Source: Shutterstock

The S&P 500 is an index containing the largest stocks in the country. Investors use it to gauge how stocks are doing overall, as it serves as a snapshot for the U.S. equities market. Generally speaking, the index is also used as a benchmark, as everyone from retail investors to hedge fund managers compare their performance to it.

With that being said, there are a lot of names in the S&P 500 that investors don’t want to own, simply because they are not performing well. Do you know how unlikely it is to consistently get 500 winners?

In that regard, let’s take a look at how investors can use key stocks held in the S&P 500 to build a winning portfolio over the long term.

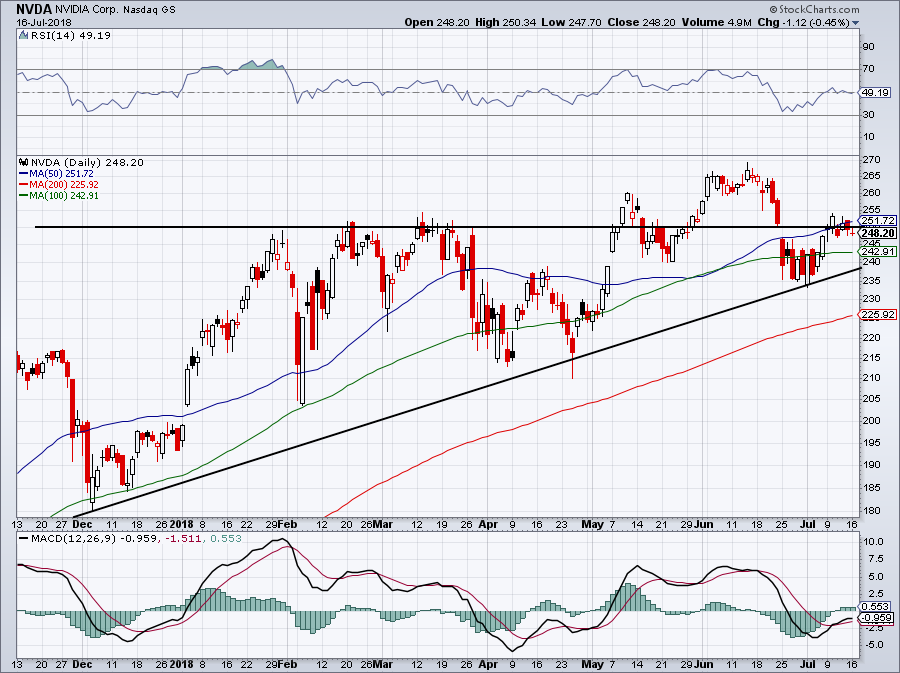

Top S&P 500 Stocks to Own: Nvidia (NVDA)

Perhaps Nvidia (NASDAQ:NVDA) is too obvious a stock to name here. But given its large rally over the past year, many investors feel like they’ve missed the boat.

Admittedly, Nvidia stock has rallied impressively over the past few years, up 53%, 379% and 1,157% over the past 12, 24 and 36 months, respectively. While another 1,000% rally in the next few years is likely out of the cards, there could still be substantial upside in Nvidia. For instance, the stock reaching over $300 in the next six to 12 months isn’t out of the question.

The company has positioned itself as a market leader in a number of secular end markets. Nvidia’s work in artificial intelligence (along with its numerous subcategories like deep learning and machine learning), in gaming chips and in the datacenter is all very impressive. Finally, it would come as a shock if Nvidia wasn’t the biggest winner from the autonomous driving race. While automotive revenue isn’t clocking in with massive growth right now, the self-driving industry is still in the very early innings. As it gains tractions, Nvidia’s DRIVE platforms will play a massive role in the industry.

While Nvidia may trade at 14 times sales, keep in mind it has far better margins than Advanced Micro Devices (NASDAQ:AMD) or Intel Corporation (NASDAQ:INTC). On an earnings basis though, Nvidia’s valuation is much more reasonable. At just 34 times this year’s earnings, that’s not much of a premium for a big-time grower like NVDA.

Analysts expect 34% sales growth this year and 50% earnings growth. While those numbers slow significantly in 2019, my guess is that they’re too conservative. Nvidia hasn’t just topped earnings estimates over the last few years — it has crushed every quarter. Its story isn’t done yet.

