It’s a different market than it was just two months ago. Volatility has returned, even if it remains modest relative to historical levels. Big names like Procter & Gamble Co (NYSE:PG) and Walmart Inc (NYSE:WMT), among others, have seen precipitous share price declines just in the past few weeks.

It’s a choppier, more cautious, environment. That’s not a bad thing, however. After a basically uninterrupted post-election rally, several stocks have seen pullbacks that provide more attractive entry points. Others simply haven’t received their due credit from the market.

While there might be reasons for caution overall – higher interest rates, macro concerns – more opportunities exist as well.

This more and more looks like a “stockpicker’s market.” For those stockpickers, here are 10 stocks to buy that look particularly attractive at the moment.

10 Best Stocks to Invest In Right Now: Exxon Mobil

Source: Shutterstock

I’m as surprised as anyone that Exxon Mobil Corporation (NYSE:XOM) makes this list. I’ve long been skeptical toward XOM. The internal hedge between upstream and downstream operations makes Exxon stock a surprisingly poor play on higher oil prices. Overall, it leads XOM to stay relatively rangebound – as it has been for basically a decade now.

But price matters, as I argued this week (insert link here if possible). And XOM is at its lowest levels in more than two years after a steady decline since late January. With the dividend over 4% and a sub-16x forward P/E multiple, Exxon Mobil stock looks like a value play. Meanwhile, management is forecasting that earnings can double by 2025, adding a modest growth component to the story.

Obviously, there’s a risk that Exxon management is being too optimistic. Years of underperformance relative to peers like Chevron Corporation (NYSE:CVX) and even BP plc (ADR) (NYSE:BP) has eroded the market’s confidence. If Tesla Inc (NASDAQ:TSLA) can lead a true electric car revolution, that, too, could impact demand and pricing going forward.

At current levels, however, the market is pricing in close to zero chance of Exxon hitting its targets. And that’s why XOM is attractive right now. A continuation of the status quo still gives investors 4%+ income annually. Any improvements in production, or pricing, provide upside. At a two-year low, Exxon doesn’t have to be perfect to see upside in XOM stock.

10 Best Stocks to Invest In Right Now: Nathan’s Famous

In this market, recommending a restaurant owner – let alone a hot dog restaurant owner – might seem silly at best. But there’s a strong bull case for Nathan’s Famous, Inc. (NASDAQ:NATH) at the moment.

NATH, too, has seen a sharp pullback of late. The stock touched a 52-week (and all-time) high just shy of $95 in November. It’s since come down about 30%, though roughly one-sixth of the decline can be attributed to a $5 per share special dividend paid in December.

Yet the story hasn’t really changed all that much. Fiscal Q3 earnings in February were solid. The company’s agreement with John Morrell, who manufactures Nathan’s product for retail sale and Sam’s Club operations, offers huge margins, while revenue continues to grow. Foodservice sales similarly are increasing.

The restaurant business has been choppier. But it remains profitable. The mostly-franchised model there is similar to those of Domino’s Pizza, Inc. (NYSE:DPZ) and Yum! Brands, Inc.(NYSE:YUM), among others, all of whom are getting well above-market multiples.

All told, Nathan’s has an attractive licensing model, which leverages revenue growth across the operating businesses. And yet, at 13x EV/EBITDA, and 20x P/FCF, the stock trades at a significant discount to peers. NATH has stabilized over the past few weeks, and Q4 earnings in June could be a catalyst for upside. Investors would do well to buy NATH ahead of that report.

10 Best Stocks to Invest In Right Now: Bank of America

Source: Shutterstock

Bank of America Corp (NYSE:BAC) trades at its highest level since the financial crisis, and has gained over 150% from July 2016 lows. Trading has been a bit choppier of late – no surprise for a macro-sensitive stock in this market — and there’s a case, perhaps, to wait for a better entry point.

But I’ve liked BAC stock for some time now, and as I wrote last week I don’t see any reason to back off yet. Earnings growth should be solid for the foreseeable future, given rising Fed rates and a strong economy.

BofA itself has executed nicely over the past few years. The company’s credit profile is solid and its stock has outperformed other big banks like Citigroup Inc (NYSE:C) and even JPMorgan Chase & Co. (NYSE:JPM). And tax reform and easing capital restrictions mean a big dividend hike could be on the way as well.

