There’s been something missing from the current market.

Throughout history, we haven’t had a bubble until there was a new way of thinking in the markets.

Well, I think the Spirited Funds/ETFMG Whiskey & Spirits ETF (NYSE: WSKY) proves that final piece of the puzzle is in place.

WSKY is an ETF that invests in companies that make booze.

Too much of a niche product for you? Then maybe the ETFMG Video Game Tech ETF (NYSE: GAMR) is for you. This one buys only video game companies.

Exchange-traded funds (ETFs) are baskets of stocks that are bought or sold as a unit.

ETFs offer investors a low-cost way to obtain a diversified portfolio. They are a good thing, but Wall Street always takes good things too far.

The Final Piece of the Bubble

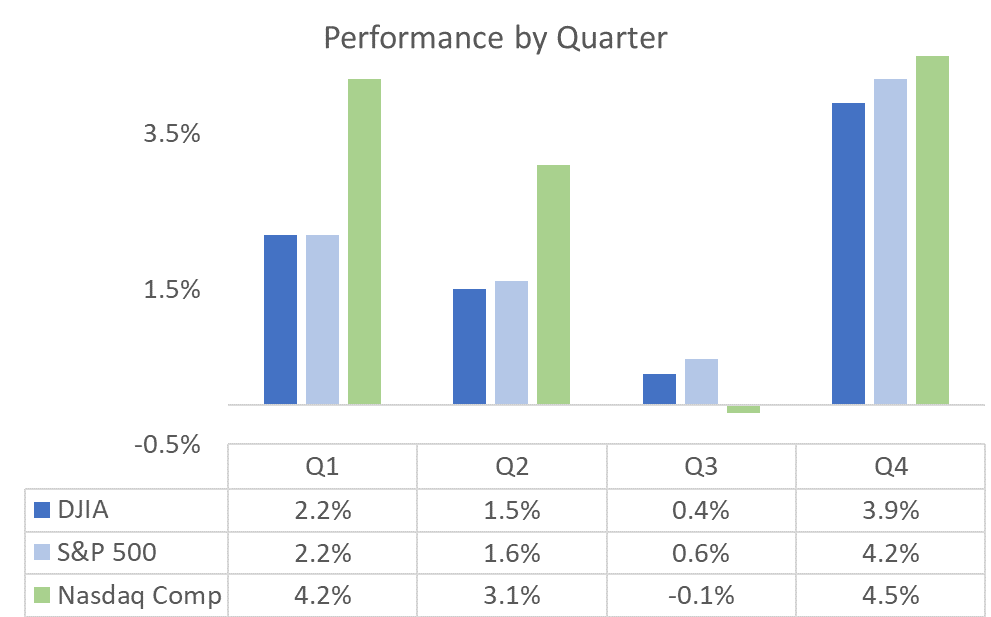

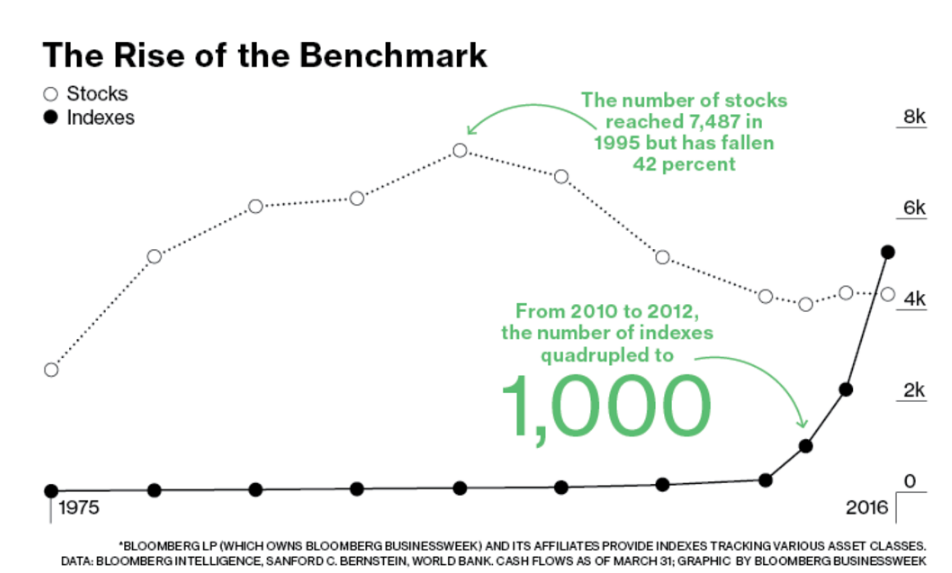

The number of ETFs has grown as Wall Street created indexes. Any index can be turned into a fee-generating ETF. That explains why we now have more indexes than individual stocks.

(Source: Bloomberg)

The history of Wall Street excesses includes turning subprime mortgages into derivatives that would destroy the financial system we knew in 2008.

In the late 1990s, Wall Street used accounting rules to turn internet startups into billion-dollar companies.

In 1987, portfolio insurance led investors to believe it was impossible to suffer a large loss in stocks.

You’ve probably noticed all these developments ended in disasters. In 1987, the Dow Jones Industrial Average fell more than 22% in one day. In 2000 and 2008, the Dow fell more than 50%.

This desire to take things too far predates Wall Street. The very first bubble in history imploded after futures on tulip bulbs were created in 17th century Holland.

The creation of stocks led to a bubble in 18th century England. Railroad bonds led to several bubbles in the 19th century. Emerging market debt first imploded in the early 20th century.

As stocks rallied this year, valuations became stretched. Irrational valuations are one part of a bubble. We were missing the final piece of the bubble, which was the new way of thinking.

ETFs now provide that piece of the bubble.

The Most Likely Path of the Stock Market

Some investors are buying ETFs because they think stocks only go up. This group is ignoring valuation and buying plain vanilla index funds. Trillions of dollars are now in funds that are designed for long-term investors.

When the next bear market comes, this money will drive downside risks when investors see stock prices go down as well as up.

Billions of dollars are in leveraged ETFs. These funds move two or three times more than their underlying index. They will lose money twice or thrice as fast, as plain vanilla funds are another source of selling pressure.

Volatility funds also hold billions of dollars. These ETFs will move wildly in a bear market as volatility increases, scaring investors out of the funds and creating even more volatility.

All of this means the end is near.

Bubbles always end with a sharp rally up. That’s the most likely path of the stock market through the end of the year.

In a bubble, some investors wonder what to buy. The answer is to buy everything until the bubble pops. It’s time to enjoy what’s likely to be a once-in-a-generation rally.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader

The 145 Companies Your Stockbroker Will NEVER Tell You About Did you know more than 145 tiny companies have grown to $1 billion-plus valuations since 2012? SpaceX is up 26,309% in value... Dropbox 31,733%... and Pinterest 487,404%. All of these 145 businesses started out as private companies your broker would have NEVER told you about. But now there’s a great way to find the next private companies poised for hyper-growth. Full Details Here.

Source: Banyan Hill