’s services currently give 9,800 customers 333,000 interconnects between data centers and world’s digital exchanges. According to the current Investor Overview presentation, Equinix owns 200 data centers in 24 countries, on five continents. This is truly an international company.

Equinix has produced 64 consecutive quarters of revenue growth – the longest growth track record in the S&P500. This results in mid-teen per share cash flow growth.

For 2018 the company forecasts 8% to 11% FFO per share and dividend increases.

The shares currently yield 2.2%.

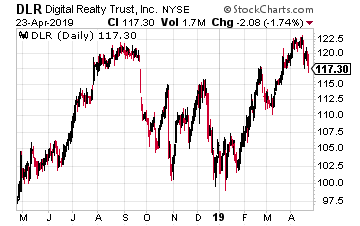

Digital Realty Trust, Inc. (DLR) is a $26 billion market cap REIT that owns 214 data centers in 13 countries. Digital Realty has 2,300 customers.

Like Equinix, Digital Realty is also a colocation and interconnection services provider. This REIT’s customer list includes some of the largest technology and telecommunications companies. In the top 10 are IBM, Facebook, Oracle, Verizon, LinkedIn, and even Equinix.

According to the current investor presentation, Digital Realty has increased its dividend per share for 14 straight years. Over that period cash flow to pay dividends has grown by a compounding 11.4% per year.

The DLR dividend has grown by 10% plus per year for the last 14 years.

The shares currently yield 4.0%.

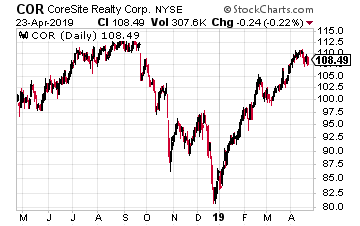

CoreSite Realty Corp (COR) is a $4.0 billion market cap REIT that owns 22 data centers in eight strategic U.S. cities. The company’s focus is to provide colocation services to enterprise, network, and cloud services companies.

CoreSite is the high growth, higher risk company out of the three covered here. From 2011 through 2017, FFO per share grew by 23% compounded and the dividend by more than 30% per year.

Future results will cycle from relatively flat to high growth years. The company is currently in a flat growth stretch with management forecasting 4% FFO growth for 2019. That could easily increase back to historic levels with a few new data center investments.

An investment in COR will not be as stable as with the large cap data center REITs. The flip side is the potential for large dividend increases and corresponding share price gains.

The shares currently yield 4.0%.

Pay Your Bills for LIFE with These Dividend Stocks

Get your hands on my most comprehensive, step-by-step dividend plan yet. In just a few minutes, you will have a 36-month road map that could generate $4,804 (or more!) per month for life. It's the perfect supplement to Social Security and works even if the stock market tanks. Over 6,500 retirement investors have already followed the recommendations I've laid out.

Click here for complete details to start your plan today.

Source: Investors Alley