Is the stock market reasonably priced or expensive? That’s the question investors are asking themselves these days, leaving many to wonder if there are any stocks to buy at this point in the cycle.

A couple of metrics have investors scared about stock prices, suggests Jim Paulsen, the chief investment strategist at The Leuthold Group. According to Paulsen, the median U.S. stock has a P/E multiple today that is almost 50% more expensive than during the dot.com bubble of 2000.

The second metric that should make you think twice is the value of U.S. stocks relative to foreign stocks. Paulsen suggests that U.S. stocks are 17% more expensive than foreign stocks, the highest spread since 2002. Also, the price-to-sales ratio hasn’t been this high since the end of World War II. Marijuana stocks are definitely contributing to this third metric.

So, what’s an investor to do?

Ben Graham used to talk about a margin of safety to protect against the potential downside of owning a stock. That’s especially true when a re-evaluation of stock prices will eventually take place.

In the past, I’ve followed stocks that have dipped by more than 10% in a certain period — a week, a month, a quarter — and what I’ve found is that they often recover over a period of months. Shortly after that, they often test 52-week or all-time highs.

It’s not a strategy I’d pursue if you’re an anxious investor, but for those people who can handle a little volatile, here are seven stocks to buy that are down 20% or more over the past three months.

The Stars Group (TSG)

3-Month Performance: -31%

It’s hard to believe that The Stars Group (NASDAQ:TSG) stock is still up over 9% year to date despite a 31% rout over the past three months.

If you bought TSG stock in July, I feel your pain, because your position is seriously upside down.

Not to fear, it will soon be back over $30. Here’s why.

In July, it completed its $4.7 billion acquisition of Sky Betting & Gaming, one of the leading gaming and sportsbook operators in the UK. The purchase not only gives it a bigger foothold in Europe, but it also cements its position within the lucrative sports betting market that’s ready to take off in the U.S.

Yes, the deal required the company to leverage itself to the hilt while also diluting shareholders to pay for Sky Betting & Gaming, but I believe this is this kind of transformational move that separates the professionals from the amateurs.

The future of online gaming is tremendous. Any correction like the one over the past three months is an opportunity to buy TSG stock at a reasonable price.

Zillow Group (ZG)

3-Month Performance: -31%

In early August, Zillow Group (NASDAQ:ZG) stock dropped 16%, its worst single-day performance since November 2011.

What sparked the selloff?

The company reported its Q2 2018 earnings. The top-line missed slightly while the bottom-line beat expectations by three cents. That wasn’t it.

It did, however, lower its guidance for the full-year from at least $1.43 billion in revenue to $1.32 billion, a drop of $110 million. Add to that its entry into the mortgage lending market through the acquisition of Mortgage Lenders of America, which prompted a downgrade from Merrill Lynch because of the stress it will put on profits, was enough to send the stock spiraling lower.

Zillow Group is moving away from its traditional areas of strength — Advertising and technology applications — into the buying and selling of homes through Zillow Offers, hence the need for a mortgage lender.

“It allows us to monetize the Zillow Offers business a second way,” Zillow CEO Spencer Rascoff said in August on CNBC. “First, we can make money from buying and selling. Second, we can make money from mortgage origination. Third, we can make money by passing the homeseller, who doesn’t want to sell their home to us, off to a premier agent.”

Personally, I’ve been a fan of Zillow stock since 2013. I like what Zillow Offers does for the house seller.

I think the market’s got it wrong. Those willing to experience a little volatility through the remainder of 2018 should be rewarded with a higher stock price.

Noah Holdings (NOAH)

3-Month Performance: -27%

I first recommended Noah Holdings (NYSE:NOAH), a Chinese wealth management company, back in June 2013 when it was trading around $13; it’s now over $40 despite the 27% haircut in the past three months.

“The most compelling reason for investing in Noah Holdings is its revenue structure, which has evolved over time since its inception,” I wrote June 6, 2013. “Three years ago it earned 77.2% of its revenue from one-time commissions from the third-party firms it represented, with the remainder in recurring service fees. Today, it earns almost 46% of its revenue from recurring service fees.”

Fast forward to 2018.

