It’s hard to tell when a stock is at the end of a strong run, or if the broader market is running out of steam.

But one thing to look for is how stocks react to bad news.

The more sensitive the stocks are to the bad news, the closer we are to the end of a recent rally and possibly going into a bear market.

On the other hand, if negative news has little effect, then the stocks still have room to run higher.

One particular group of stocks went through this just the other week.

There was an announcement that had the potential to put companies out of business, yet, despite an initial negative reaction in the stocks, shares have rebounded and held steady.

This is one industry that I honestly haven’t followed that much yet, as it is somewhat out of my wheelhouse. But the way the group as a whole reacted to the news recently has convinced me it is here to stay, and if you don’t have exposure to it yet — now is the time.

Marijuana Stocks: A Movement

The industry is marijuana stocks.

And I know, a lot of people have avoided these stocks because, well, let’s face it — it’s a drug that is illegal in most states.

That’s the same reason I haven’t followed it much. I’m not really a fan of the movement.

But after I saw how marijuana stocks reacted, it has me convinced the movement is here to stay, and apparently, more people in general are jumping on the bandwagon.

Now that the majority of people seem to be in favor of legalizing marijuana, aka cannabis, the movement may be here to stay.

That’s why a recent announcement that shook the industry was so important — I wanted to see how the stocks reacted.

U.S. Attorney General Jeff Sessions announced plans to roll back federal policies that paved the way for states to legalize marijuana — the policies that have allowed marijuana stocks to flourish and raised expectations for recreational marijuana to be allowed in more states.

This is when publicly traded marijuana stocks tanked on the news. Some were down more than 30% because, like I mentioned, a ruling like this is potentially sending many of these stocks into bankruptcy.

I was watching it as the news developed, and I bought my first marijuana stock on the dip. The buzz around the office was that the movement wasn’t going to end — and many investors feel the same way.

If you haven’t dipped your toes into this speculative trade yet, there’s still time. I have two stocks for you today that will reap the benefits as the movement stays intact.

Speculating on Marijuana

I’ll precede these two stock picks as speculative plays. Speculative because, indeed, a change in jurisdiction in the U.S. could put many marijuana-related companies out of business, and the two below would not be immune to such a change.

Plus, they each depend on further advancements in the recreational marijuana movement, which may or may not happen. So invest with caution, but it is an industry that needs to be on everyone’s radar at this point.

The first is the largest U.S.-traded pure marijuana stock — Canopy Growth Corp. (OTC: TWMJF).

Yes, both of the stocks I mention today trade on the pink sheets, or over the counter. These are stocks that typically have low volume and are risky bets. But with marijuana stocks, it’s where they are all listed and still have plenty of volume.

Canopy Growth is actually a Canadian stock that’s listed in the U.S. on the pink sheets but has an average daily volume of more than 1 million shares. The company has the highest individual market share in Canada’s medical marijuana market and will be poised to benefit a lot if Canada approves recreational marijuana use, which is expected to be passed in the coming months.

The other is Cannabis Science Inc. (OTC: CBIS). This company sells marijuana-based pharmaceutical and recreational products. It is opening two licensed dispensaries in Los Angeles this month and plans to open one more this quarter.

If you want exposure to a possible booming U.S. recreational market, this is the stock to own. It is traded on the pink sheets, but it has an average daily volume of nearly 30 million shares, so there is plenty of liquidity. However, it is a “penny stock,” trading at just $0.10 at last glance.

Again, these are speculative trades in an industry that is not quite established yet. But considering the way these stocks have held up despite major negative news, they’re stocks you should have on your radar.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

In this exciting NEW VIDEO, Wall Street legend and former multibillion hedge fund manager Paul Mampilly pulls back the curtain on the biggest investment opportunity in the market today. What insiders are calling “The Greatest Innovation in History,” this revolution will mint more millionaires and billions than any technology that came before it. Right now, the current market for this technology is just $235 billion, but given how fast this technology is moving experts predict it will soar to $19 trillion by 2020. But 8,000% growth is just the beginning—and now’s your chance to get in on the action. [CONTINUE TO VIDEO]

Source: Banyan Hill

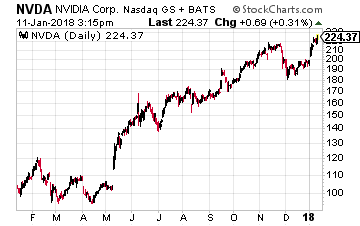

Let me start by talking about a company that was unavoidable at this year’s CES – Nvidia (Nasdaq: NVDA). Their graphics processing units (GPUs) are at the core of many machine learning and artificial intelligence solutions, including for automobiles.

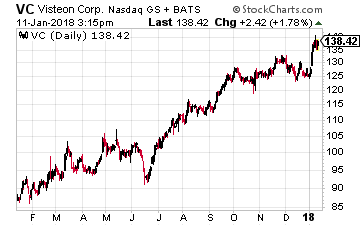

Let me start by talking about a company that was unavoidable at this year’s CES – Nvidia (Nasdaq: NVDA). Their graphics processing units (GPUs) are at the core of many machine learning and artificial intelligence solutions, including for automobiles. A company to consider is Visteon (NYSE: VC), which designs and manufactures electronics products for automakers. Visteon provides everything from standard gauges to high resolution, reconfigurable digital 2D and 3D displays to infotainment and audio systems.

A company to consider is Visteon (NYSE: VC), which designs and manufactures electronics products for automakers. Visteon provides everything from standard gauges to high resolution, reconfigurable digital 2D and 3D displays to infotainment and audio systems.