Baseball is back, with a deal for a 60-game season just announced. Professional golf is back. Nascar has been back for several weeks. Professional tennis, though off to a rocky start, is back. And, sports betting is back.

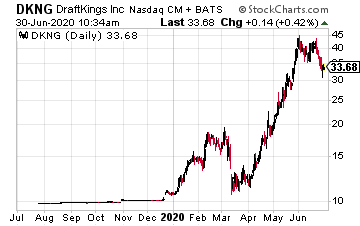

Which means companies like DraftKings (DKNG), which runs an online sports betting platform, is back in business.

Online gaming companies were left for dead when the COVID-19 pandemic hit. As sports league after sports league announced season-ending closures, there was no betting to be done.

But as sports shut down, and sports commentators and writers were left in limbo, an interesting thing happened. Some, including the more social media-famous Dave Portnoy, took to “betting” on stocks.

Portnoy, who is the founder of Barstool Sports, has used the stock market as a marketing tool, drawing millions of followers to his social media accounts with his battle cry of “Stocks only go up.” The entertaining, self-described sports bettor, can lose hundreds of thousands of dollars in a single trading session, all to the amusement of his social media followers.

What Portnoy—who once was closely associated with DraftKings, and now works as a “complete sell out” (his words) for Penn National Gaming (PENN) since its acquisition of Barstool Sports in January—has done is build an even bigger audience for sports betting when it returns.

The pent-up demand for sports betting, combined with some expert marketing from sports betting stalwarts like Mr. Portnoy, could lead to outsized gains for the sports betting stocks.

If You Could Retire Off Just One Stock, This Would Be The One [ad]

DraftKings, which went public recently as a special purpose acquisition company (SPAC) has been moving higher in recent months in anticipation of sports returning. But the company isn’t just resting on its sports-betting laurels.

On Tuesday, the company announced a new casino gaming app for customers in New Jersey. Jason March, DraftKings’ VP of Gaming said, “We are thrilled to break new ground for DraftKings in the gaming space today with the launch of our DraftKings Casino app, the Company’s first perennial product that operates year-round, irrespective of the annual sports schedules.”

This should add another leg to the DraftKings betting stool and smooth annual revenue numbers somewhat. In the company’s first earnings report last month, DraftKings reported $113.4 million in revenue, and a loss of $74 million.

The company has been spending heavily on marketing, as it enters new markets that approve online gaming, which added significantly to recent costs. If online gaming expands to additional states, seeking revenue to refill the DraftKings coffers after the COVID-19 pandemic, DraftKings could be a big long-term winner, even if they take on additional costs in the short-term.

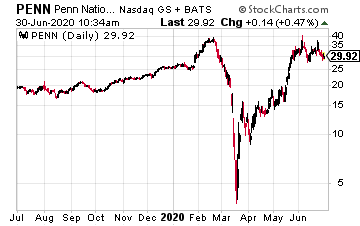

Penn National Gaming, which owns in-person gaming facilities in 19 jurisdictions, and operates 41 gambling facilities, has also made a big comeback from the lows the market set on March 23rd. As the U.S. reopens, Penn stock has moved from $3.75, back to the mid-$30s.

Another rise in COVID-19 cases may cause the stock to pull back, setting up a better buying opportunity. To ensure its financial stability, the company recently did a $300 million share offering, as well as a $300 million debt offering.

With its 36% equity position in Barstool Sports, Penn is betting on that relationship as it launches an online betting platform, scheduled for August. The company, per its investor presentation, is looking to go after the market now dominated by DraftKings, relying on its 66 million Barstool fans.

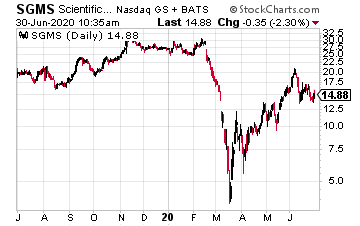

Finally, Scientific Games (SGMS), perhaps best known for its lottery ticket machines, also offers a number of casino and digital betting games, and owns SG Digital, the sports betting division of Scientific Games.

The company should benefit from the country reopening, and a return to gaming and gambling, across the board—from being able to return to the supermarket or convenience store and buy lottery tickets, to sports betting, and even stay at home casino gaming for those still sheltering at home.

SGMS is nowhere near the highs it reached prior to the COVID-19 pandemic, trading at only half its pre-pandemic price of $30. First quarter revenue for SGMS was $725 million, down 13% from $837 million a year ago. The company blamed the impact of the pandemic for the decline.