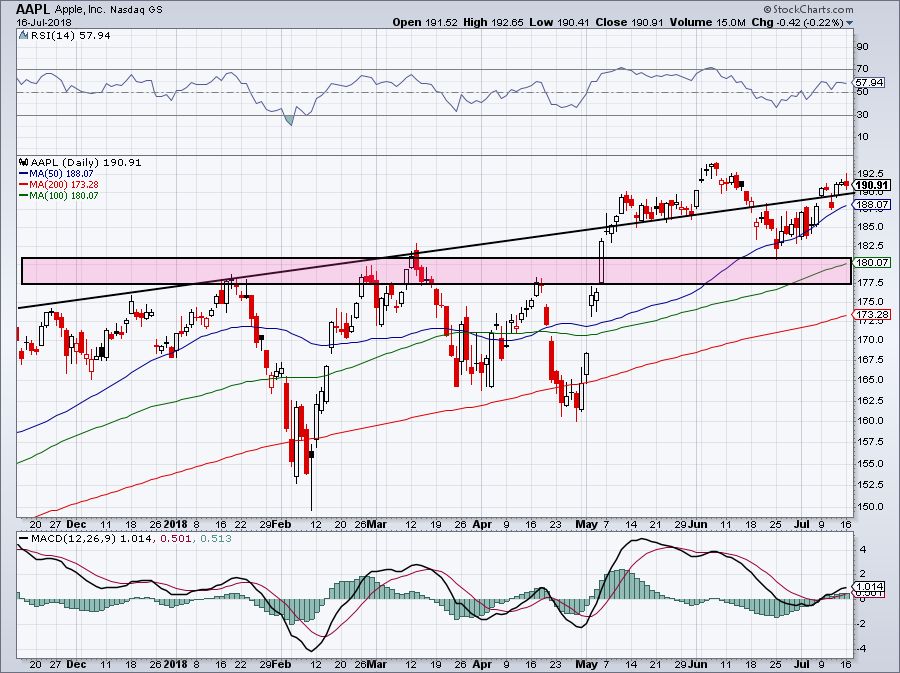

Top S&P 500 Stocks to Own: Apple (AAPL)

Apple (NASDAQ:AAPL) isn’t very controversial, but it needs to be included.

It’s the largest company in the S&P 500 and for good reason. Apple’s products and brand have made it so millions of customers around the world don’t even consider owning a competing brand. So long as it continues to make a sticky ecosystem, business should continue to do well.

Having a $100 billion buyback shows just how strong those cash flows are each quarter. Impressively, this follows previous buyback plans that ran into the tens of billions as well. More than likely, it comes ahead of many more billions being plowed into future share repurchases. Warren Buffett has made Apple the largest position in his Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B) holdings as well.

Apple also pays out a decent dividend, yielding 1.5%.

While shares are near the highs and as its market cap gravitates toward $1 trillion, it’s still one investors should have on their radar. Perhaps use a market-wide correction to initiate a new position.

At 18.5 times this year’s earnings, Apple stock is reasonably priced given its size and status. It’s also reasonable given its growth, even though on its own historical averages, it’s not exactly cheap. Analysts expect sales to grow 14% this year and 4% in 2019. On the earnings front, estimates call for 25% growth this year and 15% growth next year.

Don’t forget about the company’s budding services revenue, which could be a standalone company at this point. Last quarter its $9.2 billion in sales grew 31% year-over-year and came in vastly ahead of analysts’ expectations of $8.4 billion. If that momentum continues, it will help drive AAPL stock higher.

