Despite the recent announcement from drug giant Pfizer that it was raising prices by an average of 5% on about 10% of its drugs on January 15, the warning signs for the industry’s profitability are becoming more frequent.

The latest drug pricing proposal from Senator Bernie Sanders had some similarities to one from the Trump Administration. Down the road, that may lead to a compromise and one of the few areas Democrats and Republicans can agree on – restraining the steady rise in drug prices. And it’s easy to see why – in 2016, total U.S. prescription drug expenditures were estimated at $450 billion!

Big Pharma’s Dilemma

This leaves the large pharmaceutical companies in a dilemma. One the one side is the government trying to restrain prices while on the other side is the hard, cold fact that research and development of new drugs is growing more costly with the returns on this R&D shrinking every year.

On average, it takes about 12 years of research and development and an expenditure of $2.6 billion to move an experimental new drug from the laboratory to the market. Yet, their business is to find new drugs to treat patients.

Keep in mind that the most recent data from the CDC shows that 48.9% of Americans have a chronic condition that requires them taking at least one prescription drug within the last 30 days. I have to take three meds daily and I’m sure you, or someone in your immediate family, has a need for a prescription medicine.

A study centered on the 12 biggest pharmaceutical firms from Deliotte highlighted the recent negative R&D trend for these companies. Here are a few of the highlights of that study:

- R&D returns have declined to 3.2%, down from 10.1% in 2010

- Projected peak sales per asset decreased by more than half between 2010 and 2016

- The uptick in costs and sales per asset in 2017 was due to the drop in the number of assets in late-stage pipelines—from 189 in 2016 down to 159 in 2017.

So what can these companies do to turn their fortunes around?

One solution lies in emerging technologies such as robotics, big data and artificial intelligence (AI). Both drug companies and the technology giants are investing billions of dollars into AI, hoping it will make the drug discovery process both faster and cheaper.

AI and Pharma Research

In February 2018, Eric Horvitz – director of Microsoft Research Labs told the annual meeting of the American Association of the Advancement for Science – “I believe that AI is a sleeping giant for healthcare in general.” He said Microsoft was investing in AI for drug design and pharmacology, which studies how drugs act in the body, and called the technology a “tremendous opportunity.”

And Microsoft is far from alone in its AI bet. The Toronto-based biotech company BenchSci says more than 16 pharma firms and over 60 startups were using AI for drug discovery.

The biggest bottlenecks in drug development usually occur in the very early stages of research. That involves the the time needed in going from identifying a potential disease target (often a protein within the body) to testing whether a company’s drug candidate can hit that target. The most ambitious AI efforts aim to compress that process — which can take four to six years — into just one year.

2018 has been a banner year, with a huge jump in investment from big pharma, often in conjunction with health tech groups, into using AI. The research firm Deep Knowledge Analytics says at least 15 firms have integrated AI into their drug discovery process.

The major pharma firms are taking varied approaches – some are partnering with health tech groups, some are keeping everything in-house, and some are following both paths.

Some the major pharma firms involved include: GlaxoSmithKline with Exscientia, AstraZeneca and Sanofi with Berg Health and Merck with Numerate. Some companies though are working with AI in-house. Positive developments here include Pfizer using AI to mine patient data — stored anonymously in electronic medical records — for signs of a rare form of heart failure. And Novartis hopes a drug partially developed using AI will be registered within the next 36 months.

I believe using AI in drug discovery will be quite commonplace by the middle of the next decade. So what companies will be leading the way? Let me give you a couple of the top candidates among the major pharmaceutical companies.

Two Companies Leading the Way

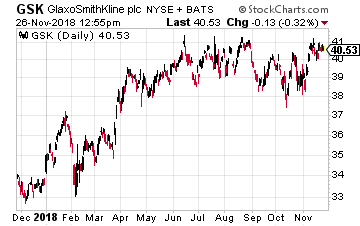

GlaxoSmithKline (NYSE: GSK) is probably the most active of all pharmaceutical companies in applying artificial intelligence to drug discovery. It even created an in-house artificial intelligence unit called the “In silico Drug Discovery Unit.”

GlaxoSmithKline (NYSE: GSK) is probably the most active of all pharmaceutical companies in applying artificial intelligence to drug discovery. It even created an in-house artificial intelligence unit called the “In silico Drug Discovery Unit.”

GSK has partnered with startups including Exscientia and Insilico Medicine.The partnership with Excscientia, announced in July 2017, has a goal of discovering novel small molecules for up to 10 disease-related targets across several therapeutic areas. The partnership with Insilico, announced in August 2017, is to identify novel biological targets and pathways.

The company is also part of the Accelerating Therapeutics for Opportunities in Medicine (ATOM) Consortium, which aims to leverage artificial intelligence to go from drug target to patient-ready therapy in less than a year. GSK gave ATOM some very useful ‘big data’ – chemical and in vitro biological data for more than two million compounds it has screened.

Other notable efforts in the AI space from GSK include the announcement in May 2018 of a partnership with Cloud Pharmaceuticals to use AI for the design of novel small molecule drugs. And the company is also working with Googleon applying AI to drug discovery. Researchers from the two firms have already developed a machine learning algorithm to identify protein crystals.

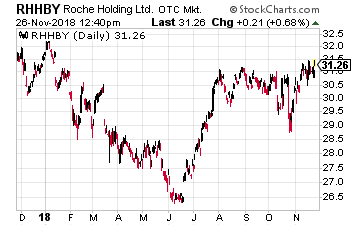

Another of my favorites in the sector with regard to the use of AI is the Swiss drug giant, Roche Holding Ltd. (OTC: RHHBY). This company’s stock, in the form of an ADR that trades well over 1.2 million shares a day, has been a slow and steady climber. It is very near its 52-week high despite a terrible stock market background.

Another of my favorites in the sector with regard to the use of AI is the Swiss drug giant, Roche Holding Ltd. (OTC: RHHBY). This company’s stock, in the form of an ADR that trades well over 1.2 million shares a day, has been a slow and steady climber. It is very near its 52-week high despite a terrible stock market background.

In June 2017, Genentech (a Roche subsidiary) announced a collaboration with the precision medicine firm GNS Healthcare focused on cancer therapy. The companies aim to use machine learning to convert high volumes of cancer patient data into computer models that can be used to identify novel targets for cancer therapy. Among the investors into GNS Healthcare are Amgen and Celgene.

Back in December 2014, Roche acquired Bina Technologies, a biotech company targeting the personalized medicine sector by providing a platform for large-scale genome sequencing. In its description of services, Bina Technologies has machine learning experts as part of its team.

Finally, Roche is another of the handful of pharmaceutical partners for the aforementioned Boston-based Berg Health, a company focused on applying AI in for the discovery and development of drugs, as well as diagnostics and healthcare applications.

High attrition rates among drug candidates are one of the main reasons for expensive drug prices, as pharma companies look to offset the cost of failed projects against the very few successful ones. Improving productivity though AI holds out hope that the attrition rate will drop, lowering drug prices.

Buffett just went all-in on THIS new asset. Will you?

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

Source: Investors Alley