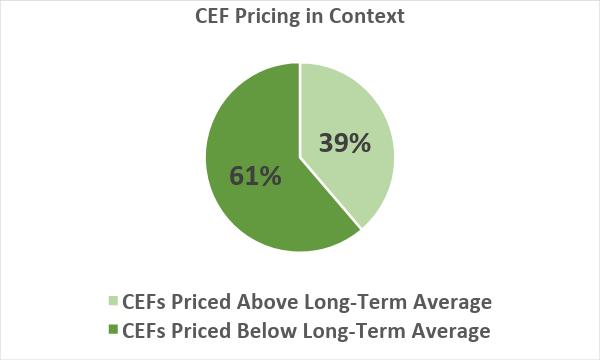

Something very weird is happening with high-yield closed-end funds (CEFs): many of them are ridiculously cheap, despite soaring double-digits this year.

(And when I say these are “high-yield” funds, I mean it: nearly all of the five funds I’ll show you shortly yield 7% and up!)

I know that sounds impossible: a big run-up and a bargain in one buy?

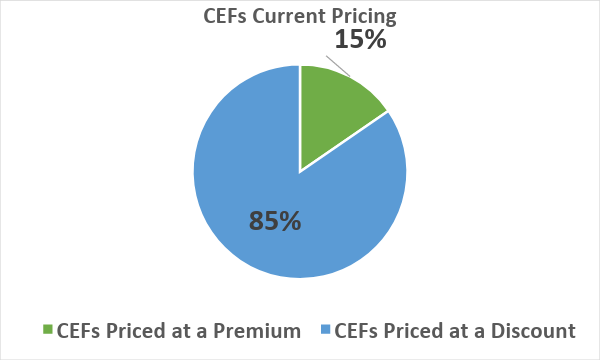

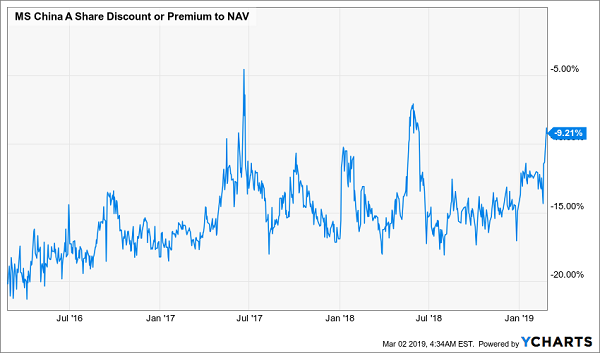

It’s true—and it’s the beauty of CEFs: unlike with mutual funds and ETFs, CEFs’ market prices can swing massively from the net asset value (NAV) of their portfolios. That’s because investors often ignore CEFs and fail to bid them up to what they’d be worth if they were liquidated tomorrow.

Situations like that are common in CEF land, and sometimes a fund is badly managed enough to deserve a huge discount. But today, many well-run, top-performing CEFs—including the five below—are priced like laggards. That nicely sets us up to grab more upside to go with their outsized dividends.

Dividend and Income Fund (DNI)

Discount to NAV: 24%

Year-to-Date Total Price Return: 25.8%

Dividend Yield: 6.9%

The S&P 500’s 17.7% return this year is good, but DNI’s 25.8% is better. And that’s an apples-to-apples comparison, by the way, because DNI has a mid-cap portfolio full of S&P 500 stocks like the Walt Disney Co. (DIS), Home Depot (HD) and Apple (AAPL). But DNI’s portfolio is more value-focused, which is why it’s crushing the index.

DNI doesn’t just offer outperformance, either: its near-7% dividend is also more than three times bigger than that of the benchmark SPDR S&P 500 ETF (SPY). In other words, DNI gives you $575 in monthly income per $100,000 invested, while SPY delivers a paltry $149.17.

New Germany Fund (GF)

Discount to NAV: 12.3%

Year-to-Date Total Price Return: 25.6%

Dividend Yield: 1.2%

Germany is having a good year, but GF is having a better one. While the iShares MSCI Germany ETF (EWG) has gained 12.7% in 2019, GF, with its experienced management team, has posted a gain twice that big. This isn’t an anomaly; since its 1998 IPO, GF is up 3.6 times as much as EWG.

So why the big discount if GF is the best way to get in on Germany’s growth? It’s simple: dividends. Most CEF investors are income-crazy, and GF’s 1.2% yield doesn’t excite them. But that’s shortsighted, because GF often pays special dividends, like the 20% payout at the end of 2018. In fact, GF has been paying an annualized double-digit yield for nearly a decade.

Kayne Anderson Midstream Energy Fund (KMF)

Discount to NAV: 12%

Year-to-Date Total Price Return: 28.5%

Dividend Yield: 7.6%

If you’re looking for oil and gas exposure, you’re best to go with an energy specialist like Kayne Anderson. The company’s energy CEFs tend to outperform their indexes over the long term, thanks to the Texas-based management team’s unique market access: KMF combines private-equity investments with well-known publicly traded energy firms like the Williams Companies (WMB), Enbridge Inc. (ENB) and Enterprise Products Partners LP (EPD).

It’s no surprise, then, that KMF’s 28.5% total return this year is way ahead of the 17.7% return of the benchmark Alerian MLP ETF (AMLP). And KMF continues to maintain a 7.6% dividend yield, giving you a nice income stream with your energy exposure.