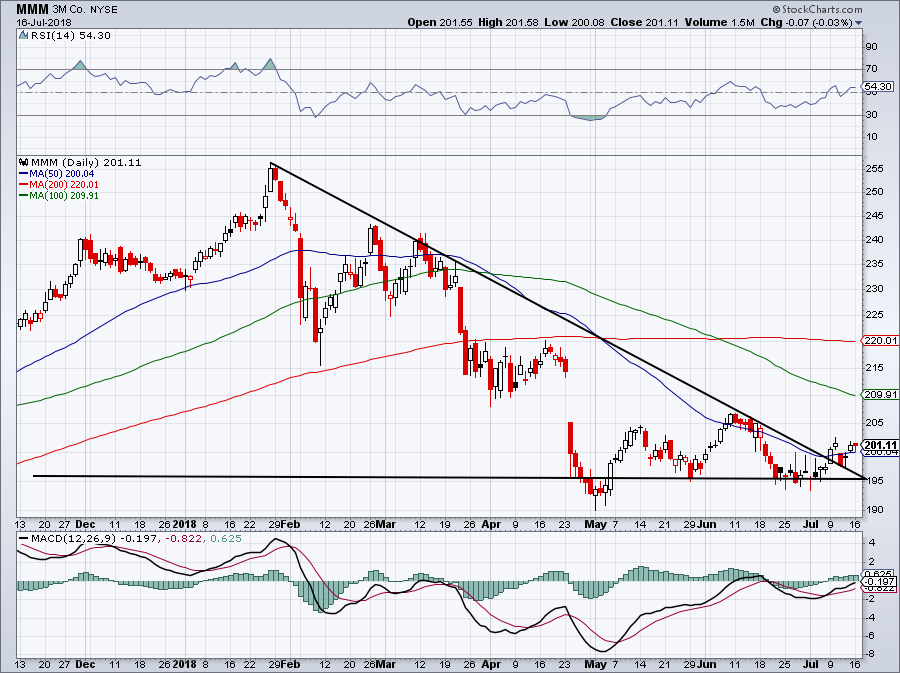

Top S&P 500 Stocks to Own: 3M (MMM)

3M (NYSE:MMM) hasn’t had the easiest time lately. But I think its business, chart and dividend make it one that certain investors should consider.

For starters, 3M made our list of best dividend stocks just this week. The company has not only paid out a dividend for a whopping 60 years, but it’s also raised its dividend every year for six decades. For income investors, there’s not much more you can ask for in terms of consistency. (The top dividend-payer only has three more years than 3M).

As for its business, estimates call for 5.7% sales growth this year and 3.5% next year. That goes along with 13% earnings growth in 2018 and 9% in 2019. For this, investors are paying about 18 times earnings.

Some will point out that they can buy Apple for a lower valuation with better growth and that’s true. 3M isn’t for all investors. But a look at the charts tells us we have a solid risk/reward opportunity here. Should MMM stay above downtrend resistance near $200, it could mean shares have finally bottomed.

This $190 to $195 area has clearly been support. If 3M can gain some upside traction, it could be attractive going into the second half of the year. Keep in mind, this stock topped out over $250 earlier this year.

Top S&P 500 Stocks to Own: General Motors (GM)

General Motors (NYSE:GM) may not be a name many would have expected, but the automaker doesn’t seem to get enough credit. With a dividend yield of nearly 4% and trading at 6.2 times next year’s earnings, GM stock is at least one to take a deeper look at.

Admittedly, the automaker does not boast great growth. Analysts expect revenue to grow just 40 basis points this year and 50 basis points next year. On the earnings front, they expect a 3% decline in 2018 and a 0.5% gain in 2019. I find that the expectations for a 3% decline may be a bit aggressive, but either way even if GM reports flat growth, it’s still rather unremarkable.

The stock recently ran from $37 to $45 in just a few days time. That was after SoftBank(OTCMKTS:SFTBY) took a near-20% stake in Cruise Automation, a company that GM bought for roughly $1 billion two years ago.

Based on the deal, that gave an $11.5 billion valuation to Cruise. In other words, GM owns a majority stake in what is now a highly valued asset. Buy low, right? However, despite GM rallying significantly after the SoftBank deal was announced, it’s now falling back down to $39.

That could give investors a great opportunity to get long the automaker at a low valuation and collect a big dividend while they wait. GM can be a big player in the autonomous driving movement, with RBS analysts predicting that it could become a $43 billion enterprise for GM by 2030.

It’s also worth noting is that GM currently has a market cap of $56 billion.

