Last week I was an invited speaker at the Las Vegas MoneyShow and made several presentations concerning income and dividend stock investing. I like the Q&A portion at the end of each talk. I benefit from learning what income focused investors are most interested in.

One topic that came up several times was my opinion in general about closed-end funds. A lot of these funds sport double digit dividend yields, which are catnip to income focused investors.

Closed-end funds (CEFs) are actively managed investment portfolios, whose shares trade on the stock exchanges. The closed-end part of the name is because these funds raise their initial capital with a one time sale through investment brokers and after that, the fund managers do not issue or redeem shares. The structure of CEFs produce a few interesting effects.

One is that share prices on the stock exchanges can be at significant premiums or discounts to the individual funds’ net asset values (NAV).

Another is that CEF fund managers cannot readily be influenced by share owners. Also, a lot of these funds are opaque concerning holdings and investment strategies.

It is my opinion that Wall Street firms use closed-end funds as a dumping ground for debt securities they manufacture that turn out to be more toxic than beneficial for investors in those securities.

Because of these reasons, I mostly stay away from the entire CEF sector. It would be too much work to analyze the hundreds of funds trading on the market to find the possible handful that are doing a good job. My recommendation to investors that ask me about CEFs is that there are better, safer ways to invest in high-yield securities.

Here are five CEFs with tempting yields where you should avoid that temptation:

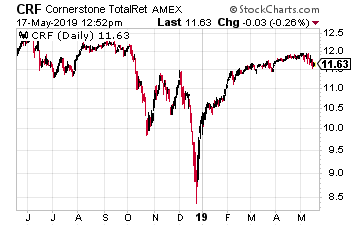

Cornerstone Total Return Fund (CRF) has the stated goal of seeking capital appreciation with current income through investment in common stocks, preferred stocks and convertible stock of large, mid and small cap companies and investment grade U.S. debt securities.

Current yield on the shares is an eye-popping 20.4%. A little digging shows why the yield is so high.

The fund’s policy is to pay out monthly dividends at a rate equal to 21% of the net asset value based on the NAV of the previous year.

The fund’s literature states “The Distribution Percentage is not a function of, nor is it related to, the investment return on a Fund’s portfolio.”

Basically, the big yield on CRF is the fund paying you back your own money. To add insult, CRF trades at a 7% premium to NAV. To buy the shares you pay $1.07 for a dollar’s worth of assets, which are then paid back to you as “dividends”.

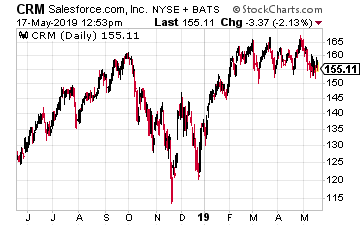

Cornerstone Strategic Value Fund (CRM) seeks long term capital appreciation through investment in global equity securities. Like Cornerstone above, this fund also yields 20% because it has the same dividend policy as its stablemate CRF.

Again the 20% is not a real return, but instead is likely to be the fund paying back your own capital. CRM currently trades at a 6% premium to NAV. These two funds, CRF and CRM are ones that I often get asked about. Looking at the distribution history, the dividends have ranged between 50% and 100% as return of capital.

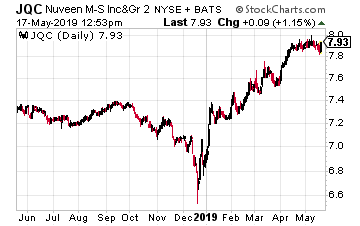

Nuveen Credit Strategies Income Fund (JQC) currently yields 15% and trades at an 8% discount to NAV. The fund invests in corporate debt securities or loans.

At the end of 2018 the fund adopted a capital return plan where now a portion of each dividend is explicitly return of capital. 63% of each monthly dividend is a return of your own money.

I think that is a pretty sneaky way for a fund management company to attract investors with a big stated yield. At least they make it very clear in the fund’s website exactly what they are doing.

But how many investors take the time to dig through a CEF’s website to see where the dividends come from?

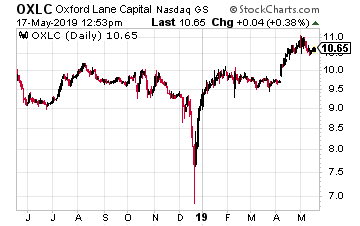

In contrast to the previous funds Oxford Lane Capital (OXLC)reports that 100% of its dividends are earned income. The fund sports a 15% yield.

The danger comes from its investment portfolio of debt and equity tranches of CLO vehicles. CLO means collateralized loan obligations. These are the type of securities manufactured out of pools of loans that caused the 2007-2008 financial crisis.

There is a huge amount of risk in this fund’s portfolio. The management team uses almost 40% leverage on the portfolio to leverage the highly leveraged securities it holds.

Finally, the shares trade at a 40% premium to NAV. Holy cow! What a time bomb.

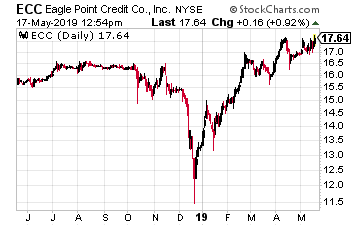

Eagle Point Credit Company LLC (ECC)also invests primarily in equity and junior debt tranches of CLOs. As I noted above, CEFs are a popular home for high risk securities.

For the last seven months 7 cents out of each 20 cent monthly dividend has been classified as return of capital, so the fund is not earning the dividends.

Current yield is 13.8% and the shares are trading at a 22% premium to NAV. That type of premium shows investors are buying shares without any understanding how the fund operates.

Pay Your Bills for LIFE with These Dividend Stocks

Get your hands on my most comprehensive, step-by-step dividend plan yet. In just a few minutes, you will have a 36-month road map that could generate $4,804 (or more!) per month for life. It's the perfect supplement to Social Security and works even if the stock market tanks. Over 6,500 retirement investors have already followed the recommendations I've laid out.

Click here for complete details to start your plan today.

Source: Investors Alley