And despite the big run, it’s not as if BAC is expensive. The stock still trades at less than 12x 2019 EPS estimates. Unless the economy turns south quickly, that seems too cheap. So it looks like the big run in Bank of America stock isn’t over yet.

10 Best Stocks to Invest In Right Now: Nutrisystem

Source: Nutrisystem

Nutrisystem Inc. (NASDAQ:NTRI) is another candidate to buy on a pullback. In a disappointing Q4 earnings release at the end of February, Nutrisystem disclosed a rough start to 2018. The beginning of the year is known as “diet season”, a key period for companies like Nutrisystem and Weight Watchers International, Inc. (NYSE:WTW), as many customers look to act on New Year’s Resolutions.

But marketing missteps led to poor results from Nutrisystem. 2018 guidance now implies basically zero revenue growth – after analysts had projected a 13% increase for the full year.

Still, Nutrisystem is now priced almost as if growth is coming to an end for good. And I as argued at the time, that’s just too pessimistic. The average Street target price still is well above $40, implying over 30% upside. NTRI now trades at under 16x the midpoint of 2018 EPS guidance, and yields over 3%.

The valuation implies that Nutrisystem management is wrong – that 2018’s deceleration is a permanent change. If Nutrisystem management is right – and they’ve earned some credibility in leading revenue and profit to soar over the past few years – then $32 is a far too cheap price for NTRI.

10 Best Stocks to Invest In Right Now: Roku

Source: Shutterstock

Roku Inc (NASDAQ:ROKU) undoubtedly is the riskiest stock on this list. And there certainly is a case for caution. The company remains unprofitable on even an Adjusted EBITDA basis. A ~7x EV/revenue multiple isn’t cheap; it’s even higher considering that almost half of 2018 revenue will come from the player business, which is a ‘loss leader’ for advertising and platform revenue.

But management also detailed a really interesting future on the Q4 call. The company is looking to build a true content ecosystem – and from a subscriber standpoint, already has surpassed Charter Communications Inc (NASDAQ:CHTR) and trails only AT&T Inc. (NYSE:T) and Comcast Corporation (NASDAQ:CMCSA).

Again, this is a high-risk play – but it’s also a high-reward opportunity. Margins in the platform segment are very attractive, and should allow Roku to turn profitable relatively quickly. International markets remain largely untapped. There’s a case for waiting for a better entry point, or selling puts. But I like ROKU at these levels for the growth/high-risk portion of an investor’s portfolio.

10 Best Stocks to Invest In Right Now: Brunswick

Source: Shutterstock

Brunswick Corporation (NYSE:BC) is due for a breakout. The boat, engine, and fitness equipment manufacturer is nearing resistance around $63 that’s held for close to a year now. Despite a boating sector that has roared of late, BC – the industry leader – has been mostly left out.

Over the last year, smaller manufacturers Marine Products Corp. (NYSE:MPX), Malibu Boats Inc (NASDAQ:MBUU), and MCBC Holdings Inc (NASDAQ:MCFT) have gained 51%, 71%, and 68%, respectively. BC, in contrast, has gained just 2%. It actually trades at a discount to MBUU and MCFT – despite its leadership position and strong earnings growth of late.

Efforts to build out a fitness business have had mixed results, and may support some of the market’s skepticism toward the stock. But Brunswick now is spinning that business off, returning to be a boating pure-play.

Cyclical risk is worth noting, and there are questions as to whether millennials will have the same fervor for boating as their parents. But at 12x EPS, with earnings still growing double-digits, BC is easily worth those risks.

And if the stock finally can break through resistance, a breakout toward $70+ seems likely.

10 Best Stocks to Invest In Right Now: Pfizer

Source: Shutterstock

Few investors like the pharmaceutical space at this point – or even healthcare as a whole. But amidst that negativity, Pfizer Inc. (NYSE:PFE) looks forgotten.

This still is the most valuable drug manufacturer in the world (for now; it’s neck and neck with Novartis AG (ADR) (NYSE:NVS)). It trades at just 12x EPS, a multiple that suggests profits will stay basically flat in perpetuity. To top it off, PFE offers a 3.7% dividend yield.

Obviously, there are risks here. Drug pricing continues to be subject to political scrutiny (though the spotlight seems to have dimmed of late). Revenue growth has flattened out of late. But Pfizer still is growing earnings, with adjusted EPS rising 11% last year and guidance suggesting a similar increase this year. Tom Taulli last month cited three reasons to buy Pfizer stock – and I think he’s got it about right.

