Source: Shutterstock

Interest rates are below the magic 3% number, earnings are strong, unemployment is low and the economy just came off its best quarter in 4 years.

Can it get any better?

Maybe. But if it even stays close to these bullish indicators, stocks will continue to climb. And if the broad market doesn’t cooperate, there are still sectors and specific companies that will continue to rally.

Below are the 10 best stocks to buy right now, regardless of a secular market rally or a more stock-focused run. These stocks have what it takes to keep their share prices on the rise for years to come.

There are always winners, even in tough markets. And these stocks typify the kind of companies that are riding long-term trends (or a shift in trends) and have what it takes to succeed in these dynamic times.

Best Stocks to Buy Now: Amazon (AMZN)

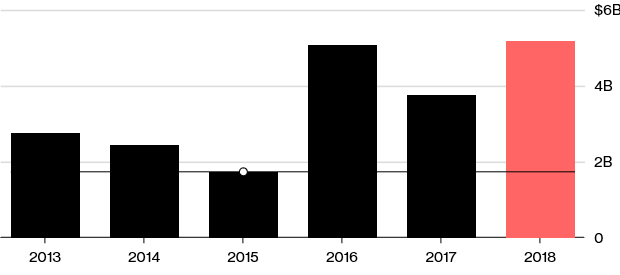

Amazon.com (NASDAQ: AMZN) is pretty much a given on this list. And it’s not just about its e-commerce empire. There are plenty of stats that show some of the major retailers are still significantly larger. It’s the fact that AMZN continues to dump its growing revenue back into its businesses. It’s not content to build up a cash hoard or dole out a symbolic dividend.

The case for Amazon grows and grows. It’s the leading cloud business in the world. It owns a grocery store chain. It’s a major entertainment company. It’s looking to get into the prescription drug business. It has its eye on building out its own logistics enterprise to support its e-commerce.

This is what makes AMZN a great stock now, and for many years to come.

Best Stocks to Buy Now: Texas Pacific Land Trust (TPL)

Texas Pacific Land Trust (NYSE: TPL) was created in 1888, from the reorganization of the Texas and Pacific Railway.

Basically, the trust received 3.5 million acres of land from the railroad and is now one of the largest landholder in Texas with about 888,000 acres of land in 18 counties that it manages.

This means TPL manages oil, gas, mineral and water rights on all this property as well as choosing what it wants to sell or lease. With some of the most productive shale properties this is a big deal.

Plus, there are a lot of companies moving to Texas, which provides even more development opportunities.

TPL stock is up 80% year to date and this trend is certainly TPL’s friend.

Best Stocks to Buy Now: Abiomed (ABMD)

ABIOMED Inc (NASDAQ: ABMD) has a $16 billion market cap, but it’s been around since the 1980s.

As a matter of fact, the founders of ABMD invented the first artificial heart. And today, the company does one thing — the Impella brand of artificial heart valve.

Now, name brand medical equipment isn’t exactly like name brand pharmaceuticals. You don’t ask your doctor what brand of valve you’re getting — if you even have the opportunity to ask.

And there are plenty of larger medical equipment companies that have a heart-pump division. But ABMD focuses on one thing. And it has a global reputation. It’s already very popular in Germany and Japan as well as the U.S.

ABMD continues to grow — up 102% year to date — and the graying of the developed world’s population plays to its growth. It could also be a very attractive acquisition for a bigger firm.

Best Stocks to Buy Now: Netflix (NFLX)

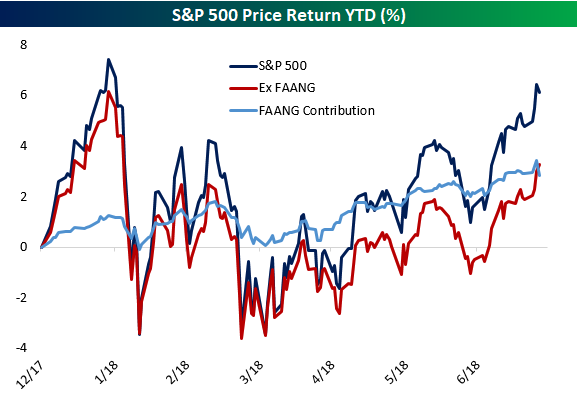

Netflix Inc (NASDAQ: NFLX) is one of the famed FANG stocks. And along with AMZN, it makes our top 10 list.

This may be surprising given the fact that NFLX recently announced it missed its projected new subscriber numbers for the quarter by almost 1 million subscribers.

But then again, NFLX stock is trading at a PE of 157. That’s higher than AMZN’s. And it was even higher before the selloff.