NOAH earns about 41% from recurring service fees, 41% from commissions, about 6% from performance fees and the rest (12%) from its online brokerage and education business.

Investors likely weren’t impressed with the company’s drop in earnings in the second quarter.

However, as a glass-half-full type of person, I look at its online brokerage and education business’s results in the second quarter — revenues were 73% higher with half the operating losses year over year — and see a stock that’s ready to rebound.

At less than $40, it’s a steal.

Ultrapar (UGP)

3-Month Performance: -25%

A year ago, Ultrapar (NYSE:UGP) was trading above $25. Today, it’s below $10.

What the heck is going on at the Brazilian conglomerate?

Well, Brazil and the rest of South America haven’t exactly been a beacon of stability in recent months. However, the issues that prevent Brazil’s economy from really taking off — low productivity, political corruption and too much spending by governments — have been around for years, making it very difficult for businesses to grow there.

However, a quick look at Ultrapar’s Q2 2018 report suggests business is just fine at most of its operating segments.

If not for a strike by truck drivers across Brazil in May, making it impossible to get fuel to its gas stations, the company’s adjusted EBITDA would have increased by 18% in the second quarter, and revenues likely would have been up more than the 19% year over year increase.

Ultrapar runs gas stations, convenience stores, pharmacies, liquified petroleum gas, specialty chemicals and a liquid bulk storage business.

It has been around for almost 80 years and will probably be around for another 80 years.

Mastec (MTZ)

3-Month Performance: -21%

New Jersey-based CressCap Investment Research provides independent analysis of over 7,000 stocks using statistics and data to help separate the winners from the losers. In May, CressCap CEO Steven Cress suggested Mastec (NYSE:MTZ) would be a big beneficiary of U.S. President Donald Trump’s push to rebuild America’s infrastructure.

Like much of the president’s economic agenda, it relies more on style than substance. The odds of a trillion-dollar-plus infrastructure bill getting passed anytime soon is fair at best.

That said, I do agree with Cress that the infrastructure construction firm is ideally positioned to benefit from any large infrastructure projects initiated by the federal government.

The company’s Q2 2018 results show a business that’s experiencing declining revenue and EBITDA, a big no-no in an economy that’s booming and corporate earnings are at a record level.

However, look more closely at its earnings and revenue, and you’ll see a business that’s doing just fine. With a $7.7 billion backlog at the end of June, Mastec has plenty of work ahead of it without the assistance of the president.

Down 21% over the past three months, now is an excellent time to consider MTZ stock.

Tata Motors (TTM)

3-Month Performance: -23%

The year-to-date price chart for Tata Motors (NYSE:TTM) stock looks a lot like a ski run in that it’s downhill all the way. The maker of Jaguars and Land Rovers started the year at $35 and now it trades for half that.

It seems like the turnaround job Tata Motors executives performed on Jaguar Land Rover (JLR) between 2008 and 2015 has been forgotten by investors; an amazing thought considering all of the beautiful cars it has released over the past two years.

I believe JLR makes the perfect spinoff stock for investors to bet on; the news that Aston Martin’s looking to go public with a $6.7 billion valuation suggests the investor appetite for luxury cars is high at the moment.

That said, it better not wait too long, or Volvo might reconsider shelving its plans for an IPO.

The other fly in the ointment for Tata Motors: As it ramps up spending at JLR, Fitch is concerned that Tata’s free cash flow will turn negative, putting a damper on future profits.

I think the risk-to-reward ratio is good at prices under $20.

Acadia Healthcare (ACHC)

3-Month Performance: -19%

If there’s a company whose services are needed in America, Acadia Healthcare (NASDAQ:ACHC) has got to be at the top of the list. Acadia provides inpatient and outpatient behavioral health services to people in the U.S. and UK. Whether it’s anxiety, an opioid addiction, PTSD or something else, Acadia is there to help.

Not only does Acadia provide the care, but it also owns many of the facilities where this care takes place.

As you can imagine, Acadia’s biggest expense is wages. After all, you can’t help people without providing professional care, and that costs money.

Its revenues grow at a reasonable pace and deliver about 7 cents to the bottom line for every dollar of revenue. It’s not a tech company to be sure, but it serves a vital service whose need won’t go away anytime soon.