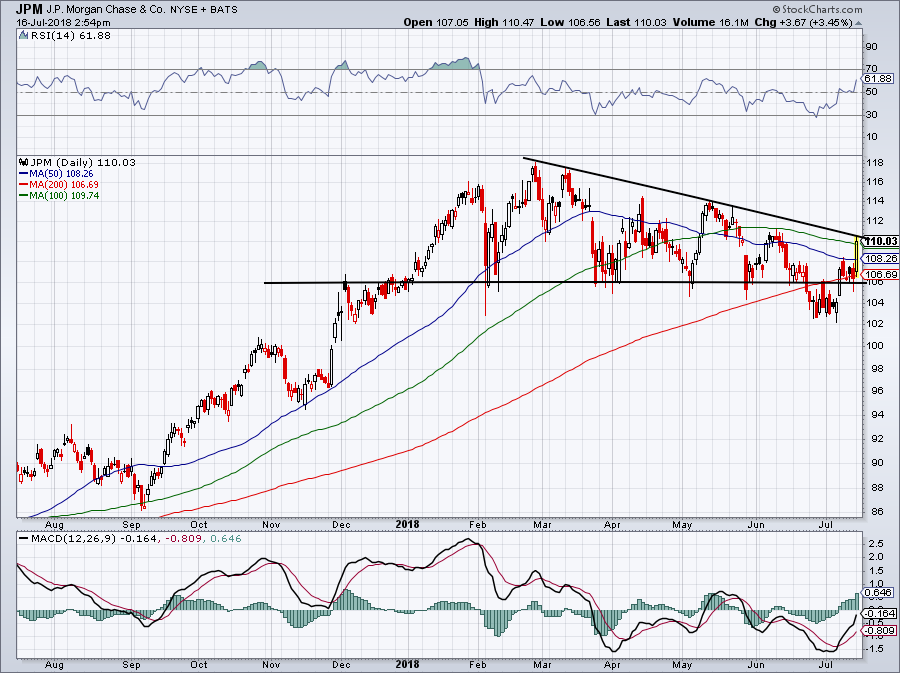

Top S&P 500 Stocks to Own: JPMorgan (JPM)

JPMorgan Chase (NYSE:JPM) beat on earnings and revenue estimates last Friday. Before that, the bank passed its Fed stress tests and gave a big boost to its capital return plans.

The bank is boosting its quarterly payout to 80 cents a share, up from 56 cents per share before the stress test results. In other words, JPM gave a 43% boost to its dividend and now yields about 2.9% annually. The bank can also buy back almost $21 billion over the next 12 months.

These positive catalysts are beginning to give JPM stock a boost, as shares crossed a vital level on Monday.

Even better, JPM’s valuation and growth profiles are attractive.

Analysts expect revenue to grow 7% this year and another 4% next year. On the earnings front though, estimates call for around 30% growth this year and another 8% growth in 2019. Given that JPM trades at just 16 times this year’s earnings, it makes it mighty attractive.

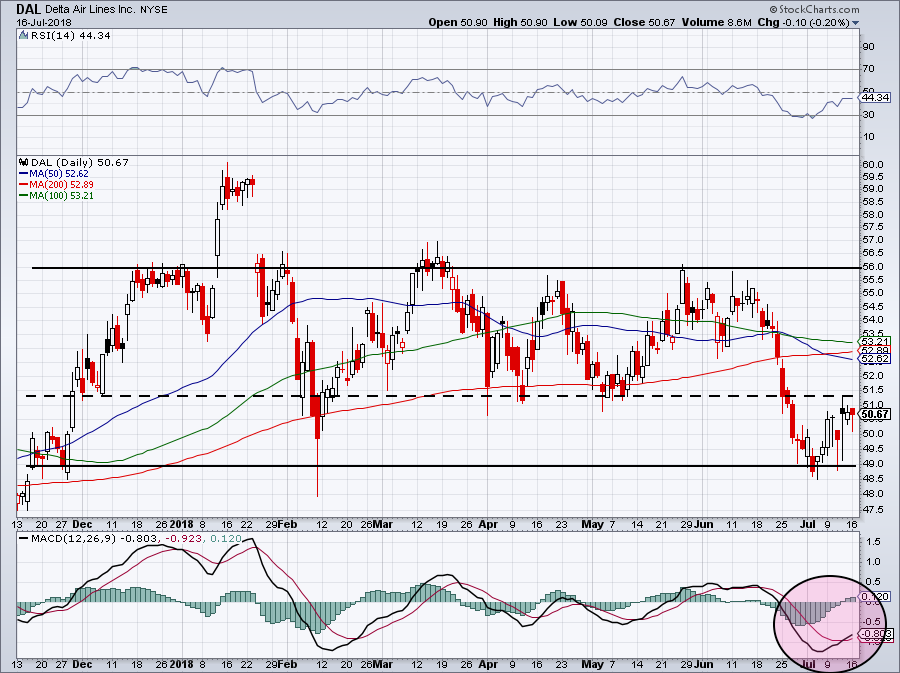

Top S&P 500 Stocks to Own: Delta (DAL)

We recently took a closer look at four airline stocks investors might want to buy. Like Apple, the four largest U.S. airline stocks are all owned by investing legend Warren Buffett. Their low valuation, strong cash flow generation and capital return make them attractive. Plus, air travel is becoming more popular than ever.

