Source: Shutterstock

Big growth stocks have performed quite well in this bull market. At the head of the big growth stockpile are Amazon.com, Inc. (NASDAQ:AMZN) and Netflix, Inc. (NASDAQ:NFLX). And it seems those two fast-growing stock behemoths get all the attention.

But this creates a problem. There’s huge demand for big growth stocks, and most of that demand is flowing into AMZN and NFLX. That means the long Amazon stock and long Netflix trades are quite crowded. Crowded trades can be dangerous trades because when the crowd turns against you, a lot of money exits the stock in a hurry. That is especially true if there is leverage involved.

Long story short, when crowded trades unwind, things can get ugly in a hurry.

That isn’t to say anything is wrong with AMZN or NFLX. Those are two great companies with winning stocks.

It is just to point out that long Amazon and long Netflix stock are crowded trades. So if you’re looking for more exposure to big growth, I wouldn’t go out and buy more AMZN or NFLX. I’d look for big growth elsewhere. In lesser-known names and in less-crowded trades.

Where would I start? Here. Below, I’ve comprised a list of my three favorite growth stocks that are growing faster than Amazon and Netflix.

Fast-Growing Stocks: Shopify Inc (SHOP)

My favorite growth stock in the market is Shopify Inc (NYSE:SHOP).

In many ways, Shopify reminds me of an early-stage Amazon. Shopify provides digital commerce cloud solutions to retailers of all shapes and sizes. In this sense, the company is a pure-play on the exact same secular trends that burst Amazon into the spotlight: digital commerce and cloud.

Shopify’s growth story may even be a little be sexier than an early-stage Amazon. Shopify is retailer-agnostic. They operate in the background. That means every retailer could use Shopify’s solutions to enhance their digital selling capabilities. Because of this, Shopify’s addressable market is larger than Amazon’s because Shopify serves all retailers, whereas Amazon serves Amazon (and Amazon accounts for less than half of all digital sales in the U.S., and presumably far less internationally).

This is why Shopify’s revenue growth last quarter (+71%) was nearly double Amazon’s revenue growth last quarter (+38%). Considering Shopify is providing solutions for essentially every player in the massive and secular growth e-commerce market, and that Shopify’s revenues were under $700 million last year, Shopify should be able to grow at a faster rate than Amazon into the foreseeable future.

Meanwhile, margins are roaring higher alongside revenue growth and the company is going from a money-losing operation to a money-making operation.

Sound familiar? This is Amazon all over again. Pure-play on digital commerce and cloud. Huge revenue growth. Massive addressable market. Strong margin ramp.

Consequently, if you’re looking for exposure to things AMZN has exposure to but don’t want to buy more Amazon stock, I’d recommend taking a look at SHOP. It could be a big winner over the next five to ten years.

Fast-Growing Stocks: Weibo Corp (ADR) (WB)

If you’re looking for big growth, a good place to start is in China, where a recent boom in consumerism (and a lack of competition from U.S. firms) is creating massive growth opportunities for Chinese tech companies.

One of the fastest growing Chinese tech companies is social media giant Weibo Corp (ADR)(NASDAQ:WB). Weibo is often considered the Twitter Inc (NYSE:TWTR) of China, but they probably wouldn’t like that comparison. Weibo has more users than Twitter (392 million versus 330 million Twitter), is growing at a way faster rate (revenues +77% last quarter versus +2% for Twitter), and is more profitable (ebitda margins of roughly 43% last quarter versus 42% for Twitter).

The exciting thing about Weibo is that the company looks undervalued at the present moment.

If you think that the consumer landscape of China will start to look like the consumer landscape of America over the next several years (which is a realistic belief considering the evolution of the Chinese economy over the past several years), then Weibo’s users should be worth as much as Twitter’s users. But Twitter’s market cap is currently $23.5 billion, meaning each one of its 330 million monthly users is worth roughly $71. Weibo’s market cap is $27.4 billion, meaning each one of its 392 monthly users is worth roughly $70.