Salient Midstream & MLP Fund (SMM)

Discount to NAV: 15.1%

Year-to-Date Total Price Return: 25.9%

Dividend Yield: 7.7%

Similar to KMF, Salient’s SMM has crushed the market with its 25.9% return while also maintaining an impressive 7.7% payout. However, unlike Kayne Anderson, Salient focuses on publicly traded shares, which, at least in theory, gives it more liquidity in case of a sudden run on energy investments.

Here’s why this matters: if you want some energy exposure but you’re worried about a sudden shock to oil prices, you may have concerns about a fund that puts some of its assets in smaller investments, like KMF does. In theory, this higher liquidity could help increase SMM’s long-term return, even if oil and gas hit some bumps in the road.

Brookfield Global Listed Infrastructure Income Fund (INF)

Discount to NAV: 14.4%

Year-to-Date Total Price Return: 27%

Dividend Yield: 8%

Brookfield has a long history of investing in infrastructure projects, meaning management has developed a keen eye for undervalued stocks in that sector.

That’s why INF’s 27% return trumps the 14% return you’d have gotten with the SPDR S&P Global Infrastructure ETF (GII) this year, although both funds focus on large-cap infrastructure stocks around the world.

Like the index fund, INF’s portfolio tends to have around half its assets abroad, although recently that’s been closer to a third due to the fund’s savvy bet on a stronger dollar. That’s a big reason why INF’s return has nearly doubled up that of the index, and this approach goes a long way toward easing any worry you may have about being exposed to the wrong currency at the wrong time.

Here’s a SAFE 9.8% Cash Dividend (with upside!) to Buy Now

I’ve uncovered 5 more CEFs boasting even bigger upside in the next 12 months, thanks to their yawning discounts to NAV.

Taken together, the 5 ironclad funds I’ll reveal right here boast an 8.3% average yield—so you’re bagging a cool $8,300 a year in dividends on a $100K nest egg! And one of these CEFs even pays out an incredible 9.8% dividend now.

In other words, if you were to cherry-pick that one fund, $9,800 would come straight back to you, in cash, every year on your $100K.

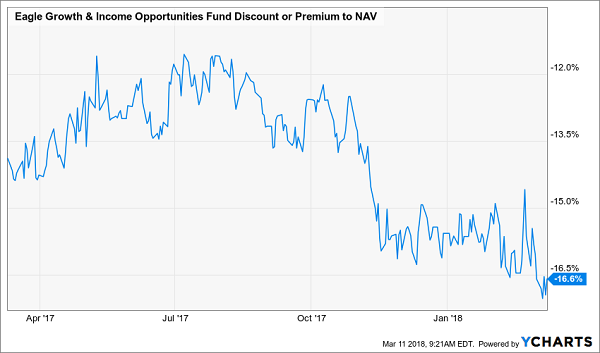

This cash-rich buy is a biotech fund that’s a perfect contrarian play right now, due to overblown headlines surrounding the healthcare business.

But we love overhyped news reports, because they give us the cheap entry points we need to grab top-notch funds like this cheap. Right now, for example, you can pick up this CEF at a fire-sale 8.4% discount to NAV, or just under 92 cents for every dollar of assets!

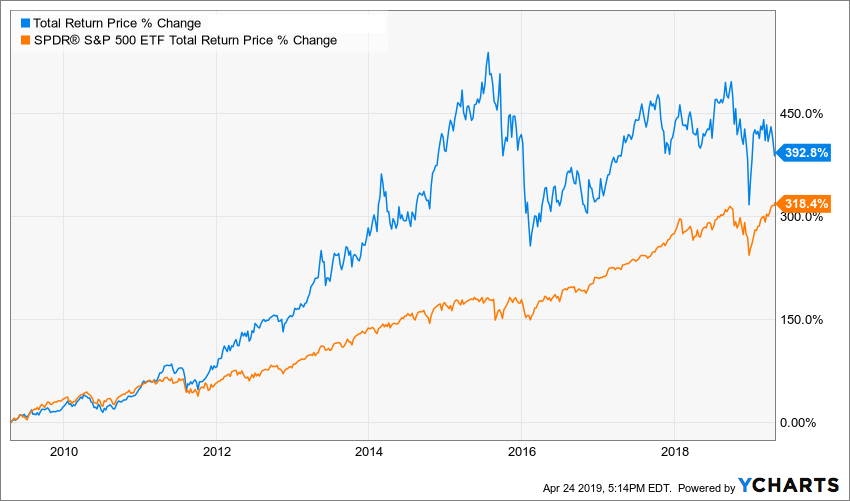

That’s totally out of whack when you consider that my pick has dominated in the last decade:

Another Cheap Outperformer

And remember that, thanks to that huge 9.8% dividend, almost all of this gain was in cash. No wonder this fund usually trades at a big premium to NAV—which is why we need to make our move now, before this bargain sale ends.

Michael Foster has just uncovered 4 funds that tick off ALL his boxes for the perfect investment: a 7.4% average payout, steady dividend growth and 20%+ price upside. — but that won’t last long! Grab a piece of the action now, before the market comes to its senses. CLICK HERE and he’ll tell you all about his top 4 high-yield picks.

Source: Contrarian Outlook