One to consider from the group is Delta Air Lines (NYSE:DAL). Check out this piece to see our simple table comparing all four names.

While Delta didn’t lead any specific category other than dividend yield, it scored high enough in each measure to be considered one of the best. The company boasts respectable revenue growth and double-digit earnings growth this year and next year.

Paying out a 2.7% dividend yield now, buying back plenty of stock and trading at less than 16 times this year’s earnings makes it too attractive to keep off the list. Unlike some other airline stocks, DAL stock is holding support too.

Now, it just needs to get through $51 and then a 10% rally is in the cards.

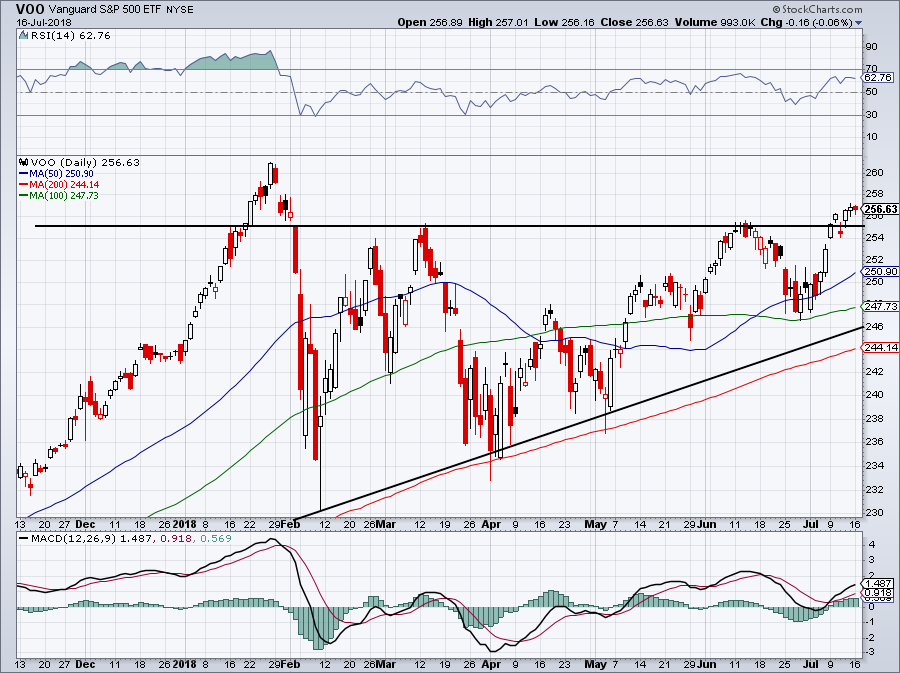

Top S&P 500 Stocks to Own: Vanguard S&P 500 (VOO)

I don’t want investors to mistake this article for a Warren Buffett rah-rah piece. But despite his humble approach, it’d be insulting to consider him anything less than an investing king at this point. Whether it has been his investments from three decades ago or how he stepped into the banks during the Great Recession, he will be remembered for eternity. (Well, probably).

In any regard, his top advice for individual investors is to invest in low-cost index funds for the S&P 500. When held over very long stretches, these investments have worked out wonderfully for investors. Throw in the low fees and the returns are better than most individual investors can muster on their own. For instance, the Vanguard S&P 500 ETF (NYSEARCA:VOO) is up 14% over the past year and 32% over the past three years.

While there’s a lot of stocks that have outperformed that and many on this list have done so, there are also plenty of duds that haven’t.

It doesn’t have to be an “either-or” situation though. Investors can use something like the VOO for a core position and, say, a few names on this list to build around it. That way they have the best of both worlds.

Source: Investors Alley

MICHAEL A. ROBINSON

MICHAEL A. ROBINSON