If Weibo keeps growing its user base at the current pace (+80 million year-over-year), then the company could have around 470 million monthly users by next year. At $71 per user, that implies $33.4 billion, roughly 20% above current levels.

Overall, Chinese tech stocks are a great place to look for growth outside of AMZN and NFLX. One of the biggest growers in that space is WB, and that stock looks materially undervalued relative to its U.S. comp.

Fast-Growing Stocks: Snap Inc (SNAP)

It seems you either love or hate Snap Inc (NYSE:SNAP). There really is no in between when it comes to the upstart social media company.

But the numbers are hard to argue. Snap’s revenue growth last quarter was 72%, by far and away the biggest market in the U.S. digital advertising quartet of Facebook Inc (NASDAQ:FB), Alphabet Inc (NASDAQ:GOOG), Twitter and Snap. User growth was 18%, again the best mark in the U.S. social media trio of Facebook, Twitter and Snap.

Bears will scream that growth should be bigger because Snap is smaller. Bulls will argue Snap is stealing market share away from Facebook, Google, and Twitter.

Market research seems to suggest the bulls are right here. According to eMarketer, Snap is chipping away at the digital advertising market dominance of Facebook and Google.

I don’t think that makes Facebook or Google any less attractive as investments. This chipping was inevitably going to happen, and the two still control 57% of the entire digital advertising market.

But I think it does make Snap more attractive as an investment. I continue to believe that Snap is morphing into a go-to digital advertising platform for small to medium-sized businesses that don’t necessarily need the max reach that Facebook and Google offer, but rather need the max engagement that Snapchat offers. This is a strong niche in the digital advertising world for Snap to operate in. As such, massive revenue growth rates in the 50%-plus range are here to stay.

If you’re looking for exposure to the high-growth digital advertising market, but don’t necessarily want to buy more FB or GOOG, SNAP should be on your radar.

Source: Investor Place

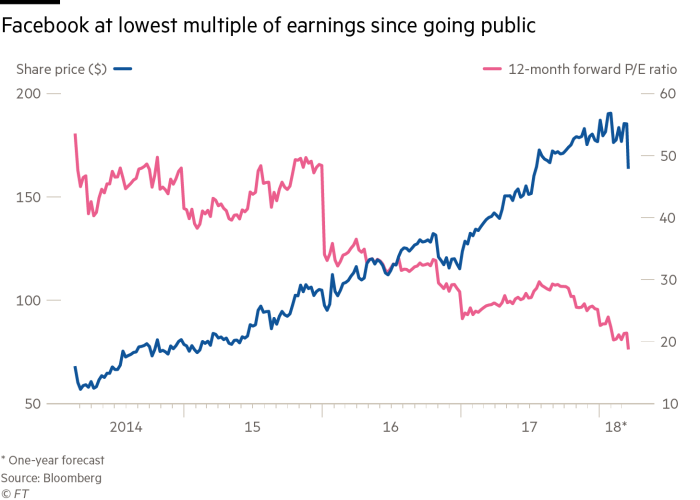

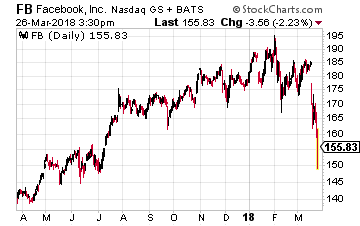

To be honest, I don’t know which is worse. . .the fact that an analytics firm used by Donald Trump’s presidential campaign improperly received data about 50 million users of the social network Facebook (Nasdaq: FB) or how poorly senior executives of the company handled the situation.

To be honest, I don’t know which is worse. . .the fact that an analytics firm used by Donald Trump’s presidential campaign improperly received data about 50 million users of the social network Facebook (Nasdaq: FB) or how poorly senior executives of the company handled the situation.