Source: Shutterstock

The Big Data market is likely to grow for the long haul. Let’s face it, the world is undergoing an explosion of data, such as from smartphones, IoT (Internet-of-things), wearables, AI (Artificial Intelligence) and machine learning.

Actually, for just about any company to compete and thrive nowadays, there needs to be a Big Data focus. It’s a strategic imperative. According to research from Statista, global spending is expected to go from $42 billion in 2018 to $103 billion by 2027.

In other words, there is substantial opportunity for investors. But what are the best stocks to buy in the category?

The good news is that the recent wave in IPOs has provided investors a group of next-generation players to choose from. So here’s a look at seven:

Yext (YEXT)

Yext (NYSE:YEXT) operates a knowledge platform, which includes a network of about 150 data providers like Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL), Facebook (NASDAQ:FB) and Apple (NASDAQ:AAPL). For the most part, the company organizes data in ways to help businesses achieve goals, such as getting more customers or providing a better service.

At the heart of this is intelligent search, which is based on context and intent. There is also AI (Artificial Intelligence) that helps provide more relevant results.

The next generation of this technology, called Yext Brain, launched in late October. The system allows customers to sync their data with AI-enabled services like search, voice assistants and chatbots.

In terms of growth for YEXT, it has been robust. During the latest quarter, revenues jumped by 33% to $58.7 million. The company also snagged nearly 80 new enterprise customers.

Source: Shutterstock

Alteryx (AYX)

Alteryx (NYSE:AYX) was an early player in the Big Data industry, having been founded in 1997. The company also bootstrapped its operations. Note that AYX did not raise any venture capital until 2011.

But this did not hamstring the company. Now AXY is one of the top Big Data stocks in the world. Then again, it has built a platform that is fairly easy for businesses to leverage analytics, such as by using visualizations. Keep in mind that Big Data systems are often focused on specialists like data scientists.

AYX’s strategy has helped to expand the market opportunity. In fact, the company believes that the spending on the category will go from $19 billion in 2016 to $29 billion by 2021.

During the latest quarter, revenues shot up by 59% to $54.2 million and the number of customers rose by 41% to 4,315.

Source: Shutterstock

Talend (TLND)

With the rapid growth in new technologies, data integration has gotten even more mission critical. Yet the tools have tended to lag. It is often the case that there needs to be professional services and custom coding.

But Talend (NASDAQ:TLND) is changing this with its innovative platform — called Talend Data Fabric — that integrates data and apps in real time across Big Data systems, cloud environments and on-premise installations. The result is that there is a unified view of data.

To bolster the product, TLND acquired Stitch, which operates a cloud service that moves data into cloud warehouses and data lakes. The service has more than 900 customers.

Granted, TLND stock got crushed on the latest earnings report. But it does look like it was an overreaction. Note that the company continues to grow at a strong pace — with revenues up 36% to $52.1 million in the third quarter.

Source: Shutterstock

Cloudera (CLDR)

Cloudera (NYSE:CLDR) has built a sophisticated Big-Data platform that uses machine learning and analytics. It is also optimized for cloud environments.

But CLDR is in the process of a major transformation — that is, the company is merging with Hortonworks (NASDAQ:HDP), which is another of the major Big Data stocks. The combined entity will be a powerhouse, which will have services for the multi-cloud, on-premise environments and the Edge. Consider that HDP has an expertise with streaming and IoT while CLDR’s focus has been AI.

There will also be significant scale, which should help provide a competitive advantage. The merger of CLDR and HDP will result in annual revenues of $720 million, with over 2,500 customers.

Splunk (SPLK)

Founded in 2003, Splunk (NASDAQ:SPLK) is a pioneer in developing systems to analyze machine data, such as from websites, apps, servers, networks and smartphones. The focus was on helping companies gain “operational intelligence.”

Despite the emergence of fierce competitors, SPLK has been able to maintain its leadership. Then again, the company continues to invest heavily in R&D. Consider that at its most recent conference — .conf18 – it had the largest number of new releases. For example, the company now has solutions for areas like IoT and Industrial IoT.