10 Best Stocks to Invest In Right Now: Valmont Industries

Source: Shutterstocks

Valmont Industries, Inc. (NYSE:VMI) offers a diversified portfolio – and across the board, business has been relatively weak of late. The irrigation business has been hit by years of declining farm income. Support structures manufactured for utilities and highways have seen choppy demand due to uneven government spending. Mining weakness has had an impact on Valmont’s smaller businesses as well.

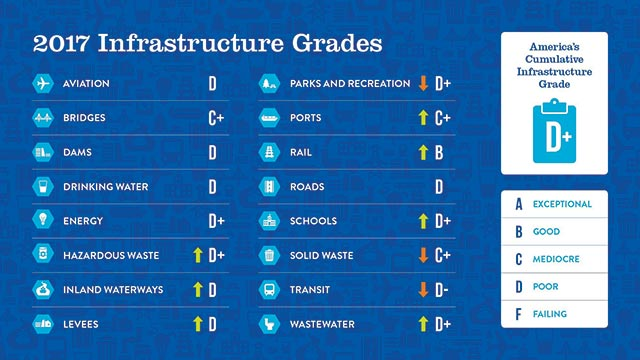

Valmont is a cyclical business where the cycles simply haven’t been much in the company’s favor. Yet that should start to change. 5G and increasing wireless usage should help the company’s business with cellular phone companies. Irrigation demand almost has to return at some point. And a possible infrastructure plan from the Trump Administration would benefit Valmont as well.

Concerns about the recently imposed tariffs on steel likely have hit VMI, and sent it back to support below $150. But many of Valmont’s contracts are ‘pass-through’, which limits the direct impact of those higher costs on the company itself. Despite uneven demand, EPS has been growing steadily, and should do so in 2018 as well.

And yet VMI trades at an attractive 16x multiple – a multiple that suggests Valmont is closer to the top of the cycle than the bottom. That seems unlikely to be the case, and as earnings grow and the multiple expands, VMI has a clear path to upside.

10 Best Stocks to Invest In Right Now: American Eagle Outfitters

American Eagle Outfitters (NYSE:AEO) is one of the, if not the, best stocks in retail – and that’s kind of the problem. Mall retailing, in particular, has been a very tough space over the past few years. And it’s not just the impact of Amazon.com, Inc. (NASDAQ:AMZN) and other online retailers. Traffic continues to decline, which pressures sales and has led to intense competition on price, hurting margins.

But American Eagle has survived rather well so far, keeping comps positive and earnings stable. And yet this stock, too, trades at around 12x EPS, backing out its net cash. And American Eagle has an ace in the hole: its aerie line, which continues to grow at a breakneck pace. aerie brand comparable sales rose 27% in fiscal 2017, on top of a 23% rise the year before.

The company’s bralettes and other products clearly are taking share from L Brands Inc(NYSE:LB) unit Victoria’s Secret. And the e-commerce growth in that business, and for American Eagle as a whole, suggests an ability to dodge the intense pressure on mall-based retailers.

In short, American Eagle isn’t going anywhere. There’s enough here to suggest American Eagle can eke out some growth, and a 2.5% dividend provides income in the meantime.

The stock already is recovering from a post-earnings sell-off last week, and should continue to do so. And longer-term, there’s still room for consistent growth, and more upside.

10 Best Stocks to Invest In Right Now: United Parcel Service

Source: UPS

United Parcel Service, Inc. (NYSE:UPS) fell when the broad market did in February – and simply never recovered. A disappointing Q4 earnings report, in which investors saw signs of higher spending, drove some of the decline. But UPS stock wound up falling 22% in a matter of weeks – which looks like an unjustified sell-off.

UPS is going to have to spend to add capacity, and in this space too there’s the ever-present threat of Amazon. But UPS is an entrenched leader, along with rival FedEx Corporation(NYSE:FDX), and it at worst can co-exist with Amazon. E-commerce growth overall should continue to increase demand; there’s enough room for multiple players in the global market.

Meanwhile, the sell-off and benefits from tax reform mean that UPS now is trading at just 15x the midpoint of its guidance for 2018. And the stock yields a healthy 3.3%. Investors clearly see a risk that growth will decelerate, but UPS stock is priced as if that deceleration is guaranteed.

