What if there was a way you could tap this market correction to grab the biggest S&P 500 stocks cheap—all while hedging your downside and getting a 7.2% dividend yield?

It’s not only possible, but you can do it in one single buy. More on that in a moment.

First, I’m pounding the table on stocks—and in particular funds like the one I’ll show you shortly—for one reason: there’s a huge disconnect between the drop in the market that we’ve seen lately …

Investors Miss the Memo

… and what S&P 500 companies are telling us.

And that is that far more firms than expected are crushing the Street’s forecasts. And better yet, revenue—the lifeblood of profits and the best measure of demand we have—is soaring: up 4.1% from a year ago.

In short, S&P 500 earnings statements are just fine, thank you very much.

Your 1-Click Opportunity to Cash in on Fear

We’re going to tap overhyped fears about profits to grab ourselves a 7.2% dividend (with upside) using a key strategy many hedge funds use in markets like this.

It’s called “positive carry income capture,” but don’t be thrown by the Wall Street–speak; it’s simple: you buy a collection of stocks and draw an income stream from them—then use that income to reinvest during downturns like this one.

This is where the Nuveen S&P 500 Buy-Write Income Fund (BXMX) comes in, because this sturdy closed-end fund (CEF) carries out this strategy for us.

With a 7.2% yield and a 2.2% discount to net asset value (NAV, or the per-share market value of the stocks in its portfolio), BXMX is worth a close look—especially because markets are volatile, and that’s precisely what this fund, known as a “covered-call fund,” is built for.

More Panic, More Cash

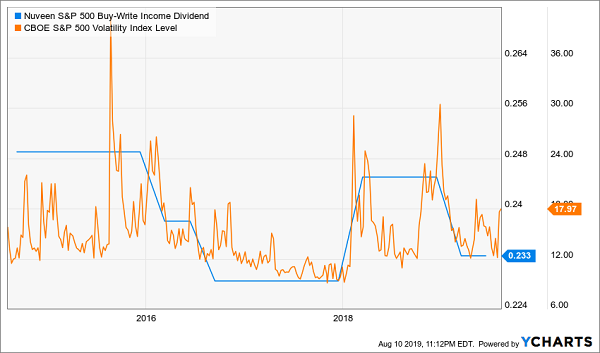

This chart shows the S&P 500 volatility index (VIX) in orange and BXMX’s income stream in blue.

What’s the VIX? Imagine a barometer of the total fear in the market, measured by how much investors are willing to pay to “insure” their stock portfolios. That’s the VIX.

When that barometer goes up, tensions are high—but notice how those moments of elevated tension also mean more income for BXMX? Rising market fears mean a payout raise for BXMX holders.

The way this works is simple. BXMX has two functions: the first is holding shares in S&P 500 companies, such as Microsoft (MSFT), Apple (AAPL) and Visa (V).

The second is selling “insurance” on the S&P 500 to investors. These funds do this is by selling call options (a kind of contract where the fund agrees to sell shares at a specific price) that limit the fund’s downside while helping short sellers limit their own losses. When those investors pay more for insurance, BXMX gets more cash, which it then hands over to investors.

There’s a tax advantage to BXMX, as well.

The cash the fund gets from selling this insurance is typically considered capital gains if investors do this individually, but BXMX can structure its payouts so that this cash is considered “return of capital,” which means it’s not taxed for many Americans. So far for 2019, 83% of BXMX’s dividend has been classified as return of capital, so is tax-free for a lot of people.

(Many folks think that return of capital is simply the fund company returning your cash to you in the form of a dividend, but that’s false. I’ve written an in-depth article busting that and other myths about return of capital that you can read when you click here.)

Beyond the tax benefits, the appeal of BXMX is twofold: because it takes advantage of investor fears by selling insurance during downturns, its income stream is over three times greater than what you’d get from an S&P 500 index fund. This means that moments of higher volatility, like what we’ve seen recently, are times to buy in and take advantage of the market’s woes.

The best part? Investors seem to have not noticed the power of BXMX’s income potential.

BXMX’s Big Dividend Flies Below the Radar

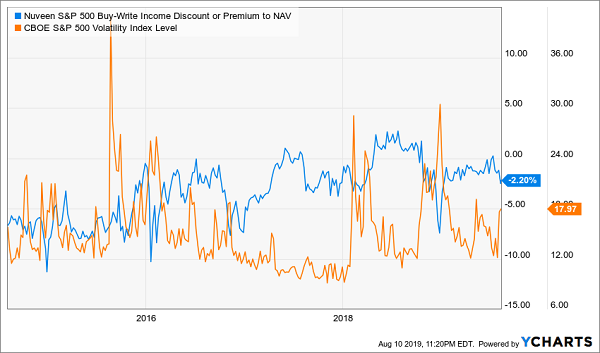

Even when the market sees a spike in volatility (in orange), BXMX’s discount to NAV (in blue) stays rigidly range-bound, despite the fact that this tax-advantaged income stream should be attracting investors left and right. This is a mispricing income-seekers like us can take advantage of.

This Is the Best Covered-Call Fund You Can Buy Now

BXMX is a great covered-call fund, but it’s not my favorite pick in this too-often-overlooked corner of the market.

My very best covered-call pick, which I’ve recommended in my members-only CEF Insider service, yields more (7.4%!) than BXMX and boasts way more upside, thanks to its comically big discount to NAV—an outsized 10.6% as I write this.

I’m ready to share this fund with you now … but it wouldn’t be fair to paying CEF Insider members if I revealed this fund’s name in a free article like this one.

So here’s what I’m going to do.

When you click right here, you’ll pull up a special investor report giving you my full CEF-picking strategy and my 5 top CEF buys now (average yield: 8%; expected upside: 20%+). You’ll also be able to grab a 60-day trial to CEF Insider with no risk and no obligation whatsoever.

That 60-day trial gives you VIP access to the CEF Insider portfolio, where you’ll find this “must-buy” covered-call CEF pick!

To sum that up, you’re getting:

- Full access to my portfolio (which contains 21 closed-end funds in all, with yields as high as 11%),

- 5 of my very best CEF picks now, and

- The name, ticker and my full research on the standout 7.4%-paying covered-call fund I just told you about.

Taken together, this is the perfect wealth- (and income-) building package for the markets we’re seeing today, and it’s all waiting for you!

Michael Foster has just uncovered 4 funds that tick off ALL his boxes for the perfect investment: a 7.4% average payout, steady dividend growth and 20%+ price upside. — but that won’t last long! Grab a piece of the action now, before the market comes to its senses. CLICK HERE and he’ll tell you all about his top 4 high-yield picks.