Growth has also remained strong. During the latest quarter, revenues increased by 49% to $325 million. The company also generates strong cash flows, which came to $59.1 million in Q3.

Source: Shutterstock

Elastic (ESTC)

Elastic (NYSE:ESTC) is essentially a sophisticated search engine for businesses. At the core of this is open-source software, which is downloaded for free. This has not only allowed for rapid adoption of Elastic — which is critical for any search engine — but ongoing innovation.

The platform also allows for searches of structured and unstructured data, say from databases, mobile apps, log files and so on. There is also AI features and machine learning.

And what about the growth ramp? Well, it has been torrid. During the latest quarter, revenues spiked by 79% to $56.6 million. The company has over 5,500 customers across more than 80 countries.

Source: ©iStock.com/tusumaru

Big Data Stocks to Buy for 2019: Mongodb (MDB)

Relational databases have been around since the 1970s. The technology is also at the core of Oracle’s (NYSE:ORCL) database franchise.

But the problem is that the technology really does not meet the complicated needs of today’s Big Data needs.

So yes, there is an alternative, called NoSQL. And the leader in the category is Mongodb(NASDAQ:MDB). The company’s database has been downloaded over 40 million times and there are more than 7,400 customers across over 100 countries. MongDB also has a thriving ecosystem, which has more than one million members in the MongoDB University.

All this has turned into a standout business. During the latest quarter, revenues soared by 61% to $57.5 million. Actually, given the critical nature of databases to Bid Data, it would not be a surprise that a larger company — say Oracle — would eventually try to buy the company.

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

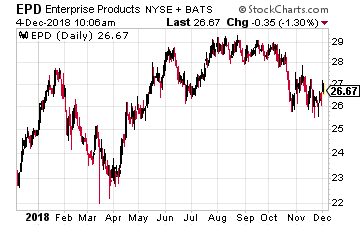

Enterprise Products Partners LP (NYSE: EPD) with a $57 billion market cap is the largest midstream MLP. The company provides the full range of energy infrastructure services.

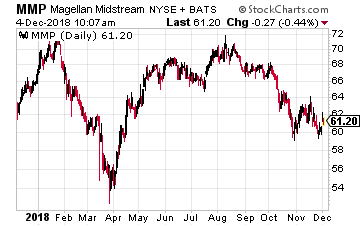

Enterprise Products Partners LP (NYSE: EPD) with a $57 billion market cap is the largest midstream MLP. The company provides the full range of energy infrastructure services. Magellan Midstream Partners LP (NYSE: MMP) primarily owns and operates refined products (gasoline, diesel fuel, jet fuel, etc.) pipelines and storage terminals. The company also owns 2,200 miles of interstate crude oil pipelines.

Magellan Midstream Partners LP (NYSE: MMP) primarily owns and operates refined products (gasoline, diesel fuel, jet fuel, etc.) pipelines and storage terminals. The company also owns 2,200 miles of interstate crude oil pipelines.

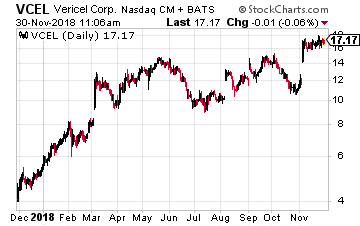

Vericel Corporation (Nasdaq: VCEL)

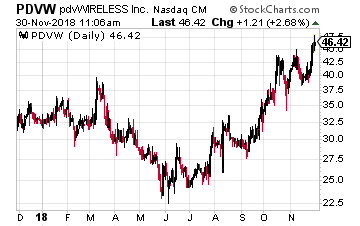

Vericel Corporation (Nasdaq: VCEL) pdvWireless (Nasdaq: PDVW)

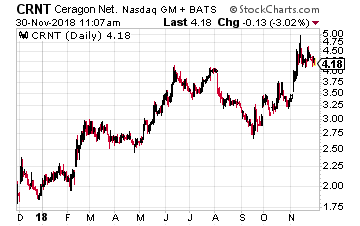

pdvWireless (Nasdaq: PDVW) Ceragon Networks (Nasdaq: CRNT)

Ceragon Networks (Nasdaq: CRNT)