Any cursory look at the markets would reveal that 2018 wasn’t the best year for investors. That goes for speculative assets as well, including marijuana stocks. Although going green has proven net positive for the early birds, the sector tanked heavily during the October selloff. Still, I wouldn’t drop them from your list of stocks to buy just yet.

Despite their well-publicized fall from grace, several marijuana stocks have stabilized from their severe correction. While that’s no guarantee that the industry is done spilling blood, the deflated prices will almost certainly attract speculators. Should enough risk-takers enter the arena, publicly traded cannabis companies will jump higher, even if it’s only a temporary swing.

However, some other factors suggest that marijuana stocks may enjoy a sustained rise. First, none of the big waves currently spooking benchmark indices affect the legal cannabis industry. Whether it’s political unrest in the Middle East, the spiraling protests in Paris or the ugly Huawei controversy, marijuana for now is mostly a North American issue.

Second, medical cannabis potentially offers significant social utility. A stunning Bloomberg article analyzed whether Gilead Sciences (NASDAQ:GILD) made the right business decision in producing a drug that cured diseases rather than managing them. The perception exists that big pharma companies should focus primarily focus on revenue generation rather than medical breakthroughs.

On the other hand, medical marijuana companies have no such quandaries. Because they are typically much smaller outfits, they don’t mind the inability to patent a naturally occurring plant. If anything, an organization that produces a proven, effective cannabis strain would represent a buyout target. This asymmetry challenges big pharma, but makes marijuana-based pharmaceuticals among the best stocks to buy.

While the sector remains risky, the deflated market environment offers attractive deals on these 10 marijuana stocks.

Tilray (TLRY)

Tilray (NASDAQ:TLRY) easily represents the most interesting and controversial picks among marijuana stocks to buy for next year. Within a few months after its initial public offering, TLRY stock pulled a ten-bagger. But as you know, the victory was short-lived, and Tilray came crashing down to earth.

Naturally, several analysts and commentators blasted the company as an unsustainable bubble. Keep in mind, though, that since its IPO, TLRY stock is up over 470%. I wouldn’t dismiss such a performance as a failure. Moreover, shares have stabilized near the $100 level. If this company was as terrible as the bears claimed, I doubt TLRY would ride this support line.

Now, it’s easy to dismiss any individual opinion. It’s much harder when a banking giant like Barclays (NYSE:BCS) increases their position. Clearly, they view TLRY as one of the best stocks to buy in 2019, and they’re putting their money where their mouth is.

Canopy Growth (CGC)

The prior two months have not been for Canopy Growth (NYSE:CGC). Taking a similar route to most other marijuana stocks, CGC dropped 26% in October. The following November appeared promising, building off a sharp burst of momentum. Unfortunately, the rally lost traction and CGC ended up losing double-digits for the month.

But what I like about Canopy Growth is that true to its name, it’s a steady grower. Despite the recent sharp losses, its longer-term bullish trend channel remains intact. I wouldn’t consider hitting the panic button unless shares started to decisively fall below the $25 level. That said, I think the broader fundamentals favor CGC stock.

Tilray has a financial institution backing it. For Canopy Growth, they have alcoholic-beverages maker Constellation Brands (NYSE:STZ). This is a trend that investors, even the skeptical ones, shouldn’t ignore. Big money is increasingly stepping into the cannabis sector, making CGC one of the best stocks to buy despite its well-publicized setbacks.

Cronos Group (CRON)

While most marijuana stocks have struggled to rekindle their prior catalysts, Cronos Group(NASDAQ:CRON) currently stands above the competition. For the month so far, CRON stock has streaked to an amazing 39% lead. Of course, most of that optimism comes courtesy of Altria Group (NYSE:MO).

The iconic tobacco company made headlines when it announced a partnership with Cronos. The deal, worth $1.8 billion, provides CRON with a boatload of cash to further develop its cannabinoid (CBD) products. On the other side of the fence, Altria needs something fresh to reinvigorate its traditional tobacco business.

A key long-term synergy could be the vaporizer market. Vaping CBD e-liquids have taken off in terms of popularity. Altria has attempted to break into the vaporizer market with its own heat-not-burn tobacco products. But with Cronos’ expertise in CBD, Altria has another angle in this sector to work.

In the meantime, feel free to put CRON in your list of best stocks to buy for next year.

Aurora Cannabis (ACB)

Aurora Cannabis (NYSE:ACB) has suffered a disjointed long-term performance in the markets, even compared to other marijuana stocks. In 2017, ACB stock shot from near-obscurity to the toast of Wall Street. This year, ACB has shown flashes of brilliance, but little to show for it overall.

I expect the cannabis sector to wake from its slumber. When it does, the currently embattled ACB has the potential to become one of the best stocks to buy for 2019. The markets really haven’t responded positively to Aurora’s buyout of Farmacias Magistrales. Farmacias made news when it became the first, and so far only Mexican importer of raw materials that contain the psychoactive component THC.

The buyout allows Aurora a viable channel to Latin America’s medical-marijuana market. In addition to Farmacias, ACB has operations in Colombia and Uruguay. Should the industry establish medical breakthroughs in Latin America, advocates will pressure the U.S. to further loosen federal cannabis restrictions.

Auxly Cannabis (CBWTF)

One of the most common misconceptions is that legal-cannabis advocates are only “fronting” to get high. While that use is unavoidable, the botanical industry has several legitimate applications. On the business aspect, several investors assume that all cannabis companies focus on growing weed.

But as Auxly Cannabis (OTCMKTS:CBWTF) demonstrates, marijuana stocks feature the same vibrancy and dynamism as other commodity related investments. Auxly specializes in all areas of the legal-cannabis supply chain, with a primary focus on upstream operations. This involves partnering with companies that grow the actual product.