The simple fact is, NFLX still has plenty of the world to conquer and its focus on content around the globe will be an asset it can monetize long after it subscribes everyone it possibly can to its services.

Right now, its big push is in India, where there are over 1 billion people. It has already started developing original content for the country and is hoping to break through in coming quarters.

Best Stocks to Buy Now: SVB Financial (SIVB)

SVB Financial Group (NASDAQ: SIVB) is an interesting new iteration of traditional banks.

Say you have a small bank where most of your customers come from Silicon Valley and the tech start-up culture (and money). You get depositors that are looking for opportunities in start-ups and you have cash to lend to these small businesses.

Plus, your customers are the people who have track records of successfully starting new firms. It’s like building a private investment bank focused on a specific sector.

SIVB is now expanding its operation up the West Coast to Washington state, where a similar culture exists and to other tech cities around the country.

Best Stocks to Buy Now: Arista Networks (ANET)

Arista Networks Inc (NYSE: ANET) was on quite a roll for a while. While year to date it has managed about an 11% gain, for the past 12 months it has delivered a 52% return to its investors.

ANET is cloud computing company that has become a major competitor to some of the bigger players in the networking and storage space. And with a $20 billion market cap, ANET is big enough to grow on its own, or it could be an acquisition target for one of its big competitors or a big tech firm looking to buy a spot in the space.

The problem with the legacy players in the space is they can’t reinvent the systems they already have in place. ANET provides much cleaner and less cumbersome solutions because it doesn’t have to worry about all the legacy hardware it needs to support and transition.

This slow time is a good time to get in for the long run.

Best Stocks to Buy Now: Ligand Pharmaceuticals (LGND)

Ligand Pharmaceuticals Inc (NASDAQ: LGND) is a new breed of pharmaceutical company.

In the old days, a biotech or pharmaceutical company would have an R&D division looking for new drugs, a team that would do early-stage development and reformulation, a team for late-stage development, another for testing and trials, and another for commercialization or partnering strategies.

But as the industry got bigger, all these divisions became expensive and costly to manage. And things got lost in the pipeline.

LGND focuses on the discovery, early-stage development, reformulation and partnering. That keeps it laser focused and cuts out all that work for its partners who handle the backend.

And given LGND stock is up 82% in the past year, this strategy is not only working, but it has a lot of believers.

Best Stocks to Buy Now: Inogen (INGN)

Inogen Inc (NASDAQ: INGN) makes portable oxygen concentrators. While that doesn’t seem like it’s a big business, it has given INGN a $4 billion market cap as one of the leaders in the sector.

Traditionally, people with breathing issues have had to haul around oxygen tanks. They’re really heavy and aren’t exactly easy to get around with, especially for people that are older and less agile than they used to be.

It’s an inelegant and difficult solution to the problem. INGN’s concentrators are game-changers. They can be easily carried around and home units are also easily moved.

They basically convert the ambient air into concentrated oxygen, so you don’t have to haul a tank around. You just charge the unit and go.

As America grays, this type of equipment has growth path for decades to come. Its up 130% in the past 12 months and 75% year to date.

Best Stocks to Buy Now: Medifast (MED)

Medifast Inc (NYSE:MED) is part of one of the hottest trends out there that doesn’t have to do with technology — prepackaged health and nutritional foods.

You’ve heard of Weight Watchers (NYSE:WTW) and Jenny Craig. Well Medifast has been around a long time as well, and it’s starting its own growth trend, even without Oprah.

MED stock is up a whopping 405% in the past 12 months and 207% year to date.

And the crazy thing is, you don’t really hear about this stock. What’s more, after all that massive growth, the stock is still trading at a PE of 76, half of that of NFLX or AMZN.

Best Stocks to Buy Now: Micron (MU)

Micron Technology (NASDAQ: MU) is memory maker. And I don’t mean that it makes life memorable. It makes memory chips, especially the new generation of flash memory chips.

Certainly there are other bigger chipmakers that make memory chips and much more. But MU is focused on this major sector. And is leveraged to its growth.

Many are coming to believe that this sector’s cyclical nature has been uprooted by the fact that the mobility revolution as well as the advent of cloud computing, Big Data, augmented/virtual reality and the Internet of Things. Demand has become less cyclical and more of a constant, which will have a significant effect on MU, as a leader in this sector.

MU stock is up almost 90% in the past year and 28% year to date. And this is with some in the industry still thinking the cyclical nature of the past will somehow reassert itself. Don’t count on it.

Louis Navellier is a renowned growth investor. He is the editor of five investing newsletters: Blue Chip Growth, Emerging Growth, Ultimate Growth, Family Trust and Platinum Growth. His most popular service, Blue Chip Growth, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.

D.R. BARTON, JR.

D.R. BARTON, JR.