Its stock dropped in July after the company’s CEO reduced its revenue and earnings guidance for 2018 as a result of higher interest rates and foreign exchange.

Those two items are a natural part of doing business. I see the company’s stock rebounding from this latest concern in the final months of 2018 and into 2019.

As of this writing Will Ashworth did not hold a position in any of the aforementioned securities.

Buffett just went all-in on THIS new asset. Will you?

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

Source: Investor Place

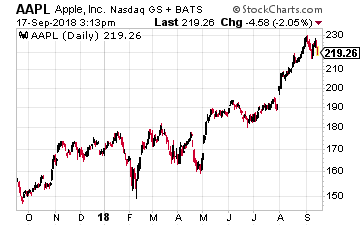

o of new phones that followed in line with its corporate strategy. That is, get buyers to pay higher prices for the phones while hopefully gobbling up more services (such as entertainment) as growth in the global smartphone market slows to a crawl.

o of new phones that followed in line with its corporate strategy. That is, get buyers to pay higher prices for the phones while hopefully gobbling up more services (such as entertainment) as growth in the global smartphone market slows to a crawl.

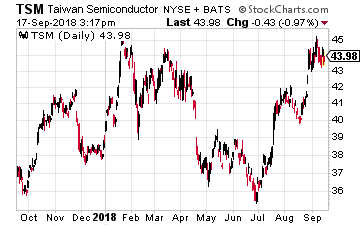

The winner has to be Taiwan Semiconductor (NYSE: TSM), also known as TSMC, which is the world’s largest contract semiconductor manufacturer with a 56% market share. And it dominates Apple’s chip production ever since Apple became Taiwan Semiconductor’s biggest client in 2015.

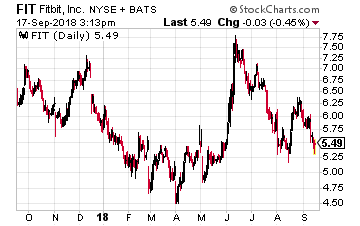

The winner has to be Taiwan Semiconductor (NYSE: TSM), also known as TSMC, which is the world’s largest contract semiconductor manufacturer with a 56% market share. And it dominates Apple’s chip production ever since Apple became Taiwan Semiconductor’s biggest client in 2015. With Apple moving into the healthcare sector in such a big way with its new Watch, a likely loser is Fitbit (NYSE: FIT). On the day Apple unveiled its Watch plans, Fitibit stock fell more than 5%, bringing its loss over the past year to 16.5%.

With Apple moving into the healthcare sector in such a big way with its new Watch, a likely loser is Fitbit (NYSE: FIT). On the day Apple unveiled its Watch plans, Fitibit stock fell more than 5%, bringing its loss over the past year to 16.5%.

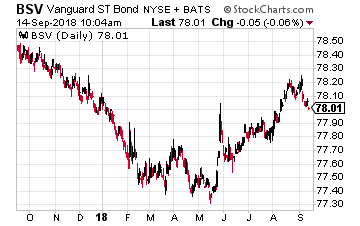

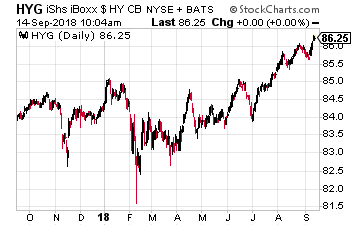

High yield bond funds such as the $16 billion in assets iShares iBoxx $ High Yield Corporate Bond ETF (NYSE: HYG) pay a more attractive current yield, but with added danger to your invested principal. High-yield is the term for non-investment grade bonds. These are also called junk bonds.

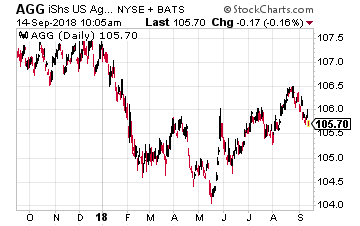

High yield bond funds such as the $16 billion in assets iShares iBoxx $ High Yield Corporate Bond ETF (NYSE: HYG) pay a more attractive current yield, but with added danger to your invested principal. High-yield is the term for non-investment grade bonds. These are also called junk bonds. The iShares Core U.S. Aggregate Bond ETF (NYSE: AGG) is the largest bond ETF with $56 billion in investor money. The fund is touted as a diversified way to cover the full range of investment grade bonds.