Discover how to grab $577 to $2,175 every 7 days even if you have a small brokerage account or little experience... And it's as simple as using these 3 proven trading strategies for earning extra cash. They’re revealed in my new ebook,

You can get it right now absolutely FREE.

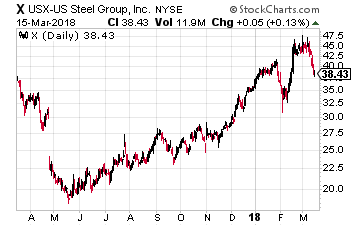

At the top of the list of steel stocks to avoid is U.S. Steel (NYSE: X), which saddens me because my grandfather used to work for the company.

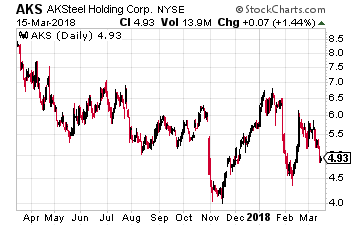

At the top of the list of steel stocks to avoid is U.S. Steel (NYSE: X), which saddens me because my grandfather used to work for the company. The second stock on the no-touch list is AK Steel Holding (NYSE: AKS). Like U.S. Steel, it faces planned maintenance outages in some facilities, affecting production. The company recorded outage costs of $85 million in 2017 and in 2018, it expects expenses associated with planned outages to be about $50 million.

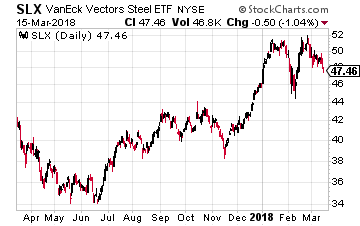

The second stock on the no-touch list is AK Steel Holding (NYSE: AKS). Like U.S. Steel, it faces planned maintenance outages in some facilities, affecting production. The company recorded outage costs of $85 million in 2017 and in 2018, it expects expenses associated with planned outages to be about $50 million. Finally, a broad way to play the chronic overcapacity in the global steel industry is through an exchange traded fund – the VanEck Vectors Steel ETF (NYSE: SLX).

Finally, a broad way to play the chronic overcapacity in the global steel industry is through an exchange traded fund – the VanEck Vectors Steel ETF (NYSE: SLX).

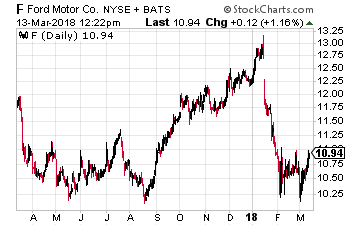

That’s bad news for big, multinational U.S. automakers like Ford Motor Co. (NYSE: F).

That’s bad news for big, multinational U.S. automakers like Ford Motor Co. (NYSE: F).

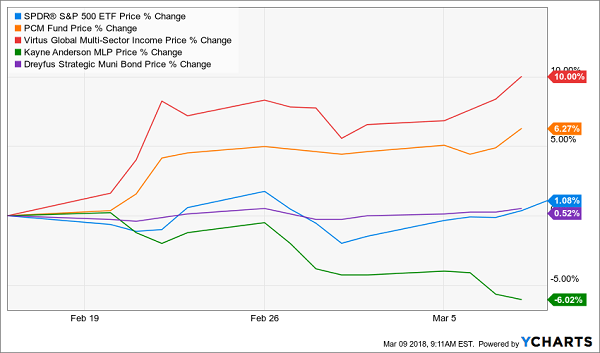

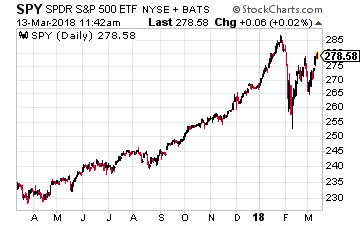

An ETF owns shares of stock to match the components of a specific stock index. For example, the SPDR S&P 500 ETF (NYSE: SPY) owns the 500 stocks in the same proportion as tracked by the Standard & Poor’s 500 stock index. The financial products industry has gone nuts with the development of new indexes to carve up the market into sectors and ETFs to track them. Currently there are over 2,000 ETFs listed in the U.S. The majority —78% of assets—of ETFs are based on stock market indexes. Those assets total over $2.4 trillion. ETF trading has become a very big part of what goes on in the stock markets.