In addition, CBWTF levers a viable midstream operation. This includes activities such as extraction, processing and branding. It also involves longer-term efforts like research and development.

The biggest advantage for CBWTF to pull this streaming business off is its balance sheet. With a favorable cash-to-debt ratio, Auxly can make key acquisitions and investments while the cannabis market is still young.

Origin House (ORHOF)

Formerly known as CannaRoyalty, Origin House (OTCMKTS:ORHOF) is another cannabis firm that made its name through streaming businesses. And while it still generates some revenue through its initial line of work, ORHOF has become a powerhouse in branding.

The proof is in its utter domination of California. Unbeknownst to me prior to this write-up, the Golden State is the world’s largest legal cannabis market. With a title like that, it’s a wonder how anything gets done around here. Joking aside, Origin House boasts more than 450 California-based dispensaries and more than 50 popular brands.

In other words, if you can make it in California, you can make it anywhere. This bodes very well for ORHOF stock. Last month’s midterm elections proved that legal weed is gaining serious momentum. Inevitably, more recreational markets will open, allowing Origin House to expand its dominating presence.

Marimed (MRMD)

Let’s face facts: Marijuana stocks don’t exactly have the greatest reputation for stability. That goes five-fold for over-the-counter offerings. One notable exception to this rule is Marimed(OTCMKTS:MRMD).

While other sector players hemorrhaged severely during the October rout, MRMD stock actually enjoyed a standout performance, gaining nearly 19%. That said, Marimed eventually gave up those gains and then some. Since the first of November, MRMD is down a little over 17%.

Still, I think it’s fair to say that compared against other marijuana stocks to buy, Marimed has held up well. Heading into the new year, MRMD has the potential to turn heads.

Its biggest advantage is its highly demanded consultation services. Covering everything from licensing application support to facilities management, MRMD provides relevant and critical insights for budding entrepreneurs. Plus in my opinion, Marimed levers one of the brightest and well-rounded leadership teams in the marijuana industry.

Medmen Enterprises (MMNFF)

Marijuana retail outfit Medmen Enterprises (OTCMKTS:MMNFF) suddenly became one of the best stocks to buy in botany around mid-October. Within a matter of days, MMNFF stock skyrocketed over 60%. But like most over-the-counter affairs, Medmen gave up its profits just as quickly.

Since its peak closing price, MMNFF stock has dropped a humbling 53%. I get that most investors will balk at such volatility. However, for the speculator, I sense serious growth opportunities for Medmen.

The company has established itself as a retailer of premium cannabis products. Yet many investors may not appreciate that Medmen is a vertically integrated organization. From its upstream production operation down to extraction, branding and distribution, Medmen essentially controls its supply chain. This is a “farm-to-bong” business at its finest.

As Medmen CEO Adam Bierman stated recently, this structure affords the company generous margin-expansion possibilities. Further, the aforementioned high-profile deals only help validate smaller players like MMNFF stock.

Aleafia Health (ALEAF)

Broader and sector weakness has hurt virtually all marijuana stocks. However, the lesser-known names have experienced disproportionate pain. Unfortunately, this is something that Canadian cannabis firm Aleafia Health (OTCMKTS:ALEAF) knows all too well.

But despite its severe market loss over the past two-and-a-half months, ALEAF stock offers a speculative opportunity for risk-takers. For starters, the underlying company features the largest network of referral-only medical cannabis clinics in Canada. Furthermore, their patient base continues to increase as the industry gains social recognition and acceptance.

Management has also invested heavily in cultivation facilities, targeting an annual growing capacity of 98,000 kilograms in 2019. Most importantly, Aleafia has the substance to back up the outlook. In its most recent third-quarter earnings report, the company increased revenue 36%year-over-year.

Diego Pellicer Worldwide (DPWW)

We’ve arrived at the end of our journey regarding marijuana stocks to buy in 2019. In keeping with my loose tradition, I like to throw in an extremely speculative name. And don’t roll your eyes at me: you know you want to know!

The following idea comes from an InvestorPlace reader named Anthony. He asked my opinion regarding Diego Pellicer Worldwide (OTCMKTS:DPWW). My answer to him is the same one I’m giving to you, which is that DPWW stock is extremely risky. Aside from its distressingly low trading volume and market capitalization, Diego Pellicer lacks financial strength to convincingly pull off its licensing and royalties business model.

However, I’m intrigued with its premium branding business. Not that I would know, but Diego Pellicer specializes in high-class cannabis products. As companies like Origin House and Medmen have proven, cannabis users eschew quantity for quality. That could lead to a surprising turnaround for DPWW stock.

Or you can lose every cent that you put in.

As of this writing, Josh Enomoto is long MRMD and ALEAF.

Buffett just went all-in on THIS new asset. Will you?

Buffett could see this new asset run 2,524% in 2018. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it...

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen...And if you act fast, you could earn as much as 2,524% before the year is up.

Click here to find out what it is.

Source: Investor Place

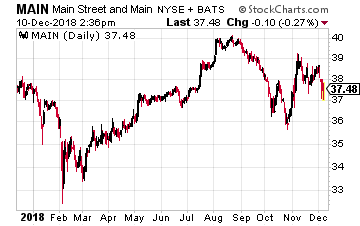

Main Street Capital (NYSE: MAIN) is a monthly dividend paying business development company (BDC). The company has also paid semi-annual, supplemental dividends since 2013. The next supplemental payout lands in investor brokerage accounts on December 27 and is equal to 150% of the normal monthly dividend.

Main Street Capital (NYSE: MAIN) is a monthly dividend paying business development company (BDC). The company has also paid semi-annual, supplemental dividends since 2013. The next supplemental payout lands in investor brokerage accounts on December 27 and is equal to 150% of the normal monthly dividend.