The iShares Core U.S. Aggregate Bond ETF (NYSE: AGG) is the largest bond ETF with $56 billion in investor money. The fund is touted as a diversified way to cover the full range of investment grade bonds.

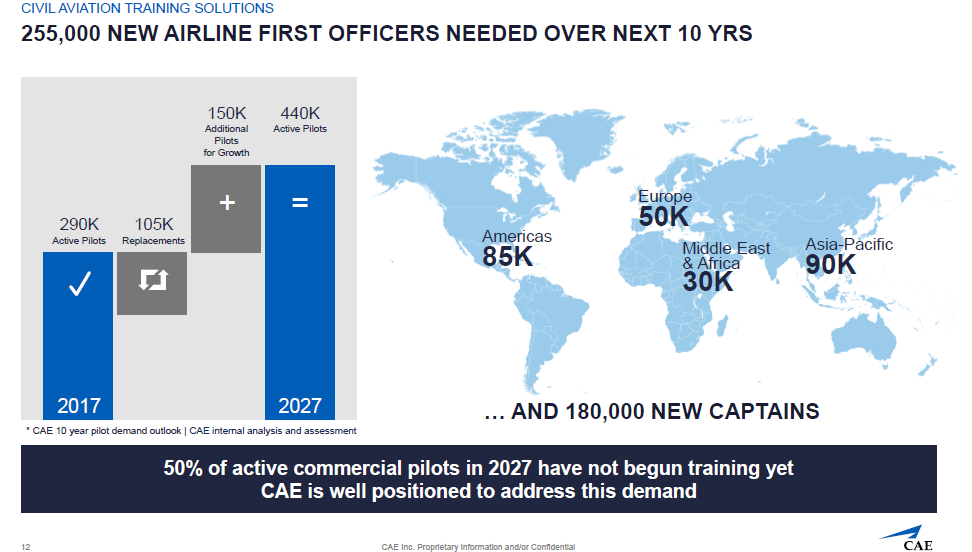

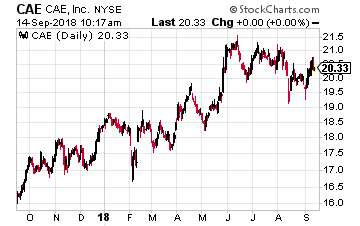

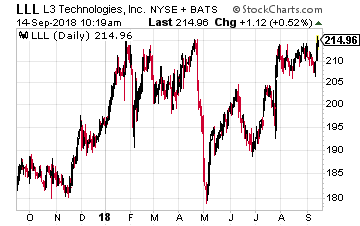

CAE (NYSE: CAE) has been in business since 1947 and offers you a “pure play” training company driven by the long-term growth in civil aviation around the world. That is in contrast to some of its competitors such as L3 Technologies (NYSE: LLL), which are involved in other businesses. The company also is riding the wave of simulation-based training in areas with critical tasks including defense and security as well as healthcare.

CAE (NYSE: CAE) has been in business since 1947 and offers you a “pure play” training company driven by the long-term growth in civil aviation around the world. That is in contrast to some of its competitors such as L3 Technologies (NYSE: LLL), which are involved in other businesses. The company also is riding the wave of simulation-based training in areas with critical tasks including defense and security as well as healthcare. CAE has the broadest global presence in the industry, with over 160 sites and training locations in over 35 countries that includes the world’s largest civil aviation network with over 50 training locations, more than 250 full flight simulators, over 2000 instructors and more than 160 aircraft. Each year, CAE trains more than 120,000 civil and defense crew members and thousands of healthcare professionals worldwide.

CAE has the broadest global presence in the industry, with over 160 sites and training locations in over 35 countries that includes the world’s largest civil aviation network with over 50 training locations, more than 250 full flight simulators, over 2000 instructors and more than 160 aircraft. Each year, CAE trains more than 120,000 civil and defense crew members and thousands of healthcare professionals worldwide.