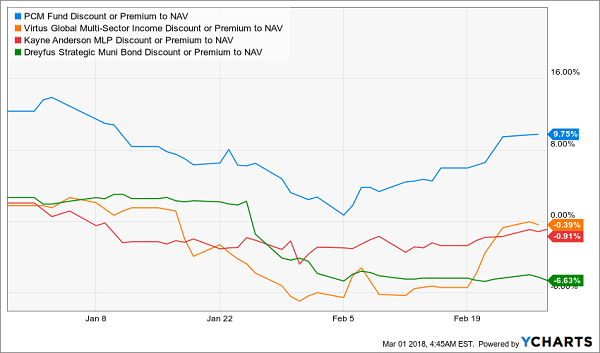

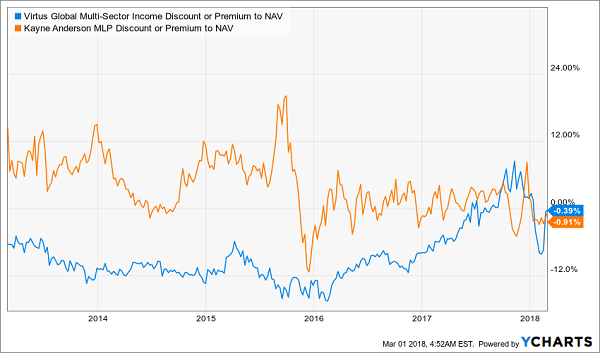

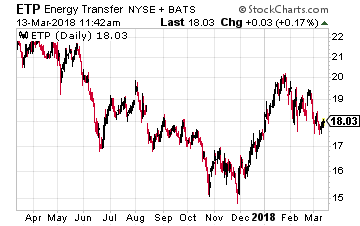

An ETF owns shares of stock to match the components of a specific stock index. For example, the SPDR S&P 500 ETF (NYSE: SPY) owns the 500 stocks in the same proportion as tracked by the Standard & Poor’s 500 stock index. The financial products industry has gone nuts with the development of new indexes to carve up the market into sectors and ETFs to track them. Currently there are over 2,000 ETFs listed in the U.S. The majority —78% of assets—of ETFs are based on stock market indexes. Those assets total over $2.4 trillion. ETF trading has become a very big part of what goes on in the stock markets. There are two ways ETF action can affect the share values of individual stocks. The most obvious and easy to discern is when the weighting of a stock in an index is changed. One high yield example is Energy Transfer Partners LP (NYSE: ETP), a large cap master limited partnership, commonly abbreviated as MLP. In April 2017 ETP completed a merger with Sunoco Logistics Partners LP, another MLP that was a large component of MLP indexes. Because of the merger, ETFs and index funds tracking MLP indexes were forced to sell significant portions of their ETP holdings to bring the size of the positions down to match the index weightings. This merger was the start of a year long decline in the ETP unit value. Later in 2017, Alerian, the provider of the most popular MLP tracking indexes, changed its methodology to cap Alerian MLP Index constituents to a 10% weight. At that time, ETP’s weight was much higher than 10% in the index, so index tracking funds were again forced to sell ETP units, regardless of investment merit. These forced sales of ETP are the source of much of the 25% value decline over the past year. The company’s fundamentals have been steadily improving, but you could not tell by the market price. ETP currently yields 12.5%.

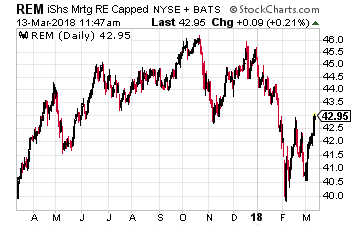

There are two ways ETF action can affect the share values of individual stocks. The most obvious and easy to discern is when the weighting of a stock in an index is changed. One high yield example is Energy Transfer Partners LP (NYSE: ETP), a large cap master limited partnership, commonly abbreviated as MLP. In April 2017 ETP completed a merger with Sunoco Logistics Partners LP, another MLP that was a large component of MLP indexes. Because of the merger, ETFs and index funds tracking MLP indexes were forced to sell significant portions of their ETP holdings to bring the size of the positions down to match the index weightings. This merger was the start of a year long decline in the ETP unit value. Later in 2017, Alerian, the provider of the most popular MLP tracking indexes, changed its methodology to cap Alerian MLP Index constituents to a 10% weight. At that time, ETP’s weight was much higher than 10% in the index, so index tracking funds were again forced to sell ETP units, regardless of investment merit. These forced sales of ETP are the source of much of the 25% value decline over the past year. The company’s fundamentals have been steadily improving, but you could not tell by the market price. ETP currently yields 12.5%. A subtler effect of the ETF boom is that trading of these funds leads to lack of discrimination between the financial results and business prospects. Stocks get lumped together into the ETFs that track specific market sectors. It is tough to figure out whether stock share prices and ETF trading are a chicken and egg dilemma, but it is becoming clearer that increases in ETF trading are tightening correlations, or the tendency for individual stocks and sectors to move up or down in lock step, regardless of a company’s fundamentals. While ETFs account for about 8% of the U.S. stock market value, ETFs are the source of more than 25% of the trading volume. Market observation clearly shows that share prices are greatly affected by short term sector switching by traders. The iShares Mortgage Real Estate ETF (NYSE: REM) provides a couple of examples. Most of the 30 or so stocks in this ETF own leveraged portfolios of residential mortgage backed securities, MBS in industry parlance. This business model is a dangerous game of lending long and borrowing short. This is a group of companies whose finances can be destroyed by a quick change in the yield curve. I recommend against owning any residential MBS focused REITs.

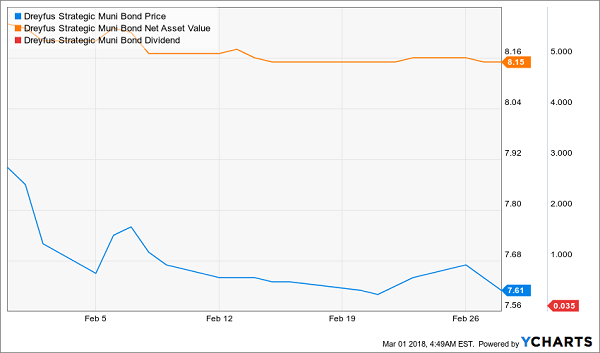

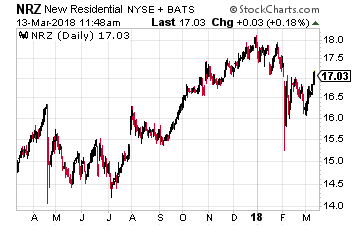

A subtler effect of the ETF boom is that trading of these funds leads to lack of discrimination between the financial results and business prospects. Stocks get lumped together into the ETFs that track specific market sectors. It is tough to figure out whether stock share prices and ETF trading are a chicken and egg dilemma, but it is becoming clearer that increases in ETF trading are tightening correlations, or the tendency for individual stocks and sectors to move up or down in lock step, regardless of a company’s fundamentals. While ETFs account for about 8% of the U.S. stock market value, ETFs are the source of more than 25% of the trading volume. Market observation clearly shows that share prices are greatly affected by short term sector switching by traders. The iShares Mortgage Real Estate ETF (NYSE: REM) provides a couple of examples. Most of the 30 or so stocks in this ETF own leveraged portfolios of residential mortgage backed securities, MBS in industry parlance. This business model is a dangerous game of lending long and borrowing short. This is a group of companies whose finances can be destroyed by a quick change in the yield curve. I recommend against owning any residential MBS focused REITs. In contrast, the third and fourth heavily weighted stocks in REM are solid companies with business operations that are sustainable through market cycles. In contrast to the rest of the REM portfolio stocks, these two will do even better when short term rates rise. Starwood Property Trust, Inc. (NYSE: STWD) and New Residential Investment Corp (NYSE: NRZ) are very attractive stocks with share prices that have trouble escaping from the trading in REM. STWD currently yields 9% and NRZ is over 11%.

In contrast, the third and fourth heavily weighted stocks in REM are solid companies with business operations that are sustainable through market cycles. In contrast to the rest of the REM portfolio stocks, these two will do even better when short term rates rise. Starwood Property Trust, Inc. (NYSE: STWD) and New Residential Investment Corp (NYSE: NRZ) are very attractive stocks with share prices that have trouble escaping from the trading in REM. STWD currently yields 9% and NRZ is over 11%.